Recent Performance Overview

Johnson & Johnson (NYSE: JNJ) has been facing some turbulence in recent times, with its stock currently trading at approximately $160 per share, down 15% from its peak of over $185 in April 2022. The company saw a decline in its stock price following challenges such as talc lawsuits and the patent expiration of certain drugs.

While JNJ stock has shown little movement over the past few years, hovering around $155 in early 2021 and now at $160, it has struggled to keep up with the S&P 500 index’s robust 35% growth during the same period. With returns of 9% in 2021, 3% in 2022, and -11% in 2023, Johnson & Johnson has underperformed the index in two out of the past three years.

Challenges in Beating the Market

Attempting to outperform the S&P 500 consistently has proven to be a daunting task for many individual stocks in recent years, including major players in the Health Care sector like LLY, UNH, and ABBV, as well as tech giants like GOOG, TSLA, and MSFT. In sharp contrast, the Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has managed to surpass the S&P 500’s performance every year, showcasing superior returns with lower volatility.

Valuation and Future Outlook

Despite facing macroeconomic uncertainties stemming from high oil prices and elevated interest rates, Johnson & Johnson could be poised for a resurgence. Valued at $160 currently, our analysis anticipates a potential upside with a valuation of $180 per share. Based on a 17x P/E multiple and projected earnings of $10.70 per share for 2024, Johnson & Johnson seems primed for growth, aligning with its historical average P/E multiple over the past five years.

A Look Back: Weathering Previous Storms

Comparing the company’s performance during the ongoing inflation shock with the 2007-08 financial crisis provides valuable insights. While JNJ stock plummeted from $66 in September 2007 to $50 in March 2009 during the 2008 crisis, it rebounded significantly, rising over 29% in the following months. In contrast, the S&P 500 index experienced a notable decline and subsequent recovery during the same period.

Fundamental Strength and Market Dynamics

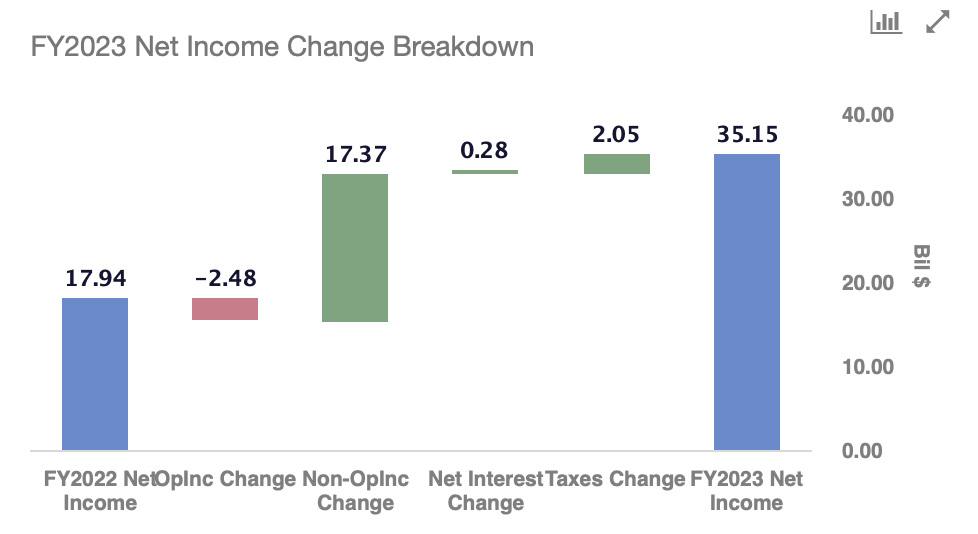

Johnson & Johnson’s revenue surged to $85.2 billion in 2023, showcasing growth driven by key pharmaceutical products such as Darzalex and Stelara. Recent acquisitions, like that of Abiomed, contributed to the expansion of its medical devices business. Furthermore, the company’s net income doubled in 2023, reaching $14.60 per share on a reported basis, reflecting a positive trajectory in earnings.

With a robust cash position, a decline in total debt, and healthy cash flows, Johnson & Johnson appears well-equipped to navigate the challenges posed by the ongoing inflation shock.

Looking Ahead: Growth Potential

As the Federal Reserve takes measures to combat inflation and potential rate cuts loom on the horizon, JNJ stock holds promise for further gains once fears of a recession subside. While near-term risks persist, including escalating costs and patent expirations, the market seems to have already factored in much of these concerns.

Overcoming recent setbacks, Johnson & Johnson stands at a crossroads with the potential for a resurgence in its stock value, offering investors an opportunity to ride the wave of growth in the upcoming period.

| Returns | Mar 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| JNJ Return | -2% | 1% | 37% |

| S&P 500 Return | 0% | 7% | 129% |

| Trefis Reinforced Value Portfolio | -2% | 2% | 626% |

[1] Returns as of 3/18/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.