Market Impacts of Tariff Debates and Inflation Reports

Tariff discussions have been prevalent in recent news cycles. With numerous developments unfolding, it can be challenging to keep track of all the changes.

Here are some of the significant events that transpired over the past week:

- On Monday, the market surged on rumors suggesting that the Trump administration would pause tariffs for 90 days. However, the White House labeled this as “fake news,” leading to an abrupt market reversal.

- In response to the proposed 25% tariff on vehicle imports, automobile manufacturers either delayed or temporarily stopped shipments.

- The bond market experienced volatility amid uncertainties from reciprocal tariffs and fears over global growth. The 10-year Treasury yield fluctuated, dipping below 4.0% last week, climbing to 4.5% on Wednesday, and stabilizing around 4.45% today.

- Crude oil prices fell sharply to four-year lows, with West Texas Intermediate (WTI) crude priced at approximately $60 per barrel.

- On Wednesday, President Trump created waves by announcing a 90-day suspension of reciprocal tariffs, affecting all U.S. trading partners except China.

- Negotiations are ramping up as more than 70 nations have reportedly reached out to the White House, expressing readiness to discuss lower tariffs.

- The stock market rebounded significantly on Wednesday, with the S&P 500, Dow, and NASDAQ increasing by 9.5%, 7.9%, and 12.2%, respectively.

- The Trump administration raised tariffs on China to 145% in retaliation to China’s 84% tariffs on U.S. goods. As a result, the ongoing trade conflict led to a market drop, erasing nearly half of Wednesday’s gains during Thursday trading.

- On Friday, China announced that it would increase tariffs on U.S. goods to 125%, up from an earlier plan of 84%, effective Saturday.

This week was packed with developments, but amid the excitement, we also received critical inflation data: the Consumer Price Index (CPI) and Producer Price Index (PPI).

These reports are particularly crucial, as they may be the final readings before we see the tangible effects of the tariffs on the economy.

In today’s Market 360, we will examine the implications of the CPI and PPI results for the market and potential interest rate adjustments. Additionally, I’ll conclude with insights on another financial event poised to impact the markets and how you might prepare for it.

Consumer Price Index

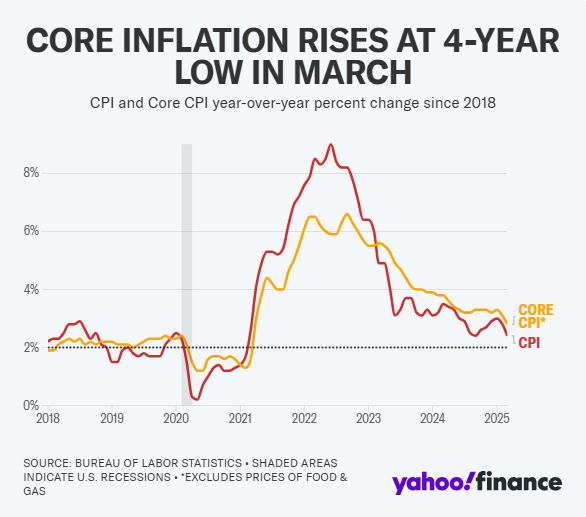

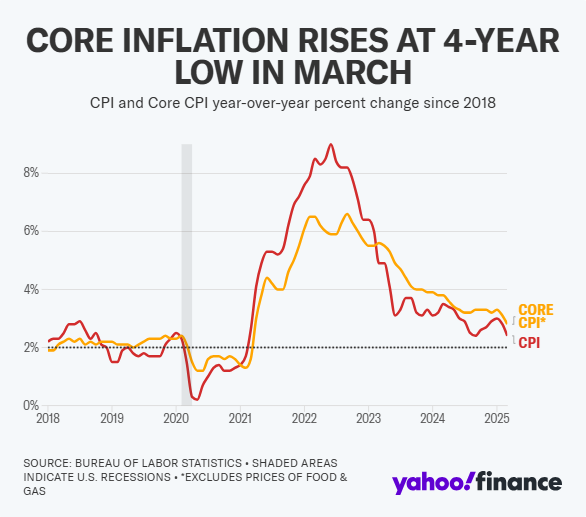

The CPI report released on Thursday exceeded expectations. Prices dropped by 0.1% in March, contrary to projections of a 0.1% increase. Notably, this marks the first monthly decline in CPI since May 2020. Year-over-year, prices rose by 2.4%, down from February’s 2.8% and below the anticipated 2.6% increase.

Core CPI, which excludes food and energy, recorded a 0.1% increase month over month, surpassing the previous month’s 0.2% gain. Annual core CPI growth was 2.8%, reduced from 3.1% in February.

Looking deeper into the data, energy prices declined by 2.4%, with gasoline prices plummeting by 6.3%. There were also decreases in airline fares, vehicle insurance, and used car prices.

The food index, however, increased by 0.4% in March and 3% year-over-year, largely driven by a 5.9% rise in egg prices. Over the past year, food at home prices rose 2.4%, while dining out costs ascended by 3.8%.

Increases were observed in other areas as well, including medical care, clothing, and new vehicles during March.

Of particular interest is owners’ equivalent rent, which reflects shelter costs. After a slight rise of 0.3% in February, the index increased by 0.4% in March, marking the smallest monthly rise since November 2021. This is encouraging news, given that housing costs have troubled CPI reports recently.

Producer Price Index

The PPI report released on Friday indicated that wholesale inflation is easing. The PPI decreased by 0.4% in March, contrasting with expectations for a 0.2% increase and February’s 0.1% rise. This drop represents the largest decline since last October.

Excluding food and energy, the core PPI fell by 0.1%, which is significantly lower than the expected 0.3% rise, bringing the annual increase down to 3.3%—the lowest rate since last September.

Inflation Eases in March, Setting Stage for Fed Decisions

Diving deeper, 70% of the March decrease in inflation can be attributed to a 0.9% drop in the index for goods, marking the largest decline since October 2023. The primary factor affecting this index was an 11.1% decrease in gasoline prices.

Excluding food and energy, goods prices rose 0.3% in March. This represents the second consecutive monthly increase and the largest two-month jump in two years. Meanwhile, service prices decreased by 0.2%, which is the most significant decline since July 2024.

Implications for the Federal Reserve

The good news from these reports points to easing inflation trends.

On the other hand, it would be wise not to overinterpret either report, especially the Consumer Price Index (CPI) report, which provided some relief – particularly with shelter costs finally beginning to cool.

However, it is essential to note that upcoming reports in the next month may be unpredictable. Until then, assessing the relevance of this month’s data or predicting the Fed’s next moves remains difficult.

That said, there is potential that these reports could incentivize the Federal Reserve to cut interest rates as early as May or June. Despite the current fluctuations in the bond market, I anticipate a stabilization where market rates trend lower.

I remain convinced that we will see a minimum of four rate cuts this year. A significant factor driving this is the trend of global interest rates declining, as many economies are facing tougher conditions than the U.S. This global context suggests that other central banks will likely lower their key interest rates as well.

Eventually, the Federal Reserve will likely follow suit.

Upcoming Challenges and Opportunities

At present, there is substantial agitation regarding tariffs. It is important, however, to remain calm amidst this frenzy. The U.S. maintains a significant advantage compared to other global economies. Our demographic strengths, competitive states, successful immigrant assimilation, and unparalleled innovation support our position.

For these reasons, the U.S. is poised to remain the world’s engine for growth.

It is crucial to stay focused, particularly as the AI Revolution unfolds. A monumental wave of change is on the horizon—a shift that many do not yet recognize.

Its impact is so profound that I label it a financial tsunami.

When this tidal wave reaches the shore, it may prove to be more severe than any financial crisis encountered in the past, threatening millions of American livelihoods, including my own.

Nonetheless, it will also generate remarkable wealth opportunities.

Having spent over 40 years in investing, I am one of the few who truly understands what lies ahead—and how to prepare effectively.

That’s why I’ve created a free special presentation to share vital information on how to navigate and benefit from this unstoppable force.

Whether you have saved $10,000 or $10 million, this information could be critical for your financial well-being. With the countdown already underway, your time to act is limited.

Click here to watch my special presentation now.

Sincerely,

Louis Navellier

Editor, Market 360