Marvell Sees Impressive Q3 Earnings Driven by AI Growth

Marvell (MRVL) announced strong Q3 earnings, showcasing remarkable growth in its AI sales. Its data center revenue jumped 98% compared to the same period last year, underscoring the company’s rapid expansion in this arena. This performance indicates that Marvell could rival the success of Nvidia (NVDA).

Solid Financial Performance

During its quarterly update, Marvell reported a 19% increase in revenue sequentially for Q3, surpassing its guidance. For Q4, the company projects another 19% sequential growth and a 26% year-over-year increase, marking the beginning of a new growth phase. CEO Matt Murphy credited this success to custom AI silicon programs now in mass production and the strong demand for cloud interconnect products, with expectations for continued momentum into FY26.

Strong Stock Performance and Analyst Upgrades

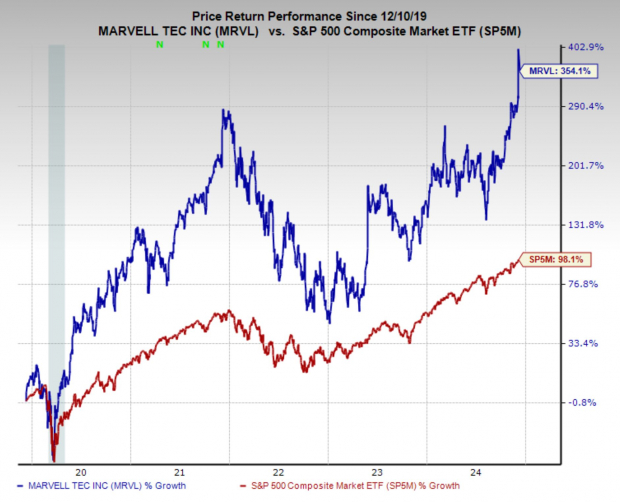

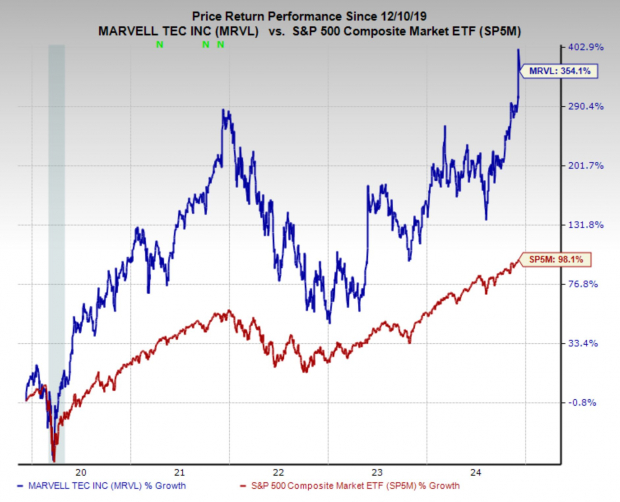

Over the past five years, Marvell’s stock has performed impressively, with an annualized return of 35.3%. With the rise of AI as a significant growth factor, the company appears to be on a positive trajectory. Analysts are responding favorably, boosting their earnings estimates and bestowing Marvell with a Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

Marvell’s Strategic AI Initiatives

While Nvidia remains a powerhouse in the AI sector with its GPUs and comprehensive solutions for hyperscalers, Marvell is carving its own niche. Instead of direct competition, the company’s custom ASIC chips complement Nvidia’s offerings, efficiently managing specific AI tasks for cloud and enterprise clients.

Partnerships with Major Tech Companies

Marvell has positioned itself as a key partner to technology leaders like Microsoft (MSFT) and Alphabet (GOOGL). Recently, the company secured a significant five-year agreement with Amazon (AMZN) to develop AI chips, further enhancing its role in shaping the future of cloud and AI technology.

Shifting Focus Amid Market Changes

This pivot towards AI development comes at an optimal time. Although some of Marvell’s older segments have faced challenges, the skyrocketing demand for AI capabilities has sparked renewed optimism. The future looks promising as data center and AI-related sales are expected to become the primary growth engine for the company.

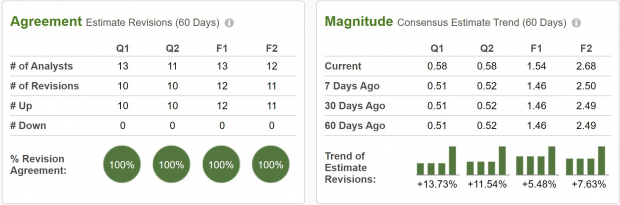

Analysts React to Earnings Revisions

Recent developments have caught Wall Street’s attention, leading analysts to significantly upgrade Marvell’s earnings projections. In the last week alone, earnings estimates for the current quarter rose by 13.7%, 5.5% for the fiscal year, and 7.6% for the next year.

Next year, sales are expected to rise by 39.4% to $7.95 billion, with earnings projected to grow by 73.6% to $2.68 per share.

Image Source: Zacks Investment Research

Investment Outlook for MRVL Shares

After the impressive Q3 report, Marvell shares increased by 23%. Despite a 5% pullback on Monday, this could represent a buying opportunity rather than a red flag. With promising advancements in AI, strong growth predictions, and a favorable Zacks Rank, MRVL is an attractive option for investors.

Explore the Future of Nuclear Energy: A Unique Investment Opportunity

Demand for electricity is rapidly increasing, driving the push to reduce reliance on fossil fuels. Nuclear energy is emerging as a key solution.

Recently, leaders from the US and 21 other nations committed to tripling the world’s nuclear energy capabilities. This ambitious initiative could spell significant gains for nuclear-related stocks—an opportunity for investors who act quickly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, dives into the key players and technologies fueling this movement, highlighting three standout stocks likely to benefit the most.

Download your free copy of Atomic Opportunity: Nuclear Energy’s Comeback today.

Curious about more investment ideas from Zacks Investment Research? You can also download our report on 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.