Rubrik Introduces New Data Security Solution for Microsoft 365 Copilot

Rubrik RBRK has unveiled its Data Security Posture Management (DSPM) solution tailored for Microsoft MSFT 365 Copilot, part of a growing trend where organizations utilize AI-powered tools. This launch is intended to bolster data security and governance amid increasing use of such technologies.

As sensitive data is increasingly stored in Microsoft 365 environments, Rubrik’s DSPM offers essential visibility and control. It aids organizations in managing data classification, labeling, and access permissions effectively.

This innovative solution aims to lessen privacy risks and guarantee that sensitive data is shielded from unauthorized access. Consequently, businesses can utilize Microsoft 365 Copilot with more confidence and security.

Strengthening the Portfolio: A Bright Future for RBRK

The rapid growth in Rubrik’s customer base and rising demand for its data security solutions have significantly contributed to its expansion.

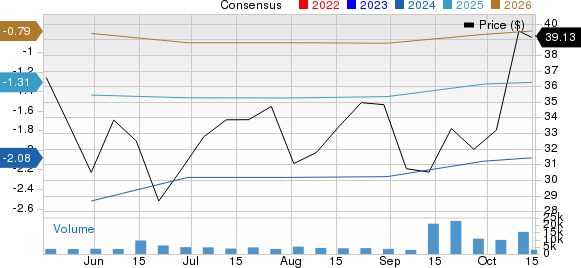

Rubrik, Inc. Price and Consensus

Rubrik, Inc. price-consensus-chart | Rubrik, Inc. Quote

In the second quarter of fiscal 2025, subscription revenues surged by 50% year over year, reaching $191.3 million. This growth was driven by a strong partner network and increased adoption of Rubrik’s solutions.

The company reported its Annual Recurring Revenue (ARR) for subscriptions at $919 million, representing a 40% rise year over year during the same quarter. This increase resulted from acquiring new customers and building deeper connections with existing ones.

Rubrik’s Client Base Expands

A diverse clientele that includes significant players like Pure Storage PSTG, Alphabet’s GOOGL cloud operations, Google Cloud, and CrowdStrike has fueled Rubrik’s success.

In September, Rubrik collaborated with Pure Storage to enhance Cyber Resilience, incorporating a three-layered defense approach that encompasses primary storage, data security, and long-term retention through Rubrik Security Cloud.

In August, the company joined forces with Mandiant, part of Alphabet’s Google Cloud, to blend threat intelligence and improve cyber recovery capacities, strengthening defenses against data breaches and ransomware attacks.

Rubrik’s notable growth in cloud services is also evident. In fiscal 2025’s second quarter, cloud ARR reached $678 million, marking an impressive 80% increase year over year. This ability to offer cloud-native solutions has positioned Rubrik as a leading player in the data management and security arena.

Outlook for RBRK’s Q3 Not So Bright

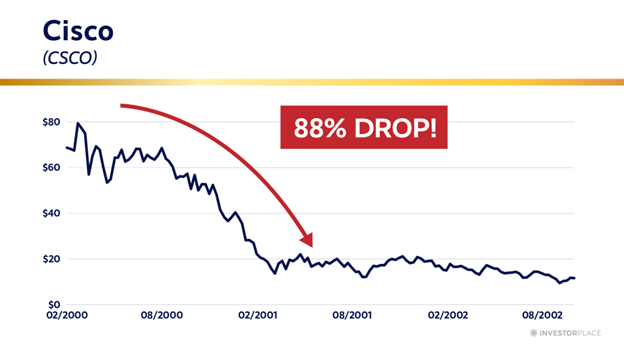

Even with strong demand for its data security solutions and a widening client base, Rubrik faces fierce competition in the cyber resilience sector and macroeconomic obstacles that may hinder RBRK’s revenue growth in fiscal 2025.

Rubrik shares have climbed 5.7% so far this year, compared to a gain of 26.8% for the broader Zacks Computer and Technology sector and a 26.3% increase for the Zacks Internet – Software sector.

Looking ahead to the third quarter of fiscal 2025, RBRK projects revenues between $216.5 million and $218.5 million, with a non-GAAP loss estimated between 40 cents and 46 cents per share.

The Zacks Consensus Estimate currently anticipates third-quarter fiscal 2025 revenues at around $217.64 million, while the consensus for the loss sits at 40 cents per share, unchanged over the last month.

Advice for Investors Considering RBRK Stock

Rubrik’s competitive standing is challenged by various data management and protection companies, including Cohesity, Commvault, Veeam, IBM, and Dell EMC.

Recently, IBM’s partnership with Palo Alto Networks highlights the heightened competitive landscape, as IBM seeks to strengthen its cybersecurity services utilizing AI solutions to improve data security and identity management.

Currently, RBRK stock appears to be on the expensive side, reflected in a Value Score of F, suggesting a premium valuation right now.

Rubrik holds a Zacks Rank #4 (Sell), indicating that investors may want to avoid buying into this stock at the present time.

To explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Zacks Names #1 Semiconductor Stock

This stock is just 1/9,000th the size of NVIDIA, a company that has soared by over +800% since our recommendation. While NVIDIA continues to perform well, our new top semiconductor pick has significant growth potential ahead.

With robust earnings growth and an expanding customer base, this company is set to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Predictions suggest global semiconductor manufacturing will jump from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Pure Storage, Inc. (PSTG): Free Stock Analysis Report

Rubrik, Inc. (RBRK): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.