Middlesex Water Shows Promise for Earnings Beat in Upcoming Report

Middlesex Water (MSEX) is a stock worth considering if you’re seeking a company with a strong track record of exceeding earnings estimates. Positioned within the Zacks Utility – Water Supply industry, Middlesex Water has shown the potential to continue this trend in its upcoming quarterly report.

Recent Earnings Performance

The company has consistently surpassed earnings expectations. Over the last two quarters, Middlesex Water recorded an average beat of 27.76% beyond analysts’ estimates.

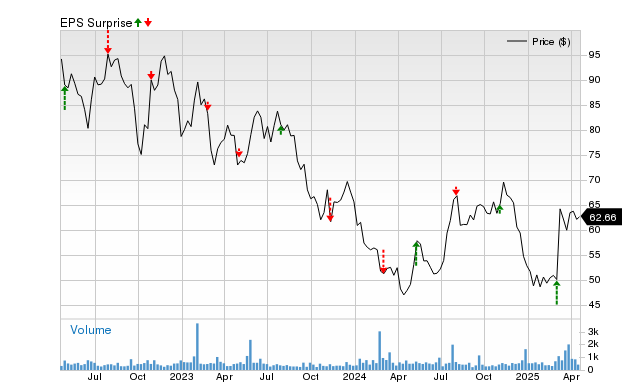

In the most recent quarter, Middlesex Water was expected to report earnings of $0.36 per share but surprised analysts by posting $0.49 per share, a 36.11% increase. In the previous quarter, the consensus estimate was $0.67 per share, but the company achieved $0.80 per share, resulting in a surprise of 19.40%.

Analyzing Price and EPS Surprises

Given this recent earnings history, analysts are now raising their estimates for Middlesex Water. The Zacks earnings ESP (Expected Surprise Prediction) is currently positive, indicating a strong possibility of an upcoming earnings beat, especially in light of its favorable Zacks Rank.

Research suggests that stocks with both a positive earnings ESP and a Zacks Rank of #3 (Hold) or better experience a positive surprise nearly 70% of the time. Thus, among 10 stocks fitting this profile, up to seven could potentially exceed expectations.

Understanding Earnings ESP

The Zacks earnings ESP compares the Most Accurate Estimate to the Zacks Consensus Estimate for the quarter. The Most Accurate Estimate reflects more timely updates from analysts who revise their predictions just before an earnings release, which may yield more accurate forecasts.

Middlesex Water currently has a positive earnings ESP of +9.09%, indicating that analysts are optimistic about its short-term earnings outlook. Combined with a Zacks Rank of #1 (Strong Buy), the outlook suggests another potential earnings beat is on the horizon.

It is crucial to note that while a negative earnings ESP may diminish predictive capabilities, it does not automatically signify an earnings miss. Many companies exceed consensus expectations for EPS, contributing to share price gains even when estimates are not met. Some stocks may also maintain stable valuations despite misses.

To enhance your chances of success, monitoring a company’s earnings ESP before quarterly releases is essential. Using our earnings ESP Filter can help identify top stocks to buy or sell ahead of their financial reports.

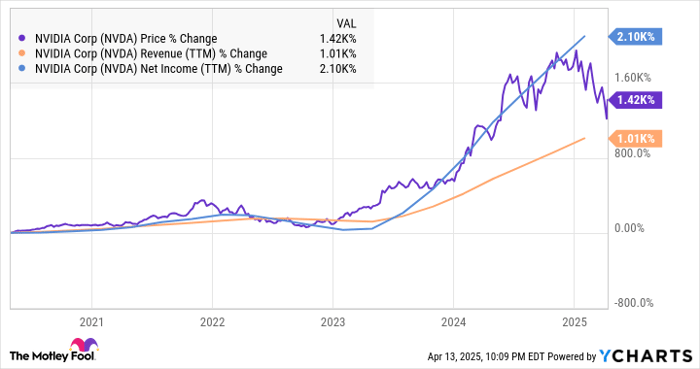

Zacks Highlights Top Semiconductor Stock

The leading semiconductor stock identified by Zacks is significantly smaller than NVIDIA, a company that has surged over +800% since our recommendation. Though NVIDIA remains strong, this new top pick has substantial growth potential.

With strong earnings growth and a rapidly expanding customer base, this stock is well-positioned to capitalize on burgeoning demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is anticipated to soar from $452 billion in 2021 to $803 billion by 2028.

See this stock now for free >>

If you’re interested in the latest recommendations from Zacks Investment Research, you can download the “7 Best Stocks for the Next 30 Days” report for free by clicking here.

For more information, refer to the free stock analysis report on Middlesex Water Company (MSEX).

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.