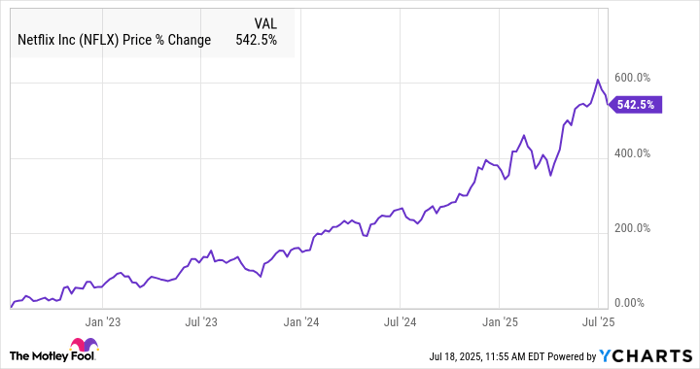

Netflix Q2 Earnings Summary

Netflix (NASDAQ: NFLX) reported its Q2 earnings on Friday, revealing a 16% increase in revenue year-over-year to $11.1 billion, its fastest growth in four quarters. Despite this positive performance, the stock fell 5% due to high investor expectations, as the results aligned closely with forecasts.

The company’s operating margin expanded from 27.2% to 34.1%, and earnings per share (EPS) rose from $4.88 to $7.19, surpassing the consensus estimate of $7.06. Netflix has stopped reporting subscriber counts, but growth has been attributed to new subscribers, robust ad revenue, and price hikes in key markets like North America. The full-year revenue guidance was also raised to between $44.8 billion and $45.2 billion.

So far this year, Netflix’s members have watched 95 billion hours, with notable growth in non-English content, which now comprises over a third of total viewing. However, management cautioned that margins may decline in the latter half of the year due to increasing content costs.