Netflix is set to increase its 2026 revenues to an estimated $50.99 billion, reflecting a year-over-year increase of 13.08%, bolstered by a lineup of new original series and high-profile films. The streaming platform is aiming for sustained subscriber growth amid intense competition from Amazon and Roku, which are also investing heavily in content to attract viewers.

Key releases for Netflix include The Rip on January 16 and Narnia: The Magician’s Nephew in December 2026. Original series like Star Search and returning favorites like Bridgerton Season 4 will contribute to subscriber engagement throughout the year. However, Netflix faces financial pressures due to substantial content spending and existing debt, with a forward price-to-sales ratio of 7.83X, compared to the industry average of 4.3X.

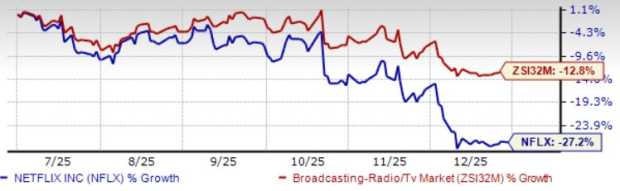

Despite these challenges, the Zacks Consensus Estimate places Netflix’s 2026 earnings per share at $3.21, a 26.93% increase from the previous year. Shares of Netflix have seen a decline of 27.2% over the past six months, compared to a 12.8% drop in the Zacks Broadcast Radio and Television industry.