“`html

Netflix (NFLX) reported third-quarter revenues of $11.51 billion, marking a 17% increase year-over-year. However, earnings fell short due to a Brazilian tax dispute. Netflix anticipates fourth-quarter revenue growth of 17%, with an operating margin projected at 23.9%. For the full year 2025, the company maintains a revenue guidance of $45.1 billion, reflecting a 16% growth, though it revised its operating margin estimate down to 29% from 30% due to the tax issue.

December’s content lineup includes Stranger Things Season 5 and Wake Up Dead Man: A Knives Out Mystery, which may drive subscriber engagement during the holiday period. Netflix’s advertising segment saw record revenues, but the company faces challenges from rising content costs and stiff competition from rivals such as Disney and Amazon, who are increasing their content investments for the holiday season.

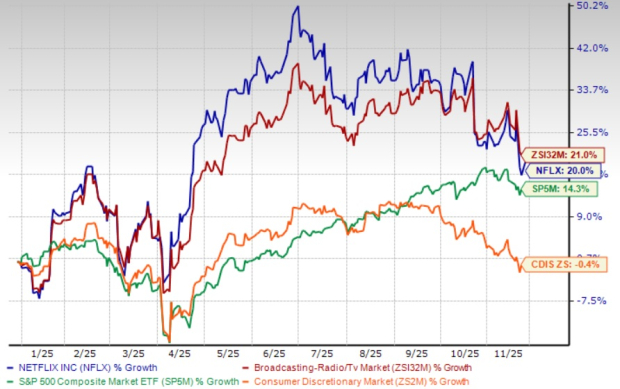

Currently, NFLX shares have gained 20% year-to-date, while the broader industry returned 21%. Netflix trades at a forward price-to-sales ratio of 9.01X, which is considered overvalued compared to the industry’s 4.17X. The consensus estimate for NFLX’s 2025 revenues is $45.09 billion, reflecting a year-over-year increase of 15.61%.

“`