The realm of artificial intelligence (AI) presents a vast ocean of hope and promise for tech behemoth Apple (NASDAQ: AAPL). With the impending debut of the iPhone 16, equipped with groundbreaking AI capabilities, the world eagerly anticipates how Apple will harness this cutting-edge technology within its iPhones, watches, and other iconic products.

Deciphering the Apple Intelligence Hype

Apple’s AI software, Apple Intelligence, promises an infusion of large language models into iOS, enhancing existing features and introducing innovative capabilities such as a revamped Siri experience. However, the journey to widespread adoption may encounter hurdles ahead.

Unveiling Apple’s AI Success Quotient

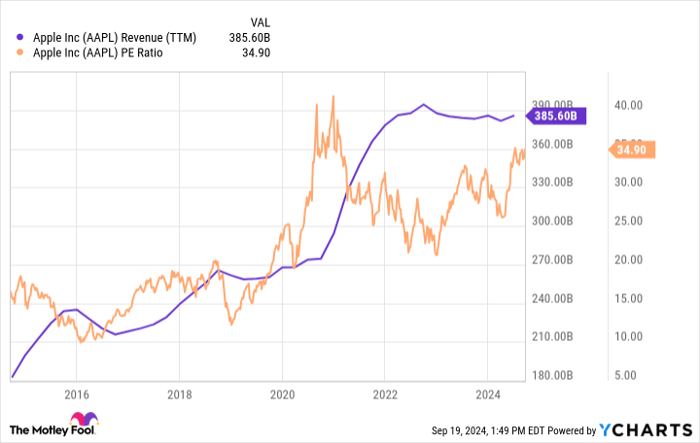

The success of the iPhone 16, intertwined with its AI prowess, stands as a pivotal juncture for Apple. Notwithstanding the fervor surrounding AI integration, a critical question looms large: Is Apple’s stock valuation already pricing in the lofty projections of another supercycle?

Investment Outlook: Navigating the Apple Stock Terrain

As investors ponder the decision to add Apple stock to their portfolios, a nuanced evaluation of the landscape is imperative. Whether Apple surges beyond $400 billion in annual revenue, or the AI iPhone cycle falls short, the repercussions on stock prices demand careful consideration.

The Investment Dilemma: To Buy or Not to Buy Apple Stock?

While Apple’s formidable brand allure and market presence are undeniable, the stock’s trajectory remains uncertain. As the AI hype train gains momentum, investors must tread cautiously, weighing the potential rewards against the inherent risks.

Insightful Investment Strategies: The Motley Fool’s Perspective

Before delving into an investment in Apple, exploring alternative avenues such as the insights provided by The Motley Fool Stock Advisor may illuminate potential opportunities for robust returns and strategic investment decisions beyond the confines of mainstream tech giants like Apple.