Intel’s Struggles: Leadership Changes and Market Challenges Ahead

Intel Corporation INTC has faced a steep decline of 59.3% over the past year, contrasting sharply with the industry’s growth of 123.4%. This downturn leaves it trailing its competitors, Advanced Micro Devices, Inc. AMD and NVIDIA Corporation NVDA. A significant part of this struggle is attributed to financial troubles and operational hurdles that prompted a thorough review of its business structure, coupled with high-level corporate restructuring.

In a notable leadership shift, Intel has appointed David Zinsner and Michelle Johnston Holthaus as interim Co-CEOs, replacing CEO Pat Gelsinger. Management is considering various strategies, which may include separating its product design and manufacturing divisions, and determining which factory projects may need to be discontinued. A key initiative is the establishment of Intel Foundry as a standalone subsidiary to enhance strategic benefits and increase capital efficiency. This division reported an operating loss of $5.8 billion in the last quarter.

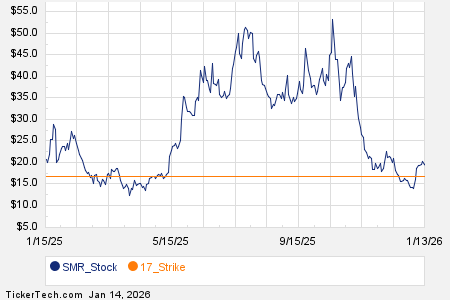

One-Year Price Performance

Image Source: Zacks Investment Research

Sticking to the Core: Strategy That Drives Intel

Despite its challenges, Intel is focused on its core strategy and plans to maintain its revenue guidance of $13.3-$14.3 billion for the fourth quarter of 2024. The company emphasized the importance of executing operational goals to emerge as a leading foundry.

However, management recognizes a need for significant cultural transformation to transition from Integrated Device Manufacturing to becoming a distinguished foundry. This shift requires a move from a “no wafer left behind” approach, which involved building extra capacity for demand, to a “no capital left behind” strategy aimed at maximizing efficiency from existing resources.

Exploring New Horizons: AI Chips and Innovation

In a significant step towards innovation, Intel has launched AI chips targeted at data centers and PCs. This initiative represents one of the most substantial architectural changes in the company’s history during the last 40 years. The goal is to establish a stronger presence in the growing AI sector, which encompasses cloud services, enterprise servers, and edge environments in response to shifting market conditions.

Additionally, Intel is advancing its 5N4Y initiative, aiming to reclaim leadership in transistor and power performance by 2025. The launch of Intel Xeon 6 processors, with Efficient-cores (E-cores) named Sierra Forest, marks a crucial step for high-density workloads. Furthermore, the introduction of Intel Xeon 6 processors with Performance-cores (P-cores) known as Granite Rapids, alongside the Intel Gaudi 3 AI accelerator, signifies ongoing progress.

Further widening its AI PC capabilities, Intel revealed the Intel Core Ultra 200V series processors (previously Lunar Lake) in the third quarter, with plans to release Arrow Lake shortly after. Looking ahead to 2025, the Panther Lake is expected to bolster its presence. The company also announced the development of glass substrates for advanced chip packaging, aiming for mass production by the decade’s end with an ambitious target of delivering 1 trillion transistors on a package by 2030.

Will Intel Overcome Its Hurdles?

Some analysts believe the recent product launches from Intel may be “too little too late.” Although the company is expanding its AI capabilities, it continues to lag behind NVIDIA, which has seen tremendous success with its H100 and Blackwell GPUs—devices critical in constructing computer clusters for AI applications. This has resulted in significant revenue growth for NVIDIA as demand increases.

Furthermore, the accelerated production of AI PCs is negatively impacting Intel’s short-term margins, particularly due to the higher costs associated with their facilities in Ireland. Non-core business expenses, unused capacity charges, and an uneven product mix have further strained margins.

Intel is also grappling with challenges posed by the rapid rise of over-the-top service providers in the tech landscape. Intensified competition in customer retention within its core business could jeopardize Intel’s efforts to attract and keep consumers, adversely affecting its future operating and financial performance.

As Intel looks toward the future, it faces a challenging path fraught with obstacles. How the company addresses these challenges in 2025 remains to be seen. Currently, Intel holds a Zacks Rank #3 (Hold). You can access the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expert Insights: Top Stock Picks for Potential Gains

Among thousands of stocks, five Zacks experts have identified their top pick expected to soar by +100% within the coming months. From these options, Director of Research Sheraz Mian has singled out one company with the highest potential for explosive gains.

This selected company targets millennial and Gen Z audiences, boasting nearly $1 billion in revenue last quarter. A recent downturn in its stock presents a timely buying opportunity. While not all picks are winners, this selection may significantly outpace previous successful Zacks’ picks like Nano-X Imaging, which increased by +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

For the latest recommendations from Zacks Investment Research, you can download the report on 5 Stocks Set to Double. Click here to get this free report.

Intel Corporation (INTC): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.