Nike Stock Faces Challenges Amid Leadership Changes and Slumping Sales

[Note: Nike’s fiscal year ends in May]

Nike’s stock (NYSE: NKE), known for its footwear, apparel, and accessories, is currently trading at $77 per share (Dec 16), down about 55% from its pre-inflation high of $170 in November 2021. The company’s growth momentum has hit a wall following strong performance post-pandemic, leading to a leadership shift with former executive Elliott Hill returning as CEO. In the fiscal first quarter, Nike reported a 10% year-over-year revenue decline of $11.6 billion, driven by a 20% drop in digital sales and a 13% decrease in Nike Direct revenue. Additionally, wholesale revenue fell by 8%, affecting sales across all regions. Diluted earnings per share were reported at $0.70, down 26% year-over-year during the same period.

Upcoming Earnings Report and Financial Forecast

The company will release its second-quarter earnings on Thursday, December 19. Analysts predict revenue declines of 8-10% and a gross margin contraction of 150 basis points, suggesting an anticipated drop in earnings per share. Management has indicated that fiscal 2025 will be a transitional year, stressing the need for ongoing innovation and operational efficiencies to tackle current obstacles. A primary focus will be enhancing digital engagement to address the 20% decline in Q1. Year-to-date, Nike’s stock has dropped almost 28%. Comparatively, its peer Lululemon (NASDAQ: LULU) stock has decreased by 23% since the start of the year.

Valuation Insights

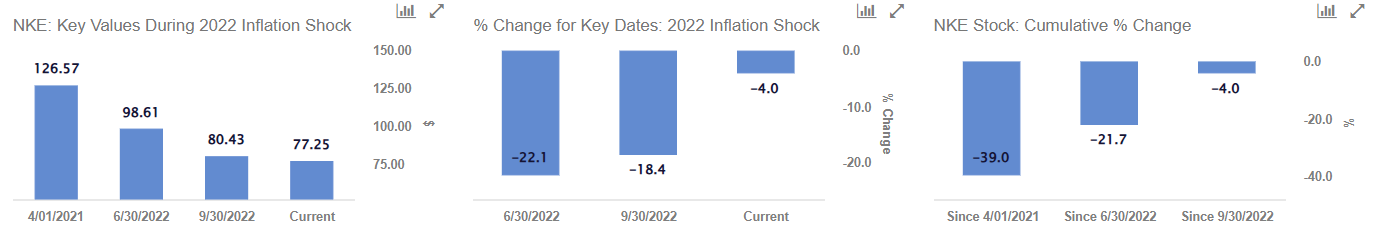

To return to the pre-inflation level, NKE would need to jump about 120% from its current position. While there is potential for recovery, we estimate NKE’s Valuation to be approximately $91 per share, which is nearly 18% above the present market price. A deeper analysis of NKE’s performance since the inflation shock highlights trends amid turbulent market conditions throughout 2022 and makes comparisons to performance during the 2008 recession. In this challenging landscape, Nike continues to uphold its reputation as an industry leader with significant financial resources and partnerships, including agreements with the NFL, NBA, and the Olympics. For Q1, Nike’s gross margin increased by 120 basis points to 45.4%, thanks to lower product and warehousing costs combined with strategic pricing initiatives. Demand creation expenses rose 15% to $1.2 billion, reflecting heightened marketing activities linked to major sports events.

Past Performance and Market Comparison

Over the last three years, NKE stock has consistently underperformed compared to the broad market. Returns were 19% in 2021, -29% in 2022, and -6% so far in 2023. In contrast, the Trefis High Quality (HQ) Portfolio has been less volatile and has outperformed the S&P 500 each year during this period. Given the current macroeconomic uncertainties surrounding interest rates and global conflicts, will NKE continue this trend of underperformance, or could a recovery be on the horizon?

Understanding the Inflation Shock

Here’s a timeline of the inflation shock:

- 2020 – early 2021: Increased money supply to mitigate lockdown impacts leads to a surge in demand, outstripping production capabilities.

- Early 2021: Ongoing shipping disruptions and labor shortages continue to hinder supply.

- April 2021: Inflation rates exceed 4% and continue to rise rapidly.

- Early 2022: Energy and food prices spike due to the Russian invasion of Ukraine; the Fed commences rate hikes.

- June 2022: Inflation peaks at 9%, the highest in 40 years, coinciding with a S&P 500 decline of over 20% from peak levels.

- July – September 2022: The Fed aggressively raises interest rates, leading to an initial recovery in the S&P 500 followed by another sharp decline.

- October 2022 – July 2023: Continued Fed rate hikes with improving market sentiment allowing the S&P 500 to recoup some losses.

- Since August 2023: The Fed maintains steady interest rates to mitigate recession fears, with a rate cut anticipated in September 2024.