ServiceNow Faces Challenges Amid Market Adjustments

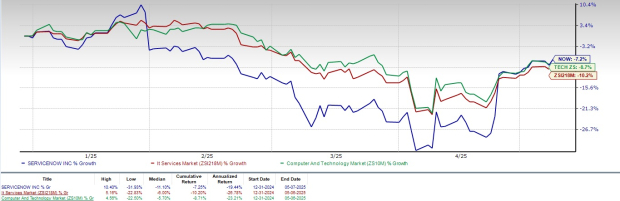

ServiceNow (NOW) shares are down 7.2% year-to-date, a decline that is slightly better than the Zacks Computer & Technology sector’s drop of 8.7% and the Zacks Computers – IT Services industry’s decrease of 10.2%. The decline in ServiceNow’s stock is primarily attributed to a deteriorating macroeconomic landscape, exacerbated by U.S. President Donald Trump’s imposition of tariffs on trading partners like China and Mexico.

Performance to Date

Image Source: Zacks Investment Research

Despite the challenging conditions, ServiceNow’s extensive portfolio, strategic acquisitions, and strong partner relationships provide a foundation for growth. At its recent annual event, Knowledge 2025, the company unveiled a new solution developed with Amazon (AMZN) in the Amazon Web Services (AWS) cloud computing platform.

This innovative solution enhances the ServiceNow Workflow Data Network ecosystem, allowing organizations to unify enterprise data and act more efficiently. By incorporating bi-directional data integration and automated workflow orchestration, it offers real-time insights and AI-driven capabilities across IT, operations, and customer service sectors.

Strategic Partnerships Drive ServiceNow’s Growth

ServiceNow’s diverse partnership base includes major players like Amazon, Microsoft, NVIDIA (NVDA), Zoom Communications (ZM), and Vodafone Business. Notably, ServiceNow achieved 72 transactions exceeding $1 million in net new annual contract value (ACV) during the first quarter of 2025. Customer relationships also expanded, with 508 clients boasting over $5 million in ACV—an impressive 20% year-over-year growth.

Recently, the company deepened its collaboration with NVIDIA to introduce the Apriel Nemotron 15B reasoning model and a new data flywheel architecture, aimed at optimizing the capabilities of enterprise AI agents through NVIDIA’s advanced GPU infrastructure.

ServiceNow also partnered with Zoom Communications, integrating Zoom CX with ServiceNow CRM and IT Service Management, producing an AI-first solution for enhanced customer service and IT support.

In addition, a recent partnership with Vodafone Business yielded AI-powered service management solutions, enhancing customer interactions with quicker query resolutions and proactive anomaly detection.

Innovative Solutions Strengthen ServiceNow’s Position

ServiceNow launched AI agents in its Security and Risk solutions, revolutionizing enterprise security with self-defending systems for improved response times and risk management, in collaboration with Microsoft and Cisco.

The introduction of the Core Business Suite, an AI-driven solution, is designed to streamline core operations such as HR, finance, procurement, facilities, and legal. This suite unifies workflows and automates processes to boost efficiency and enhance employee experiences.

Acquisitions have played a significant role in expanding ServiceNow’s offerings. In April 2025, the company announced the acquisition of Logik.ai, which specializes in AI-powered Configure, Price, Quote solutions, further enhancing its CRM capabilities, particularly in sales and order management.

Earnings Estimates Show Stability

The Zacks Consensus Estimate for second-quarter 2025 earnings stands at $3.53 per share, unchanged in the last 30 days, reflecting a 12.78% increase compared to 2024’s reported figure.

ServiceNow, Inc. Price and Consensus

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

ServiceNow has consistently exceeded the Zacks Consensus Estimate in the last four quarters, averaging a surprise of 6.61%. The consensus for second-quarter 2025 revenues is projected at $3.12 billion, representing an 18.81% increase over the previous year.

Investment Outlook for ServiceNow

ServiceNow is perceived as overvalued, as indicated by a Value Score of F. Currently, it trades at a forward 12-month Price/Sales ratio of 14.69X, considerably above the sector’s average of 5.72X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

ServiceNow’s robust AI capabilities and strong partnerships position it well for future growth. However, challenges including unfavorable forex conditions, stiff competition, and ongoing tariff concerns constitute potential risks. The current valuation makes ServiceNow stock less appealing for value-focused investors.

ServiceNow holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more favorable opportunity before acquiring shares.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.