Nvidia’s Future: Can It Maintain Its Stellar Growth After a Record High?

Nvidia (NASDAQ: NVDA) continues to soar, its stock climbing approximately 185% this year, following a striking 239% increase in 2023. The critical question now is: Can Nvidia replicate this success in 2025?

Rising GPU Demand Drives Nvidia’s Dominance

The surge in Nvidia’s stock is largely linked to the booming demand for artificial intelligence (AI). Nvidia’s graphics processing units (GPUs) power AI applications, enabling users to train their models effectively. Companies are purchasing thousands of GPUs instead of just one or two, resulting in substantial sales for Nvidia.

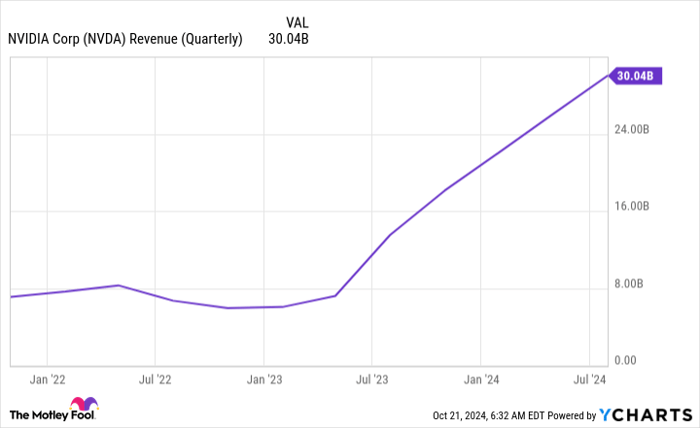

This growing demand has propelled Nvidia’s revenue to new heights, consistently breaking previous records.

NVDA Revenue (Quarterly) data by YCharts.

Management anticipates a further rise, predicting $32.5 billion in revenue for the third quarter of fiscal year 2025, which ends around October 31—potentially marking yet another all-time high.

Despite this impressive growth, signs of slowing revenue increase are emerging. For a company as large as Nvidia, achieving year-over-year revenue growth that triples is nearly impossible due to market saturation. The company continues to grow rapidly, but at a decelerating pace.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts.

If Nvidia meets expectations for Q3, its year-over-year revenue growth will be around 80%. While still impressive, this slowdown presents challenges to repeating past performance.

Looking ahead to the 2026 fiscal year, analysts predict a 43% increase in revenue. This is commendable given Nvidia’s size, yet not sufficient to expect stock prices to triple.

Nvidia’s Stock Commands a Premium Price

Nvidia’s stock valuation reflects both exceptional demand for its products and effective delivery on that demand. Currently, it trades at a significant premium.

NVDA PE Ratio data by YCharts.

At 65 times trailing earnings, Nvidia’s stock is not considered cheap. However, projections for fiscal year 2026 suggest a valuation of 34 times forward earnings if it meets analysts’ expectations. If Nvidia hits these targets, its stock could trade at this valuation once it reports Q4 FY 2026 results, a figure close to what many technology stocks currently trade at.

What can investors realistically expect for Nvidia’s stock over the coming year? It’s a challenging prediction as market feelings and Nvidia’s growth remain uncertain. Analysts set an average one-year price target at $154, which indicates an 11.5% upside, but such predictions involve significant speculation.

Long-term investors should focus on the big picture. AI demand is in its infancy, and Nvidia remains key to this trend. With anticipated demand remaining strong beyond 2025, its product relevance is assured. Nonetheless, current stock prices imply that the company must execute flawlessly to maintain profits.

While Nvidia is unlikely to replicate its recent meteoric growth, it still has potential for a strong performance, provided AI demand does not falter. However, the days of fantastical returns may be behind it.

Seize This Opportunity Before It’s Too Late

Pondering whether you missed out on investing in top-performing stocks? Now might be your chance.

Occasionally, our expert analysts provide a “Double Down” stock recommendation for companies expected to rise sharply. If you’re feeling like you’ve missed the boat, now is the time to act before another opportunity slips away. The track record demonstrates results:

- Amazon: A $1,000 investment when we doubled down in 2010 would now be worth $21,365!*

- Apple: A $1,000 investment from 2008 would have grown to $44,619!*

- Netflix: A $1,000 investment made in 2004 would soar to $412,148!*

Currently, we are offering “Double Down” alerts for three exceptional companies, and this could be your last chance to invest in them.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.