Nvidia Stock Soars: Can It Climb Even Higher?

Nvidia (NVDA) stock has surged nearly 180% so far this year, leading to rising concerns about whether it can sustain this momentum and meet investors’ expectations. The stock’s daily fluctuations reflect a battle between optimists and pessimists. As we explore Nvidia’s prospects, the key question remains: Can it continue to achieve new all-time highs after such an impressive rise?

Nvidia is widely recognized for its graphics processing units (GPUs), powerful processors essential for a range of applications, from gaming to cryptocurrency mining to training large AI models like ChatGPT. However, the company offers more than just GPUs. Nvidia also produces data processing units (DPUs), central processing units (CPUs), and switches tailored for AI supercomputing.

While skeptics argue that Nvidia’s rapid ascent may have peaked, I maintain a positive outlook for its long-term potential. This optimism stems from the company’s robust market position, its crucial role in the tech landscape, and its multiple avenues for future growth.

A Strong Market Position

Nvidia boasts a significant market advantage, which bolsters my positive outlook. Mizuho Securities estimates that Nvidia commands between 70% and 95% of the AI chip market. Its offerings in AI chips and the associated ecosystem remain unparalleled, even as competitors like Intel (INTC) and AMD (AMD), along with tech giants such as Alphabet (GOOG) and Microsoft (MSFT), develop their own chips. Nvidia provides a comprehensive suite for accelerated computing, including processors, switches, nodes, and Cuda libraries.

This competitive edge has enabled Nvidia to become one of the most profitable companies globally. Currently, its trailing twelve-month operating margins are at 62%, with gross margins hitting 76%. These figures indicate strong demand and significant pricing power. Over the last decade, Nvidia has achieved a compounded annual growth rate of 58.5% in net income, outpacing revenue growth of 36% during the same period. Thus, Nvidia is likely to maintain its profitability driven by its pivotal role in the AI investment landscape.

A Hub of Innovation in AI

An additional factor supporting my bullish outlook is Nvidia’s influential role as a driver of AI innovations. AI is poised to catalyze major structural shifts globally for years to come, with Nvidia set to play a central role due to its technological capabilities. As mentioned in my review of TSMC (TSM), while the current practical applications of AI may seem limited, the potential is vast and Nvidia is positioned to enable these developments.

For example, Nvidia’s October 2024 investor presentation highlighted burgeoning uses for its technology, including drug discovery, robotics, and autonomous vehicles. The company is already at the forefront of these innovative applications. Furthermore, governments worldwide are enhancing their AI capabilities, with Nvidia as a primary partner, having established a Sovereign AI partner network that includes France, Switzerland, Spain, and Japan.

Long-Term Growth Potential

Nvidia has numerous growth opportunities on the horizon, and its commitment to continuous innovation fuels my long-term bullish stance. Although I’ve outlined several opportunities, it’s essential to recognize that the future remains unpredictable, with many potential applications yet to be explored. Currently, demand for Nvidia’s products is outstripping supply, and its Blackwell platform is in full production despite earlier reports of delays.

Moreover, Nvidia is focused on staying ahead of its rivals. The company intends to introduce new AI accelerators annually. CEO Jensen Huang has announced plans for a Blackwell Ultra chip in 2025, along with another AI platform dubbed Rubin in 2026. Investors have much to anticipate, suggesting that Nvidia’s impressive run might not be over.

Valuation Perspectives

A key discussion on Wall Street centers around Nvidia’s valuation. Can it continue to meet or exceed expectations, and how do we gauge a fair valuation multiple? Currently, the stock trades at 47.5 times this year’s earnings and 33.5 times next year’s earnings. Analysts project earnings growth of 139% this year and 42% next year, with a stabilization at 53% growth per year over the following five years. I prefer not to delve too deeply into long-term forecasts, so I will focus on near-term expectations.

Nvidia’s market cap now stands at $3.31 trillion, with investors anticipating annual profits around $100 billion. For the twelve months ending July 31, the company reported a net income of $53 billion, up 413% year-over-year. While maintaining such rapid growth long-term may be a challenge, the current multiples of 33.5 times projected earnings aren’t excessive given Nvidia’s short-term growth potential.

Bernstein’s Senior Analyst, Stacy Rasgon, regarded as a top analyst by Tipranks, believes that a multiple in the “mid-to-high 30s” is quite reasonable for NVDA stock if growth continues. Rasgon has rated Nvidia as Outperform, setting a price target of $155. Should Nvidia sustain its earnings growth, its stock could appear undervalued in retrospect.

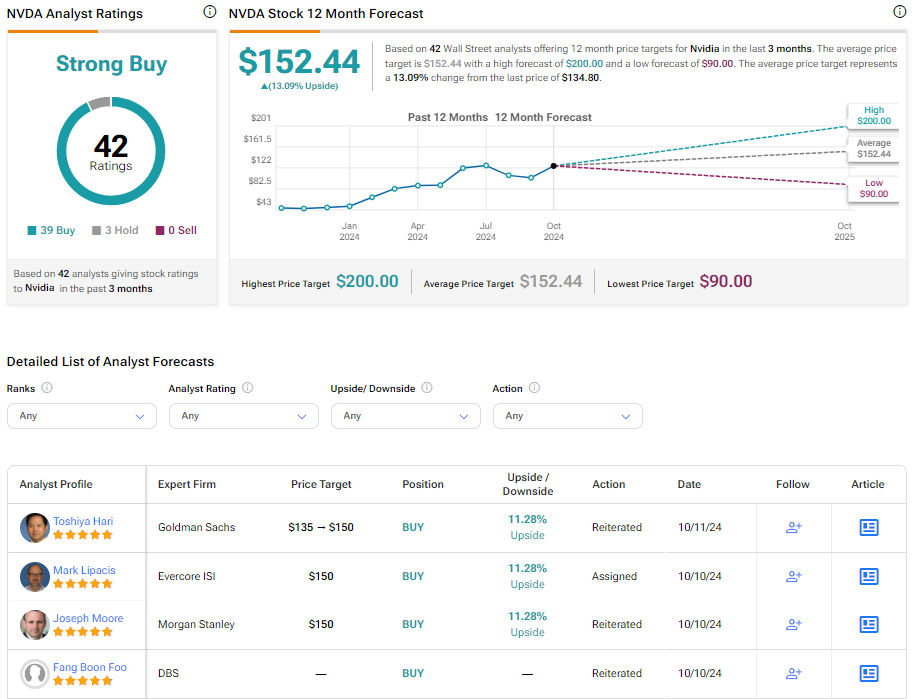

Analysts’ Outlook

Overall, Nvidia stock carries a consensus Strong Buy rating, supported by 39 Buy recommendations and 3 Hold ratings. The average price target stands at $152.44, suggesting a potential upside of 13.09% from current levels. Notably, the highest price target among analysts is $200, indicating a potential upside of 50% from present prices.

Explore more NVDA analyst ratings

Concluding Thoughts

Nvidia remains a leader in AI chips, and even after its impressive stock performance, the potential for further growth is significant. As a pivotal player in the AI sector, its strong profitability and commitment to growth indicate a promising future. While many new AI applications remain untapped, Nvidia’s dedication to innovation validates its current valuation. However, it may be wise to monitor the stock closely and consider waiting for a price dip. Nvidia is one to hold onto for the long haul, rather than trade frequently.

Disclosure

Disclaimer

The views and opinions expressed herein are those of the author and do not necessarily reflect the views or opinions of Nasdaq, Inc.