Palantir Technologies: The High-Flying Stock with Potential and Risks

Palantir Technologies(NASDAQ: PLTR) has emerged as a standout performer in the stock market this year. Its impressive results facilitated its transition to the Nasdaq, with possible inclusion in the prestigious Nasdaq 100 index on the horizon.

Could this shift act as a catalyst for further growth for this leading artificial intelligence (AI) company?

The Positive Impacts of Joining Nasdaq

Palantir’s transition from the New York Stock Exchange to Nasdaq might seem minor at first, given that many successful growth stocks are listed on both. However, the excitement stems from the potential to secure a spot in the Nasdaq 100 index, which features the largest non-financial companies.

Currently, many companies within the Nasdaq 100 have market values below $100 billion, making Palantir’s market cap of over $145 billion a strong candidate for inclusion. Being listed on the Nasdaq 100 would mean greater visibility as the stock becomes part of numerous exchange-traded funds and investment portfolios. This could lead to increased buying activity, further boosting its stock value.

A spot in this prestigious index would be a significant milestone for Palantir, highlighting its growth and success in data analytics. Plus, it could also raise awareness among investors unfamiliar with the company, tapping into an audience that may not be well-versed in one of today’s hottest growth stocks.

Challenges Ahead for Palantir’s Stock Growth

While increased visibility could attract more investors, many will scrutinize Palantir’s high valuation closely. The company’s stock currently trades at 58 times its revenue from the last year and over 320 times its earnings. This lack of significant justification for its price makes some wary.

Many investors seem to buy Palantir solely based on its reputation as a standout AI stock, seeing it as an example of the Greater Fool Theory—expecting to sell to someone else at a higher price without considering the fundamentals.

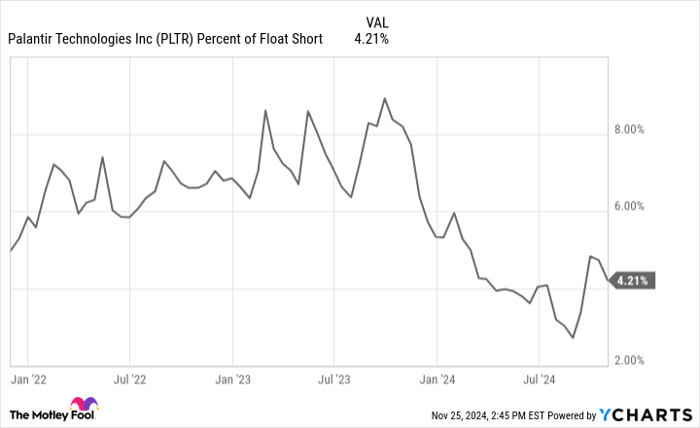

Investors’ renewed interest can have mixed results; while some may buy shares, others could short the stock as short interest has been rising lately, reflecting growing skepticism. As the company’s valuation has soared, it wouldn’t be surprising to see an increase in those betting against Palantir.

PLTR percent of float short; data by YCharts.

With a pricey addition to the Nasdaq 100, the overall index may become less appealing to some investors, raising concerns about whether increased visibility will guarantee favorable outcomes for current shareholders.

Beware of Palantir’s High Valuation

Palantir’s soaring stock price might seem reassuring to some, but caution is essential for those investing without considering the company’s fundamentals. While it’s clear the company is performing well, its valuation currently doesn’t align with its earnings or revenue.

This discrepancy puts investors in a precarious situation. A sudden downturn in the tech sector, an unexpected earnings report, or any significant event could lead to a swift decline in the stock’s value.

Seize Potential Investment Opportunities

If you ever felt like you missed opportunities with top-performing stocks, here’s your chance to learn about potential investments.

Occasionally, our expert analysts identify companies poised for rapid growth, dubbed “Double Down” stocks. If you believe you overlooked your opportunity, now may be your moment to invest wisely.

- Nvidia: a $1,000 investment when we doubled down in 2009 would be worth $358,460!*

- Apple: a $1,000 investment made in 2008 would have grown to $44,946!*

- Netflix: a $1,000 investment from 2004 is now worth $478,249!*

At this moment, we are issuing “Double Down” alerts for three outstanding companies that could soon present another lucrative opportunity.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.