A Closer Look at Bath & Body Works Stock

Bath & Body Works stock (NYSE: BBWI), the titan of specialty home fragrance and body care retail in the U.S., formerly under the banner of L Brands, embarks on a crucial journey as it gears up to unveil its fiscal fourth-quarter results come February 29th. Anticipations of a dip loom as revenue and earnings projections might fall short for the fourth quarter. Foot traffic dwindled amidst uncertainties stemming from soaring inflation during the initial three quarters of FY 2023, casting a shadow over the short-term outlook. However, the intrinsic appeal and financial standing should position the stock favorably in the grand schema of things. The blueprint unveiled by management involving the launch of fresh off-mall outlets, the refurbishment of existing stores, and strategic investments in technology and supply chain – encompassing a substantial capital expenditure of $300 to $350 million earmarked for FY2023 – paints a picture of resilience and adaptability.

The vast array of offerings, including men’s grooming products, manifested within a market valuing $8 billion, adds a layer of promise to BBWI’s future trajectory. Additionally, the company’s robust loyalty program boasting nearly 41 million patrons, steering two-thirds of U.S. sales, plays a pivotal role in fostering repeat business – a crucial asset in contemporary retail dynamics. What’s more, data showcasing a marked surge across all product categories comes as a testament to the company’s sustained growth momentum, auguring well for its prolonged success.

Peering Into the Fiscal Crystal Ball

The impending fourth-quarter stands poised to witness a 1% to 5% slip in net sales, juxtaposed against the backdrop of $2.9 billion revenue clocked in Q4 of 2022. The anticipated earnings per diluted share for Q4 are slated to range between $1.70 and $1.90, showcasing a slight retreat from the $1.86 mark in 2022’s fourth quarter. Navigating through the fiscal terrain of 2023, BBWI envisages a decline in net sales of 2.5% to 4%, relative to the $7.6 billion revenue recorded in 2022. The full-year earnings projection for 2023 gravitates between $2.99 and $3.19 per diluted share, a mild drop from the previous year’s $3.40. The adjusted EPS for 2023 is forecasted to oscillate within the $2.90 to $3.10 bandwidth, spotlighting the resilience of the company amid challenging market conditions.

While BBWI stock marked a robust 30% ascension from the trenches of $35 at the outset of January 2021 to the prevailing $47 price point, with the S&P 500 trailing closely at a 35% gain over the same period, the stock’s journey proved a rollercoaster ride. The stock pencil in an 88% surge in 2021, followed by a dour tumble of 40% in 2022, only to nudge up by a modest 2% in 2023. Contrariwise, the S&P 500 charted returns of 27% in 2021, a stumble of 19% in 2022, and a hearty 24% romp in 2023, flagging that the grass wasn’t always greener on the BBWI side. The caprice of the market terrain unfurled a challenging landscape for S&P 500 darlings like AMZN, TSLA, and TM, alongside tech behemoths GOOG, MSFT, and AAPL. In contrast, the Trefis High-Quality Portfolio, donning 30 stocks, emerged as the phoenix that perennially outperformed the S&P 500, showcasing the allure of stability and profitability amid tempestuous market tides.

Deciphering the Investment Cipher

Propelling into clarity, the valuation compass points at $39 per share for BBWI, a stark 18% trimming off the current market quotation. Delve deep into the interactive dashboard analysis on BBWI Earnings Preview: What To Expect in Fiscal Q4? for a more granular understanding.

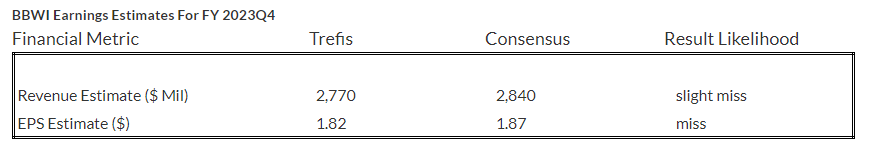

The bonnet of BBWI hood reveals a mixed bag of outcomes. While Trefis advocates a forecast of $2.8 billion revenues for Q4 2023, marginally shy of consensus estimates, the preceding quarter witnessed a 3% sales plunge to $1.6 billion, fueled by lackluster demand in home fragrance and personal care segments. Smart maneuvers in cost-cutting and merchandising steered the ship through these choppy waters. The full-year revenue forecast for 2023 sees Bath & Body Works’ revenues curtail marginally to $7.4 billion.

On the earnings patio, BBWI’s Q4 2023 EPS aims at $1.82, as per Trefis analysis, a 3% divergence from the consensus forecast. The Q3 2023 narrative unraveled a 30% uptick in diluted earnings per share, culminating at $0.52, underlining the resilience and mettle displayed by the retail titan in clawing its way through market vagaries.

Draped in stark contrast, the valuation tapestry weaves a narrative wherein an earnings per share (EPS) estimate of approximately $3.07 laced with a P/E multiple of 12.6x for fiscal 2023 tips the scales to a $39 price target – a sizably distant reverberation from the current market resonance, delineating the chasm between perceptions and reality.

Amid Peers and Portfolios

Rummage through the peer corridors to juxtapose Bath & Body Works’ stock performance against industry contemporaries, for a more insightful lens over price estimates and market positioning. A comparative odyssey across industry verticals at Peer Comparisons exposes the underbelly of competition beyond the comfort zones of BBWI stock.

| Returns | Feb 2024 MTD [1] |

Since start of 2023 [1] |

2017-24 Total [2] |

| BBWI Return | 11% | 13% | -28% |

| S&P 500 Return | 5% | 32% | 127% |

| Trefis Reinforced Value Portfolio | 4% | 43% | 633% |

[1] Returns as of 2/28/2024

[2] Cumulative total returns since the end of 2016

Charting the Investment Horizon

Seize the reins of investment possibilities with Trefis. Navigate through the spectrum of market-beating portfolios, charting a course across various investment vistas.

Witness the entire arsenal of Trefis Price Estimates