Qualcomm Aims for Growth Amid 5G Transition with Upcoming Earnings Report

QUALCOMM Inc. QCOM leads the fabless semiconductor industry, primarily focusing on 5G mobile network technology. The company is shifting from being a wireless communications firm for the mobile sector to becoming a major player in connected processors for the intelligent edge.

QUALCOMM operates through three segments: QCT (QUALCOMM CDMA Technologies), QTL (QUALCOMM Technology Licensing), and QSI (QUALCOMM Strategic Initiatives). The company plans to disclose its fourth-quarter fiscal 2024 earnings results on November 6, after the market closes. Currently, the stock has a Zacks Rank #2 (Buy) with an Earnings ESP of +0.48%.

Data shows that stocks with a Zacks Rank of #3 (Hold) or better (Rank #1 or 2), combined with a positive Earnings ESP, have a 70% chance of beating earnings expectations. Such stocks often see growth after releasing earnings results. Use our Earnings ESP Filter to uncover top stocks to monitor before earnings are announced.

Earnings Estimates Signal Positive Growth for Qualcomm

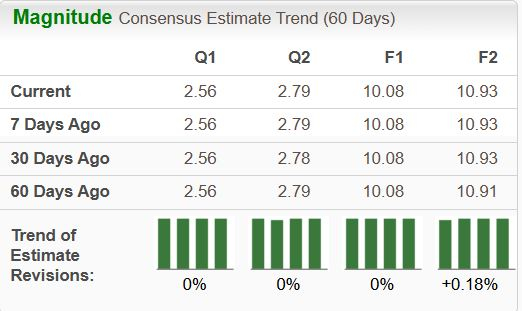

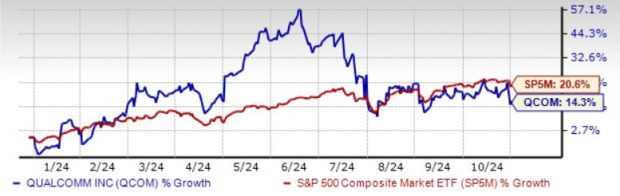

For the fourth quarter of fiscal 2024, the Zacks Consensus Estimate forecasts revenues at $9.90 billion, reflecting a 14.7% growth year over year. The consensus estimate for adjusted earnings per share (EPS) stands at $2.56, a significant increase of 26.7% compared to the previous year. Qualcomm has consistently surprised investors positively over the last four quarters, with an average earnings beat of 7.6%.

In addition, earnings expectations for fiscal 2025 (ending September 2025) have also been revised upward in the past 60 days. The Zacks Consensus Estimate now predicts increases of 8.2% for revenues and 8.4% for EPS in fiscal 2025.

Image Source: Zacks Investment Research

Key Factors Affecting Fourth Quarter Performance

Analysts estimate that Revenue from QCT Handsets will reach $6.15 billion, showing a 12.8% increase year over year. Furthermore, Revenue from QCT IoT (Internet of Things) is projected at $1.47 billion, reflecting a growth of 6.4% compared to last year.

For the automotive segment, analysts anticipate Revenue from QCT Automotive to be $791.51 million, indicating a remarkable 48% increase. The average prediction for Revenue from QCT overall is $8.42 billion, representing a 14.1% year-over-year growth.

The consensus among analysts suggests that Revenue from QTL will hit $1.44 billion, a rise of 14.3% from the same period last year. Additionally, Revenue from Non-GAAP Reconciling Items is estimated at $44.71 million, showcasing a year-over-year increase of 54.2%.

Furthermore, expectations for Revenue from Equipment and services are set to reach $8.36 billion, marking a 14.7% increase from a year ago. Analysts forecast Licensing Revenue to be $1.49 billion, suggesting growth of 11.2% year over year.

As per analyst estimates, ‘Income before taxes from QTL’ is likely to reach $1.04 billion, contrasting with $829 million reported last year. Analysts also predict that Income before taxes from QCT will be approximately $2.35 billion, compared to $1.89 billion a year ago.

Strategic Partnerships and Industry Trends

QUALCOMM has recently partnered with Alphabet Inc. GOOGL to advance generative artificial intelligence (AI) for digital cockpit solutions and expedite digital transformation in the automotive field. The company has also launched the Snapdragon Cockpit Elite platform to enhance in-vehicle digital experiences, along with the Snapdragon Ride Elite platform for automated driving assistance.

These innovations are gaining traction in the market, with major automakers like Mercedes-Benz AG and Li Auto planning to incorporate these technologies into their next-generation vehicles.

QUALCOMM is also experiencing strong demand for EDGE networking products, which are vital for transforming connectivity across various sectors, including automotive, smart factories, homes, and more.

The company is witnessing a growing demand for advanced chipsets, particularly the AI-optimized Snapdragon 8 Gen 3 chips, which offer enhanced features for voice assistants and image creation.

Investors are also eager to learn about updates on Qualcomm’s latest Snapdragon X PC chips, as major companies like Microsoft Corp. MSFT plan to launch new computers featuring these innovative processors.

QCOM Stock Valuation Looks Promising

QUALCOMM is part of the Zacks Defined Computer and Technology – Wireless Equipment Industry, currently ranking in the top 40% of the Zacks Industry Rank. This position suggests that the industry is expected to outperform the market in the coming 3 to 6 months.

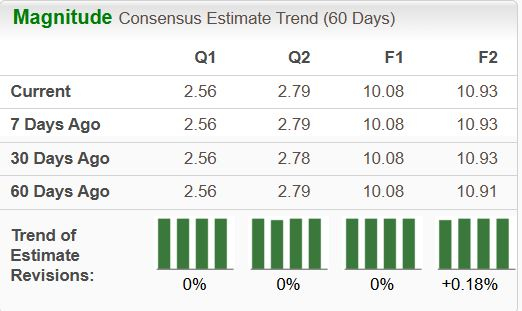

Despite this, QCOM’s stock price has underperformed the S&P 500 index year to date. The following chart illustrates QCOM’s price performance during the same period.

Image Source: Zacks Investment Research

Currently, QCOM is trading at an appealing valuation relative to its peers, with a forward price/earnings (P/E) ratio of 15.12X, which is lower than the industry average of 15.99X and the S&P 500’s P/E of 19.15X. The company boasts a return on equity (ROE) of 38.12%, significantly higher than the S&P 500’s ROE of 16.78% and industry’s ROE of only 8.32%.

Significant Short-Term Upside Potential for QCOM Shares

Brokerage firms project an average short-term price target indicating a potential increase of 30.6% from the last closing price of $165.27. The target price ranges between $160 and $270, suggesting a maximum upside of 63.4% and a minimal downside of just 3.2%.

Image Source: Zacks Investment Research

Top Stock to Watch: A Potential for Doubling Returns

From a vast selection of stocks, five Zacks experts have chosen their favorites expected to increase by +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian has handpicked one stock that shows the highest potential for explosive growth.

This company targets millennial and Gen Z demographics, having nearly generated $1 billion in revenue in the previous quarter. A recent dip in its stock price presents a good opportunity for investment. While not all recommended picks succeed, this one could outperform previous Zacks favorites like Nano-X Imaging, which surged by +129.6% in just over nine months.

Free: Check Out Our Top Stock and More

Would you like to receive the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.