Snap Introduces AI-Powered Ad Format for Increased User Engagement

Snap (SNAP) is launching a brand-oriented advertising solution called Sponsored AI Lenses, leveraging generative AI technology. This new format enables the generation of personalized, AI-driven images, fostering self-expression and encouraging social sharing among users. According to Snap, brands utilizing Sponsored AI Lenses can experience a 25-45% rise in impressions in just one day.

Early adopters of this innovative format, such as Uber and Tinder, reported higher-than-average user engagement, indicating that Sponsored AI Lenses effectively capture user attention. By merging advanced AI with Snapchat’s strengths in augmented reality (AR) and visual communication, these lenses provide brands with an excellent opportunity to enhance awareness and build consumer loyalty in a saturated digital landscape.

Furthermore, this initiative aligns with Snap’s broader objective to strengthen its brand advertising segment. The company aims to improve revenue through immersive, high-impact ad formats designed to attract major advertisers while distinguishing itself with AI-powered innovations in a competitive advertising market.

Earnings Outlook Remains Positive for SNAP

The Zacks Consensus Estimate for SNAP’s earnings in the first quarter of 2025 stands at 4 cents per share, unchanged over the last two months. This projection reflects a year-over-year increase of 33.33%.

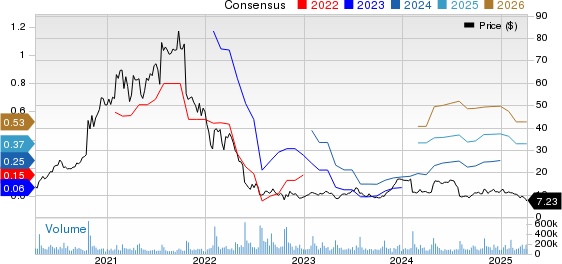

Snap Inc. Price and Consensus

Snap Inc. price-consensus-chart | Snap Inc. Quote

For the first quarter of 2025, Snap anticipates revenue between $1.33 billion and $1.36 billion. The consensus revenue estimate is $1.35 billion, representing a 12.82% year-over-year growth.

SNAP has surpassed the Zacks Consensus Estimate for earnings in three of the last four quarters, with an average surprise of 58.57%.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Stock Performance Review for SNAP

Over the past year, SNAP shares have declined by 33.4%, underperforming both the Zacks Computer and Technology sector and the S&P 500 index, which decreased by 6.4% and 1.4%, respectively. The stock has also lagged behind the Zacks Internet – Software industry, which saw a 2.7% decline during the same period.

This downturn is primarily linked to decreasing revenues from brand-oriented advertising, which has faced challenges for two consecutive years due to reduced spending by a small pool of large advertisers.

Competing with major players like Meta Platforms (META), Alphabet (GOOGL), and Apple (AAPL), Snap has struggled to maintain market position. Meta’s extensive scale and data-driven ad solutions attract numerous marketers, while Alphabet provides more tailored and scalable advertising options through platforms such as Google Search and YouTube. Apple’s advertising services within the App Store appeal to brands targeting high-intent users in a privacy-conscious setting. In contrast, shares of Meta and Alphabet have dropped 1.6% and 7.4%, respectively, over the last 12 months, while Apple’s stock increased by 2.7%.

Although Snap has gained traction with small businesses through direct response ads, its brand advertising segment requires attention. To revitalize this area, Snap introduced Sponsored Snaps in October and now enhances its portfolio with Sponsored AI Lenses.

Investment Considerations for SNAP Stock

Snap’s long-term growth outlook remains robust, bolstered by consistent investments in machine learning, scalable ad formats, and enhanced creator engagement. In 2024, the company doubled its number of active advertisers, attributing much of this growth to small and medium-sized enterprises leveraging Snap Promote. Improved automation and partnerships with firms like Snowflake and LiveRamp have streamlined performance gains. Additionally, the Snapchat+ service achieved significant popularity, boasting 14 million subscribers last year. These initiatives underscore Snap’s ongoing commitment to innovation and user experience.

Currently, SNAP holds a Zacks Rank #2 (Buy) alongside a Growth Score of A, indicating a solid investment opportunity according to Zacks’ rating system. View the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Poised for Significant Growth

These selected stocks were identified by a Zacks expert as top picks with the potential to increase by 100% or more in 2024. Previous selections have seen remarkable gains, including increases of 143.0%, 175.9%, 498.3%, and 673.0%.

Many stocks in this report are currently under the radar on Wall Street, presenting an excellent opportunity to invest early.

Today, discover these 5 potential home runs >>

Interested in Zacks Investment Research’s latest recommendations? You can download the 7 Best Stocks for the Next 30 Days now. Click to obtain this free report.

Apple Inc. (AAPL): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

Snap Inc. (SNAP): Free Stock Analysis report

Meta Platforms, Inc. (META): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.