Snowflake Inc. Growth Driven by Customer Expansion and Partnerships

As of January 31, 2025, shares of Snowflake (SNOW) have risen 5.7% year-to-date, largely due to a robust product portfolio and a growing partner network that has effectively increased its customer base. The number of customers surged to 11,159, up from 9,384 on the same date in 2024. Notably, this customer group includes 745 companies from the Forbes Global 2000 and has contributed to 45% of Snowflake’s fiscal 2025 revenues, which reached $3.6 billion—a 29% increase from fiscal 2024.

The company’s successful adoption and utilization of its platform is highlighted by a net revenue retention rate of 126% as of January 31, 2025. Additionally, the count of customers generating over $1 million in product revenue over the trailing twelve months rose from 455 to 580 between fiscal 2024 and 2025.

Innovation continues to drive Snowflake’s success, as demonstrated by the addition of over 400 product capabilities in fiscal 2025—more than double the amount from the prior year. Currently, there are over 4,000 customers regularly utilizing its AI and machine learning technologies.

Assessment of SNOW’s Stock Performance

Image Source: Zacks Investment Research

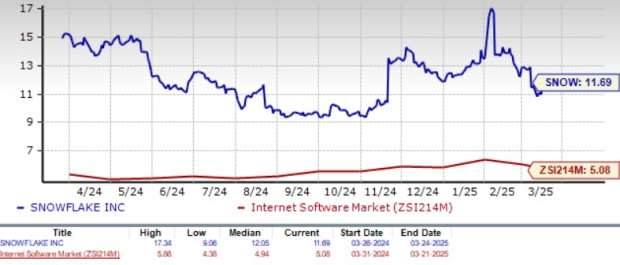

Nevertheless, Snowflake’s shares are currently viewed as overvalued, reflected by a Value Score of F. The stock is trading at a 12-month price/sales (P/S) ratio of 11.69X, significantly above the industry average of 5.08X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Given this high valuation, investors may wonder if SNOW stock still presents a viable investment opportunity. Let’s take a closer look.

Snowflake Gains Ground with Strong Portfolio and Diverse Partnerships

Innovative offerings such as Apache Iceberg, Hybrid tables, Polaris, and the Cortex Large Language Model are instrumental in attracting new clients to Snowflake. Features that emphasize interoperability and data transformation resonate well with customers. The Cortex AI technology is being utilized by clients to create data agents capable of managing both structured and unstructured data, offering advanced retrieval features through Cortex Search and Analyst.

Snowflake’s extensive partner network includes notable companies such as Amazon, ServiceNow, Microsoft (MSFT), NVIDIA, Fiserv, EY, LTMindtree, Next Pathway, and S&P Global. In collaboration with Microsoft, Snowflake has developed a Snowflake Power Platform connector for Microsoft Power Platform, fostering seamless bidirectional access between Dataverse and Snowflake’s AI Data Cloud. This connector enhances data interoperability between Microsoft’s service offerings, including Dynamics 365.

Recently, Snowflake and Microsoft have broadened their partnership to facilitate the creation of user-friendly, reliable AI-powered applications directly within Snowflake Cortex AI. The acquisition of Datavolo further enhances Snowflake’s platform, offering robust support for both structured and unstructured data while streamlining data engineering workflows. This acquisition will also lead to additional Snowflake connectors in private preview, improving connectivity and integration with essential platforms such as SharePoint, Google Drive, Workday, and Slack. Additionally, Night Shift’s acquisition bolsters Snowflake’s position within the federal space.

Positive Projections for Q1 and Fiscal Year 2026

For the first quarter of fiscal 2026, Snowflake anticipates product revenues between $955 million and $960 million, signifying year-over-year growth of 21-22%.

The Zacks Consensus Estimate for first-quarter fiscal 2026 revenues stands at approximately $1 billion, reflecting a growth rate of 21.15% year-over-year. The consensus forecast for earnings indicates earnings of 22 cents per share, up from previous estimates, suggesting an impressive year-over-year increase of 57.14%.

For the entirety of fiscal 2026, Snowflake expects product revenues to rise by 30% compared to fiscal 2025, targeting $3.46 billion. The Zacks Consensus Estimate for SNOW’s fiscal 2026 revenues is currently projected at $4.46 billion, anticipating a growth rate of 23.11% year-over-year, with earnings estimated at $1.13 per share—up 13% over the last 30 days and suggesting a year-over-year increase of 36.14%.

In the recent past, SNOW has exceeded Zacks Consensus Estimates for earnings in three of the last four quarters, with an average surprise of 28.04%.

Snowflake Inc. Price and Consensus Chart

Snowflake Inc. price-consensus-chart | Snowflake Inc. Quote

Explore the latest EPS estimates and surprises on Zacks earnings Calendar.

Investor Guidance on SNOW Stock

While Snowflake enjoys a robust partner network, a growing customer base, and strategic acquisitions supported by an innovative product suite, the company is also facing competitive pressures and increasing operational costs. Rivals like Databricks pose considerable competition, alongside the rising costs associated with GPU investments as Snowflake aggressively pursues AI initiatives.

Currently, SNOW is trading below its 50-day moving average, suggesting a bearish trend.

SNOW Stock Trading Below the 50-Day SMA

Image Source: Zacks Investment Research

With a Zacks Rank of #3 (Hold), SNOW may be a stock to monitor until a more advantageous entry point emerges. To explore today’s Zacks #1 Rank (Strong Buy) stocks, click here.

5 Stocks Set to Double

Selected by Zacks experts, these stocks are favorites expected to gain +100% or more in 2024. Historically, past recommendations have achieved returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in this report remain under Wall Street’s radar, providing an excellent opportunity for early investment.

Today, discover These 5 Potential Home Runs >>

For the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days. Click to access this complimentary report.

Microsoft Corporation (MSFT): Free Stock Analysis report

Snowflake Inc. (SNOW): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.