SoFi Technologies: A Soaring Stock Facing New Challenges

Shares of the member-centric consumer bank SoFi Technologies (NASDAQ: SOFI) have experienced a remarkable increase. The stock surged by 148% between June 30 and December 1, 2024.

Despite this impressive run, SoFi stock has faced recent declines. Analysts from investment banks question whether the company’s business growth can support its high valuation.

Is SoFi Technologies still a solid investment, or has it climbed too high? In this article, we’ll explore the reasons behind its rise this year and why Wall Street’s outlook has dimmed.

The Factors Behind SoFi’s Surge in 2024

SoFi Technologies has quickly expanded its member base by issuing a large number of unsecured personal loans. Investors who were wary about potential loan defaults were reassured when delinquencies lasting over 90 days decreased for two consecutive quarters after reaching a peak of 0.72% earlier this year.

| Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | |

|---|---|---|---|---|---|

| 90+ Day Personal Loan Delinquencies | 0.48% | 0.56% | 0.72% | 0.64% | 0.57% |

Data by SoFi Technologies. Table by author.

The U.S. economy has created favorable conditions for SoFi and its loan business. The Federal Reserve lowered interest rates by 0.75% in 2024, with another 0.25% drop anticipated on December 18, 2024.

While lower rates can compress profit margins, volume gains in lending have compensated for this. In the third quarter, SoFi’s lending division posted record revenues, achieving a 17% year-over-year increase in contribution profit to $238.9 million.

Alongside lending growth, SoFi’s other financial services are expanding as well. Borrowers frequently enroll in checking, savings, and retirement accounts. Early in 2023, this segment was still operating at a loss, but by the third quarter, it showed significant growth with a contribution profit of $99.8 million.

Instead of outsourcing card issuance and payment processing, SoFi owns the Galileo financial technology platform. This technology is utilized by various financial institutions like Toast and H&R Block to streamline operations. Contribution profits from this technology segment reached a record $33 million in the third quarter.

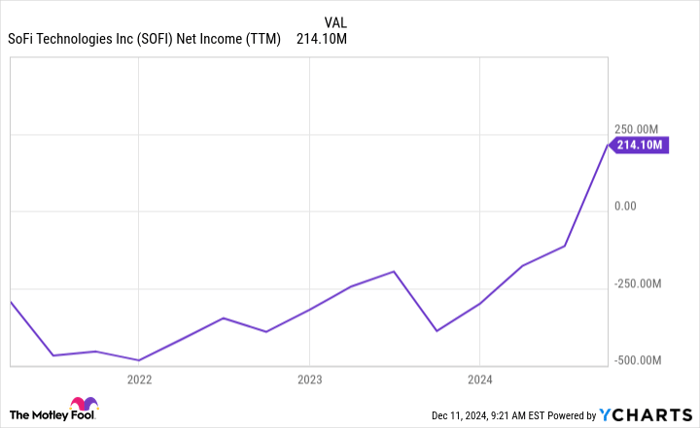

SOFI Net Income (TTM) data by YCharts.

SoFi Technologies is not only growing but also managing expenses effectively. Management anticipates net income on a GAAP basis to reach $205 million, indicating a slight decrease yet a significant improvement over last year’s losses.

The Shift in Analyst Sentiment

Despite its robust growth, Bank of America analyst Mihir Bhatia has downgraded SoFi stock to underperform. He set a price target of $12 per share, suggesting a potential loss of about 22% from its closing price on December 10, 2024.

Bhatia has not raised concerns regarding SoFi’s core operations. However, he pointed to the stock’s high valuation as problematic. At a market cap of $16.6 billion, the stock is trading at more than four times the bank’s tangible book value.

While some investors contend earnings multiples are more appropriate for evaluating SoFi, the stock remains expensive on that basis as well, trading at over 80 times management’s 2024 earnings estimate.

In order to validate its elevated valuation, SoFi must grow at a rate that exceeds typical expectations for established banks. Acquiring more shares at its current valuation seems unwise. It may be prudent to keep this stock on a watchlist and await a more reasonable price.

Keep an Eye on Lucrative Opportunities

Have you ever felt you missed the chance to invest in a high-performing stock? Now may be the time to reconsider.

Occasionally, our expert analysts identify “Double Down” stock opportunities—companies poised for significant growth. If you believe your window for investment is closing, this might be the moment to act.

- Nvidia: if you invested $1,000 when we issued our recommendation in 2009, you’d have $350,239!*

- Apple: if you invested $1,000 based on our advice in 2008, you’d have $46,923!*

- Netflix: if you invested $1,000 when we recommended it in 2004, you’d have $492,562!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, with limited chances to join before significant growth occurs.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Bank of America is an advertising partner of Motley Fool Money. Cory Renauer has positions in SoFi Technologies. The Motley Fool has positions in and recommends Bank of America and Toast. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.