Advanced Micro Devices AMD is expected to have benefited from strong Client and Data Center revenues in first-quarter 2024 earnings, set to be released on Apr 30.

AMD’s first-quarter top-line growth is expected to have benefited from an improving PC market.

The PC segment witnessed growth in the first quarter of 2024 after two years of decline. Per IDC’s latest report, 59.8 million PCs were shipped, up 1.5% from the year-ago period. Lenovo topped the shipment list, trailed by HP HPQ and Dell Technologies DELL, in terms of market share. Lenovo, HP, Dell and Apple AAPL had 23%, 20.1%, 15.5% and 8.1%, respectively.

Moreover, in terms of shipment, Lenovo and HP witnessed growth of 7.8% and 0.2%, respectively, while Dell Technologies lost 2.2%. Apple witnessed 14.6% growth, the strongest on the list.

AMD’s expanding portfolio has been a key catalyst in driving Client segment revenues. AMD has expanded its gaming portfolio with the launch of the Radeon RX 7600 XT graphics card.

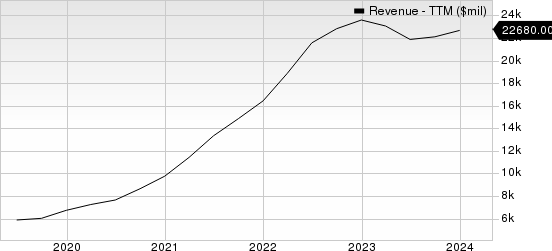

Advanced Micro Devices, Inc. Revenue (TTM)

Advanced Micro Devices, Inc. revenue-ttm | Advanced Micro Devices, Inc. Quote

It has also expanded its desktop portfolio with the introduction of the new Ryzen 8000G series desktop processors for the AM5 platform, including the Ryzen 7 8700G, with the world’s most powerful built-in graphics. AMD Ryzen 8000G series features up to eight cores and 16 threads.

AMD introduced Ryzen AI to unlock more AI for desktop consumers. Moreover, AMD launched Ryzen 5000 processors that include the new Ryzen 7 5700X3D, leveraging powerful 3D V-Cache technology.

Client revenues are expected to have increased 16.3% year over year to $859.3 million, per our model.

Click here to know how AMD’s overall first-quarter performance is likely to be.

Diversified Product Portfolio: Key to AMD’s Prospects

AMD benefits from a robust product portfolio and expanding partner base. It continues to strengthen its footprint in the enterprise data center arena by leveraging the power of fourth-generation EPYC CPUs.

AMD, along with its partners, continues to offer solutions that enable greater data center consolidation. It combines CDNA 3 architecture and Zen 4 CPUs to deliver robust performance for HPC and AI workloads. Partners like Microsoft, Oracle and Dell are already using the accelerators in their systems.

AMD’s expanding portfolio, which now includes the Ryzen 8040 series processor with Ryzen AI and Instinct MI300 Series data center AI accelerators, has been noteworthy. It has introduced the ROCm 6 open software stack with significant optimizations and new features supporting large language Models.

Our model estimates for Data Center revenues are pegged at $2.27 billion, indicating a year-over-year increase of 75.6%.

AMD currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

HP Inc. (HPQ) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.