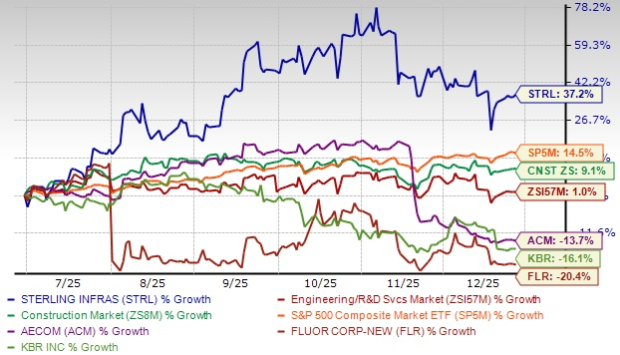

Sterling Infrastructure, Inc. (STRL) reported a 1% year-over-year decline in revenues within its Building Solutions segment for Q3 2025, largely driven by a 17% drop in legacy residential revenues. This decline reflects ongoing affordability challenges for homebuyers following recent interest rate cuts by the Federal Reserve on December 10, 2025. Despite these pressures, STRL’s E-Infrastructure Solutions segment recorded $417.1 million in revenue, marking a 58% increase compared to the previous year and comprising approximately 60% of total revenues.

As of September 30, 2025, STRL’s signed backlog reached $2.6 billion—a 64% increase from the prior year. The total potential work exceeds $4 billion when including awards and future phases, indicating a robust pipeline primarily driven by E-Infrastructure. While housing market softness continues to pose challenges, the growth in E-Infrastructure segments is positioned to mitigate these impacts leading into 2026.