STMicroelectronics Faces Tough Year, Launches New Products for Future Growth

STMicroelectronics (STM) shares have dropped 47.5% year-to-date (YTD), starkly contrasted by the Zacks Semiconductor-General industry’s return of 126.4% and the Zacks Computer & Technology sector’s 32.3% gain. This decline marks a tough period for the company.

In comparison, several rivals have seen significant stock increases. Notable examples include NVIDIA (NVDA), which has soared 172.7%, along with Amtech Systems (ASYS) and Texas Instruments (TXN), which have risen by 31.2% and 11.5%, respectively.

The downturn can be attributed to fewer orders and shrinking customer backlogs this past quarter, especially within the auto and industrial markets. A shift in consumer preferences has also been observed, favoring hybrid vehicles over fully battery electric models, and moving from premium to budget-friendly options.

Despite these challenges, STM is actively working to enhance its product lineup to spur growth. Recently, the company launched the STM32N6 microcontroller (MCU) series, which it labels as its strongest MCU yet. This new product integrates the Neural-ART Accelerator, promising 600 times better machine-learning capabilities than current high-end STM32 MCUs.

The STM32N6 aims to support advanced embedded systems and wearable devices, delivering impressive flexibility and AI functionality in a compact design. With its developer-friendly software tools, it allows easy integration of AI models, achieving faster inference speeds thanks to the Neural-ART Accelerator, exceeding STM’s own expectations.

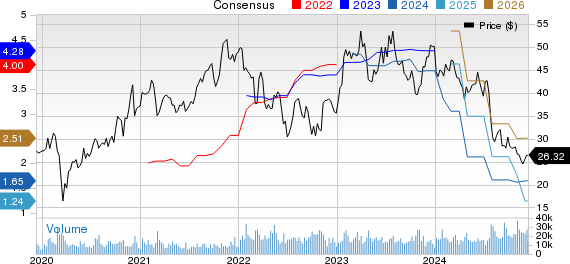

STMicroelectronics N.V. Price and Consensus

STMicroelectronics N.V. price-consensus-chart | STMicroelectronics N.V. Quote

New Product Launches to Boost STM’s Industrial Growth

Recently, STMicroelectronics unveiled the EVLDRIVE101-HPD motor-drive reference design. This innovative product includes a 3-phase gate driver, an STM32G0 microcontroller, and a 750W power stage on a compact 50mm diameter PCB. Its small size makes it suitable for robots and drones, as well as for powering industrial devices like pumps.

The introduction of ultra-low-power STM32 MCUs will further benefit the industrial sector. These MCUs can cut energy consumption by up to 50%, which can lessen battery waste and reduce replacement frequency. Consequently, designs leveraging renewable energy sources, such as solar cells, can operate without batteries.

Furthermore, STM has made strides with the ST Edge AI Suite, a collection of software tools aimed at simplifying the development and deployment of embedded AI applications.

STMicroelectronics Issues Caution for Q4 and FY24

For the fourth quarter of 2024, STM anticipates revenues of $3.32 billion at the midpoint, signifying a 22.4% decline year-over-year. The Zacks Consensus Estimate mirrors this expected revenue figure.

The company projects a gross margin of roughly 38% at the midpoint, impacted by a 400 basis point drop due to product mix changes, lower sales prices, and higher unused capacity charges. Earnings are expected to reach 35 cents per share, which is an 18.6% decrease from one month ago, amounting to a 69.3% decline year-over-year.

For the entire fiscal year 2024, STM projects revenues around $13.27 billion, reflecting a 23.2% annual decrease primarily due to reduced earnings in Automotive and Industrial sectors, though a slight gain in Personal Electronics is expected. The earnings consensus stands at $1.65 per share, indicating a notable 63% decline year-over-year.

The anticipated gross margin for the full year is about 39.4%, expected to be negatively affected by approximately 290 basis points due to unused capacity charges.

Furthermore, STMicroelectronics has expressed concern over the slow recovery in the Industrial market and lower-than-anticipated growth in the Automotive sector for the latter half of the year.

Should Investors Consider STM Stock Now?

Despite current hurdles, STMicroelectronics demonstrates resilience and long-term growth potential through innovative product launches and strategic partnerships. Challenges like inventory management and macroeconomic uncertainty still loom overhead.

While STM appears attractive with solid fundamentals and a Zacks Value Style Score of A, caution may be prudent due to immediate obstacles. Currently, STM holds a Zacks Rank #3 (Hold), suggesting that existing investors may wish to hold on, while potential new buyers should seek a more favorable entry point.

Get Access to Zacks’ Top Recommendations

We’re not joking.

Years ago, we surprised our members by offering 30-day access to all our stock picks for just $1. No further obligations required.

Many have benefited from this offer, while others hesitated, thinking it too good to be true. Our aim is simple: we want you to try out our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which collectively closed 228 positions with significant gains in 2023.

Want to see today’s top Zacks Investment Research recommendations? Download now for free details on 5 Stocks Set to Double.

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

STMicroelectronics N.V. (STM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Amtech Systems, Inc. (ASYS): Free Stock Analysis Report

For the complete article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.