Investors have watched in awe as the “Magnificent Seven” stocks outshined the market with staggering share price increases over the past decade, some even soaring by nearly 20,000%. Of the group, only Tesla (NASDAQ: TSLA) has faced recent struggles, prompting calls for its removal from the elite club by notable figures like Jim Cramer.

While Tesla’s successor remains uncertain, one contender stands out among the rest with a market cap of nearly $900 billion, poised to potentially cross the $1 trillion mark in the near future. Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), while not a tech-centric powerhouse like its peers, presents a compelling case for becoming the next trillion-dollar company.

Breaking the Tech Norm

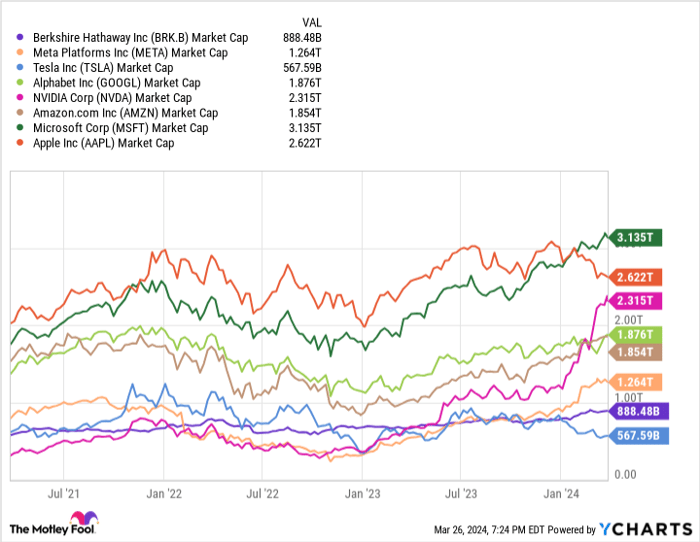

Technology giants dominate the trillion-dollar club, including Alphabet, Meta Platforms, Apple, Amazon, Nvidia, and Microsoft, all riding the wave of tech advancement. In this landscape, Berkshire Hathaway emerges as an unconventional candidate for Tesla’s replacement, given its market cap’s proximity to the coveted trillion-dollar milestone.

Comparatively, Tesla’s current market cap of about $570 billion pales in size when measured against Berkshire’s reach, positioning the latter as a more fitting member of the esteemed “Magnificent Seven.”

BRK.B market cap data by YCharts.

Amid skepticism regarding Berkshire’s tech credentials, a closer look reveals its significant investments in tech giants. Notably, Berkshire’s substantial stake in Apple, valued at approximately $168 billion, accounts for nearly 30% of Tesla’s market cap. Moreover, the conglomerate’s diverse tech holdings, including Amazon, Visa, Mastercard, Snowflake, HP, and BYD, position it more strategically in the tech arena than commonly perceived.

A Value Proposition

Comparing Tesla and Berkshire directly proves to be a challenging exercise due to their distinct business models and valuation methodologies. However, benchmarking their valuations against peers illuminates their relative pricing dynamics.

Tesla’s premium valuation vis-a-vis traditional automakers like Ford, General Motors, and Volkswagen, as well as new electric vehicle players like Rivian, underscores its steep pricing. Conversely, Berkshire, while commanding a premium over its industry counterparts, maintains a significantly more modest premium, making it a more attractive investment opportunity.

TSLA PS ratio data by YCharts; PS = price to sales.

Despite its potential, Berkshire is unlikely to crack the exclusive “Magnificent Seven,” given its limited tech focus. Nevertheless, its substantial tech investments underscore its hidden tech prowess, making it an appealing option for investors seeking a reliable and reasonably priced asset.

As Tesla faces valuation challenges, Berkshire Hathaway emerges as a stable and reasonably priced alternative for savvy investors. While its ascent to the trillion-dollar club remains uncertain, its performance warrants a closer look for inclusion in individual portfolios.

Should you invest $1,000 in Berkshire Hathaway right now?

Prior to diving into Berkshire Hathaway stock, investors should consider this:

The Motley Fool Stock Advisor analyst team recently unveiled their top picks for investors, excluding Berkshire Hathaway. These compelling selections offer the potential for significant returns over the coming years.

Stock Advisor equips investors with a user-friendly roadmap for success, featuring expert insights, portfolio building advice, and two new stock recommendations monthly. Since 2002, the Stock Advisor service has surpassed S&P 500 returns threefold*.

Discover the 10 stocks

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, sits on The Motley Fool’s board of directors. Randi Zuckerberg, a former director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, also serves on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also a board member. Ryan Vanzo holds no position in the mentioned stocks. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, BYD, Berkshire Hathaway, Fairfax Financial, HP, Markel Group, Mastercard, Meta Platforms, Microsoft, Nvidia, Snowflake, Tesla, Visa, and Volkswagen Ag. The Motley Fool suggests General Motors, Loews, and Nu, and provides options advice on long January 2025 $25 calls on General Motors, long January 2025 $370 calls on Mastercard, long January 2026 $395 calls on Microsoft, short January 2025 $380 calls on Mastercard, and short January 2026 $405 Calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The author’s views and opinions expressed herein do not necessarily align with those of Nasdaq, Inc.