Nvidia Stock Performance and Outlook

Nvidia’s stock (NASDAQ: NVDA) has seen an extraordinary rise of over 800% from 2023 to 2025, but growth slowed to just 39% in 2025. For fiscal year 2026, ending January 2026, analysts project a significant revenue growth of 63%. This trend indicates that Nvidia’s stock may be poised for a rebound in 2026, particularly as demand for its graphics processing units (GPUs) remains robust, with expectations of 52% revenue growth for fiscal year 2027.

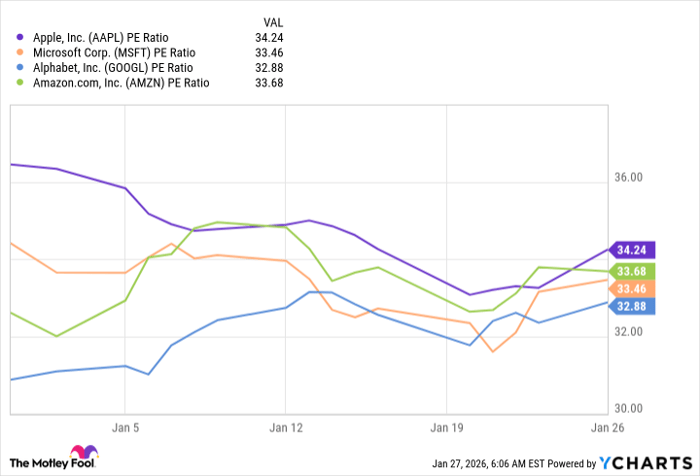

Wall Street analysts estimate that Nvidia will generate $7.66 in earnings per share (EPS) next fiscal year. Utilizing a price-to-earnings (P/E) ratio of 46, consistent with the company’s growth rate, could position the stock price at $352 by the end of the fiscal year, representing an 87% potential return. A more conservative P/E ratio of 33 predicts the stock price at $253, indicating a 35% gain.