Investing Wisdom: Why Billionaires Favor Alphabet Stock

Just because a group of billionaires owns the same stock doesn’t automatically make it a great addition to your portfolio. Different investors have varying goals and levels of risk tolerance. However, these billionaires are wealthy for a reason, and it may be worthwhile to examine one stock they collectively endorse, especially one that shows strong performance.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Given this context, we’ll take a closer look at a technology stock currently favored by billionaires: Alphabet. For investors seeking relatively low-risk growth, this stock might indeed be a wise choice. Following a strong 2024, it seems poised for additional gains in the coming year.

Major Hedge Funds Backing Alphabet

The billionaires in question primarily include hedge fund managers. Research from The Motley Fool explored 16 of the biggest funds in the industry to identify popular tech holdings. Among the usual suspects like Nvidia, Meta Platforms, and Microsoft, Alphabet (NASDAQ: GOOG, NASDAQ: GOOGL) is a favorite, owned by more than two-thirds of these investors.

These stock-pickers have been rewarded for their investment choices: after a tumultuous 2022, Alphabet’s shares are expected to rise about 40% this year, building on nearly 60% growth in 2023—despite concerns over a potential breakup sought by the Department of Justice.

However, sustaining such rallies can be challenging. Analysts anticipate slower growth ahead with the current consensus price target of $210.79 suggesting only about 9% upside from the current stock price, which may deter some investors.

Three Factors That Could Boost Alphabet’s Performance in 2025

Despite external challenges, Alphabet is seeing steady business growth. Last quarter’s revenue rose 15% year over year, leading to even higher operating income. This positive trend has been evident since the overall market rebounded from COVID-19 disruptions. Analysts expect more growth in the near future. Here are three optimistic factors to consider:

1. Expected Growth in Cloud Computing

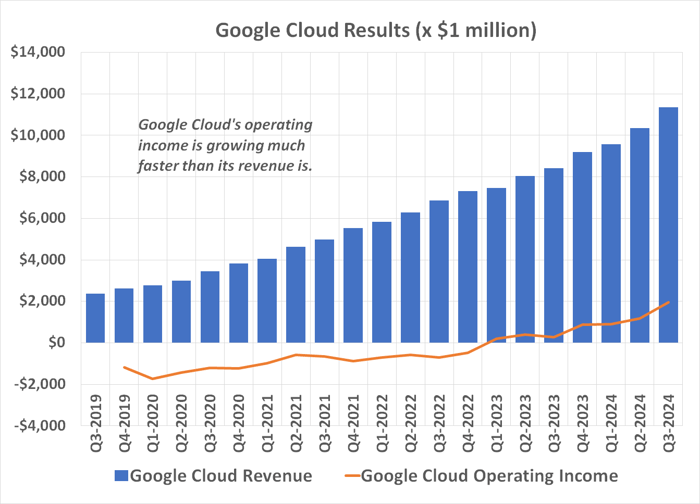

Google Cloud has recently begun turning a profit, and its growth potential remains substantial. If Google Cloud achieves operating margins similar to those of Microsoft and Amazon, it could add as much as $16 billion in annual operating income. Continued growth in this area suggests even greater profit potential lies ahead.

Data source: Alphabet.

To put this into perspective, Alphabet currently generates around $100 billion in operating income annually.

2. Advancements in AI Chat Technology

Alphabet is making meaningful progress in artificial intelligence chat platforms, such as its Gemini tool—growing its share of AI chatbot usage from 13% to 27% within a year. Statista reports its rapid growth places it close to the leader, ChatGPT, which holds a 31% share. Furthermore, First Page Sage states that globally, Gemini is the fastest-growing AI chat option among major players.

3. Strong Growth in Core Search Business

While Alphabet diversifies into AI and cloud services, its main revenue driver remains its search engine. Data from GlobalStats shows Google handles 90% of global web searches. Google’s search business makes up more than half of Alphabet’s revenue and is expected to maintain a growth rate of 11% annually through 2032, fueled by AI integration into search results.

Consider Long-Term Stability with Alphabet

While these factors bode well for Alphabet, short-term fluctuations are still possible. The stock has increased by 30% since its September low, suggesting a potential correction. It may be wise to hold off on purchases in the immediate future for a better entry point.

However, it’s crucial to recognize that these advantages are primarily long-term trends. Given Alphabet’s unpredictable short-term performance, buying now rather than waiting for a dip could be justified. Furthermore, the DOJ’s actions attempting to force the sale of the Chrome browser are concerning but not detrimental enough to undermine Alphabet’s operations significantly. The potential sale could yield $20 billion, a small amount compared to the company’s overall market cap of $2.4 trillion.

A New Opportunity Awaits Investors

Have you ever felt you missed out on investing in successful stocks? If so, you might want to pay attention now.

Occasionally, our expert analysts recommend a “Double Down” stock—companies they believe are nearing substantial growth. If you’re worried about missing opportunities in these stocks, now might be the best time to invest before the chance passes. Consider these examples:

- Nvidia: An investment of $1,000 back when we recommended it in 2009 would now be worth $362,166!*

- Apple: Invested $1,000 at our recommendation in 2008? That would be $48,344 today!

- Netflix: If you had invested $1,000 in 2004, it would now be $491,537!*

Currently, we are issuing “Double Down” alerts for three outstanding companies that you might not want to miss.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. Randi Zuckerberg, former spokeswoman for Facebook and sister to Meta’s CEO, holds a similar position. James Brumley has shares in Alphabet. The Motley Fool holds positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. They also advise trading long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on the same stock. For more details, refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.