Verizon Launches New Cybersecurity Solutions Amidst Market Challenges

Verizon Communications Inc. (VZ) has recently strengthened its cybersecurity efforts for larger mid-sized businesses with the introduction of its Trusted Connection solution. This innovative Zero Trust Network Access (ZTNA) service integrates networking and security services, enhancing secure access from any user device to a variety of digital resources.

This new service enhances cloud-centric security and enables secure access to websites, software-as-a-service (SaaS) applications, and private applications. By encrypting data paths between users and cloud applications, Trusted Connection significantly improves functionality and control, reducing the risk of potential cyberattacks.

Leveraging Generative AI within 5G Framework

In addition to enhancing cybersecurity, Verizon is utilizing its private Mobile Edge Compute (MEC) technology to facilitate digital transformation and innovation across businesses. The company has partnered with NVIDIA Corporation (NVDA) to enable real-time Generative AI applications over its 5G private network. This collaboration integrates Verizon’s private On Site 5G and private 5G Edge with NVIDIA’s AI Enterprise software, which allows enterprises to maximize the use of 5G and mobile edge computing for greater operational efficiency.

Enterprises gain access to a private network and edge compute infrastructure, providing secure connectivity for real-time AI applications that demand ultra-low latency and high bandwidth. The AI-powered solution designed by Verizon and NVIDIA is modular and supports future advancements in AI computing while allowing multi-tenancy for diverse applications. This adaptable solution can be effortlessly scaled and operated either remotely or on-site for improved decision-making through local processing.

The integrated stack is capable of supporting compute-intensive applications including Generative AI Large Language Models, Vision Language Models, video streaming, and various IoT technologies. This unified ecosystem enables clients to tailor the right models and architectures to achieve their objectives.

Robust Wireless Network Fuels VZ’s Growth

Verizon operates one of the most efficient wireless networks in the United States, delivering rapid peak data speeds. This efficiency stems from a combination of meticulous planning, rigorous engineering, and significant infrastructure investments. Key components of Verizon’s 5G network strategy include expansive spectrum holdings, particularly in millimeter-wave bands, along with deep fiber resources for enhanced data transfer and a large deployment of small cells.

The company is witnessing considerable 5G adoption and momentum in fixed wireless broadband through its premium unlimited plans. Verizon has plans to broaden its 5G Ultra Wideband network availability across the country, with a focus on mobility, nationwide broadband, and advanced mobile edge computing solutions.

Rising Infrastructure Costs Impact Margins

Despite strong performance in its wireless segment, Verizon’s wireline division faces ongoing challenges. A steep decline in access lines is attributed to competitive pressure from voice-over-Internet protocol (VoIP) providers and aggressive offerings from cable companies. To attract new customers, Verizon is also facing increased promotional costs and discounts, further straining its profit margins.

Additionally, Verizon has recorded high capital expenditures necessary for establishing and expanding its 5G Ultra Wideband network, as well as upgrading its Intelligent Edge Network architecture. The recent C-Band auction has resulted in significant spending to acquire mid-band spectrum, which is essential for future 5G deployments. Failure to justify these expenses may lead to further margin compression.

In an increasingly saturated U.S. wireless market, Verizon must navigate a spectrum crunch which complicates the management of mobile data traffic and generates surging demand for video streaming. The company also reported 60,000 net losses in Fios Video during the fourth quarter of 2024, marking a continued shift from traditional linear video services toward over-the-top alternatives.

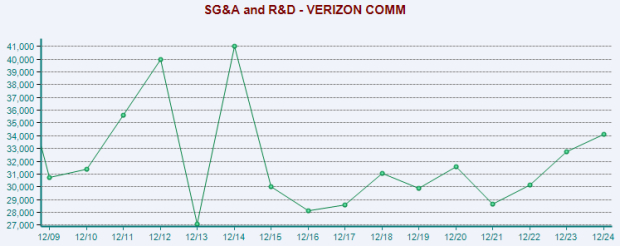

Image Source: Zacks Investment Research

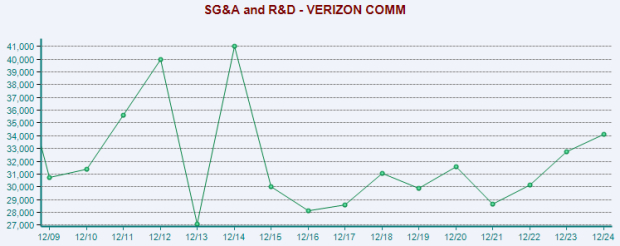

VZ Price Performance Overview

Over the past year, VZ’s shares have risen by 7.1%, trailing behind the industry average growth of 36.4% and competitors such as AT&T Inc. (T) and T-Mobile US Inc. (TMUS).

One-Year VZ Stock Price Performance

Image Source: Zacks Investment Research

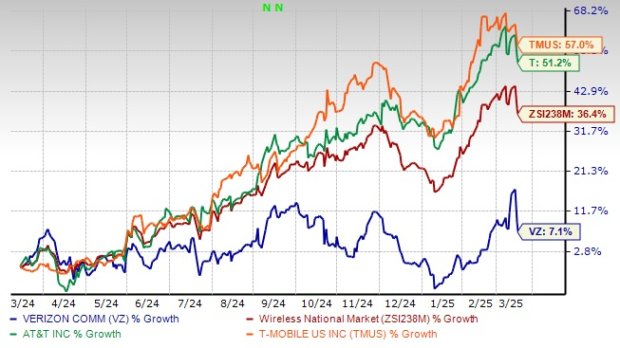

Future Earnings Estimates for VZ

Earnings estimates for Verizon in 2025 have dropped by 0.8% to $4.68 over the past year, while estimates for 2026 decreased by 1.2% to $4.86. This trend reflects a cautious outlook for the Stock.

Image Source: Zacks Investment Research

Conclusion

Through continual investment in infrastructure and the adoption of innovative technologies, Verizon aims to bridge the digital divide and improve national connectivity. This strategy is expected to drive subscriber growth and increase revenue on a per-user basis, along with higher broadband and fiber penetration.

Nevertheless, a competitive landscape and aggressive pricing wars are likely impacting profitability. The downward trend in earnings estimates suggests uncertainty about growth potential for the Stock. With a Zacks Rank of #3 (Hold), Verizon appears to be navigating cautiously, and investors are advised to consider this while making trading decisions. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Experts have recently identified 7 elite stocks from a current selection of 220 Zacks Rank #1 Strong Buys. They believe these stocks have the potential for early price increases.

Historically, this exclusive list has outperformed the market by more than twice the average, recording an average gain of +24.3% per year since 1988. It is advisable to pay attention to these carefully chosen stocks.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to access this free report.

AT&T Inc. (T): Free Stock Analysis report

Verizon Communications Inc. (VZ): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

T-Mobile US, Inc. (TMUS): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.