“`html

Netflix has announced its acquisition of Warner Bros. Discovery for an enterprise value of approximately $82.7 billion, according to a statement made on December 5, 2025. This cash-and-stock transaction aims to merge Netflix’s streaming capabilities with Warner Bros. Discovery’s extensive content, which includes popular franchises like Harry Potter and Game of Thrones.

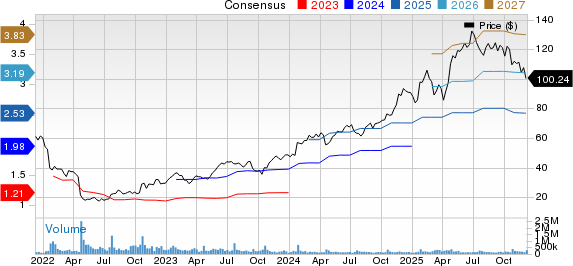

In its third-quarter report for 2025, Netflix reported revenues of $11.51 billion, marking a 17% year-over-year growth, but missed earnings expectations with earnings per share at $5.87. The company has plans to achieve $2 billion to $3 billion in annual cost savings from the acquisition, anticipated to be accretive to earnings by its second year. However, regulatory scrutiny is expected, particularly regarding competition concerns, as the merged entity may exceed a 30% market share in streaming.

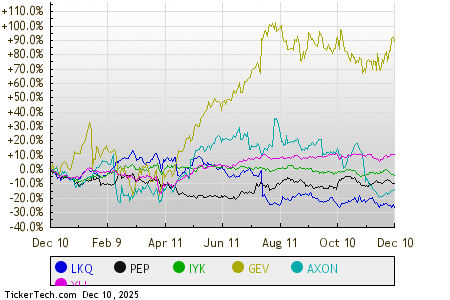

Despite the acquisition’s transformative potential, the transaction involves significant risks, including a substantial debt load. Netflix is also facing challenges with its stock performance, having lost 18.1% over the past six months, contrasting with gains from competitors like Apple, which saw a 38.4% increase.

“`