William Blair Downgrades Becton, Dickinson to Market Perform

Fintel reports that on May 1, 2025, William Blair downgraded their outlook for Becton, Dickinson and Company (XTRA:BOX) from Outperform to Market Perform.

Analyst Price Forecast Indicates Potential Growth

As of April 23, 2025, the average one-year price target for Becton, Dickinson and Company is set at 239.15 €/share. Predictions vary significantly, with estimates ranging from a low of 214.85 € to a high of 293.11 €. This represents a potential increase of 32.72% from its latest reported closing price of 180.20 € per share.

Projected Financial Performance

The anticipated annual revenue for Becton, Dickinson is 21,727 million euros, which reflects an increase of 4.12% compared to previous estimates. Additionally, the projected non-GAAP earnings per share (EPS) stands at 15.17.

Fund Sentiment Analysis

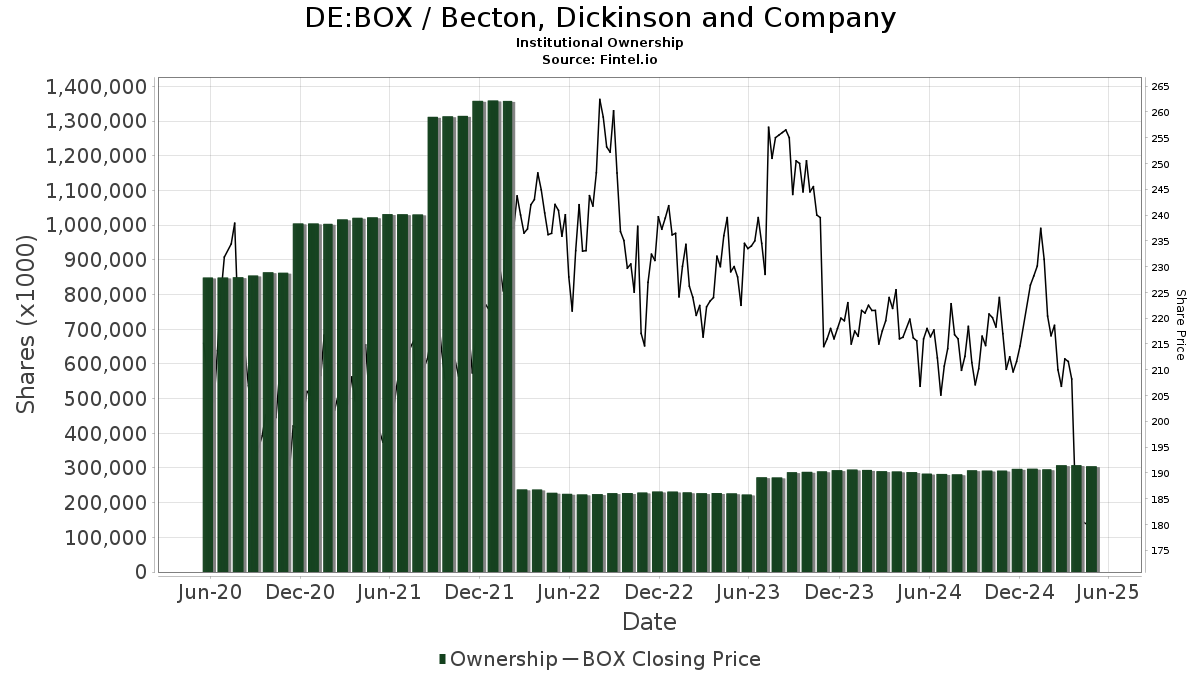

Currently, there are 2,549 funds or institutions reporting positions in Becton, Dickinson—an increase of 76 owners or 3.07% during the last quarter. The average portfolio weight of all funds invested in BOX is 0.39%, up by 1.75%. Total shares owned by institutions rose by 2.64% over the last three months, reaching 305,222K shares.

Actions of Key Shareholders

Price T Rowe Associates holds 12,347K shares, representing 4.30% ownership of the company. This reflects a decrease from the previous filing of 13,598K shares, marking a 10.14% drop. Moreover, they reduced their portfolio allocation in BOX by 14.46% over the last quarter.

T. Rowe Price Investment Management, on the other hand, owns 12,127K shares for a 4.22% stake. Their previous filing indicated ownership of only 8,907K shares, revealing a 26.55% increase. Consequently, they improved their portfolio allocation in BOX by 31.05% in the same period.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 9,058K shares, equating to 3.15% ownership. This is down from the previous 9,160K shares, showing a 1.13% decrease in their position, with a portfolio allocation in BOX declining by 8.31% recently.

Lastly, the T. Rowe Price Capital Appreciation Fund (PRWCX) has increased its stake, holding 7,982K shares for a 2.78% ownership, up from 5,911K shares—a 25.95% increase. Their allocation to BOX has grown by 28.94% this past quarter.

Fintel is a leading platform providing extensive research resources for investors, financial advisors, and hedge funds.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.