Williams Companies, Inc. (WMB) exceeded expectations with a strong fourth-quarter report, announcing adjusted earnings per share of 48 cents, beating the Zacks Consensus Estimate by 1 cent. Despite the beat, the bottom line fell from the year-ago period. The company’s revenues of $2.78 billion also surpassed estimates, but declined from the previous year’s reported figure. This mixed performance left investors both relieved and rattled, akin to riding a rollercoaster with unexpected twists and turns.

Key Takeaways

Adjusted EBITDA totaled $1.72 billion, down 3% year over year. Cash flow from operations amounted to $1.93 billion, showing a significant increase from the corresponding quarter of 2022. This bolstered investor confidence, demonstrating the company’s ability to weather financial storms.

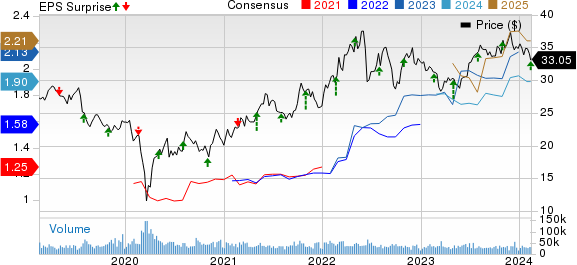

Williams Companies, Inc. (The) Price, Consensus and EPS Surprise

Williams Companies, Inc. (The) price-consensus-eps-surprise-chart | Williams Companies, Inc. (The) Quote

Segmental Analysis

Transmission & Gulf of Mexico: The segment reported an adjusted EBITDA of $752 billion, up 7.4% from the year-ago quarter’s level, showcasing its resilience and potential for growth.

West: This segment’s adjusted EBITDA totaled $323 million, depicting a slight decline from the prior-year quarter’s level due to external market factors, creating fodder for strategic considerations.

Northeast G&P: This segment registered an adjusted EBITDA of $485 million, displaying an upward trajectory that infused the company with renewed optimism.

Gas & NGL Marketing Services: This unit generated an adjusted EBITDA profit of $69 million, underperforming compared to the prior-year quarter’s level – an aspect that requires attention and scrutiny.

Costs, Capex & Balance Sheet

In the reported quarter, total costs and expenses of $1.7 billion declined almost 8.1% from the year-ago quarter’s figure. The prudent cost management instilled a sense of fiscal discipline and resilience.

Total capital expenditure was $788 million compared with $806 million a year ago. The company’s cash and cash equivalents of $2.2 billion and long-term debt of $23.4 billion, with a debt-to-capitalization of 65.3%, displayed a balanced liquidity position.

Guidance

In 2024, WMB expects Adjusted EBITDA in the $6.8-$7.1 billion range, coupled with substantial growth and maintenance capex. This forward-looking approach and transparent communication were well received by industry analysts and investors.

Looking ahead to 2025, the company expects Adjusted EBITDA between $7.2 billion and $7.6 billion, signaling a forward momentum that resonated well with shareholders and industry insiders.

Zacks Rank and Key Picks

Currently, WMB carries a Zacks Rank #3 (Hold). Investors interested in the energy sector might look at some better-ranked stocks, each presenting unique opportunities for growth and income.

Subsea 7 S.A. (SUBCY) and Energy Transfer LP (ET), both sporting a Zacks Rank #1 (Strong Buy), and Murphy USA Inc. (MUSA), carrying a Zacks Rank #2 (Buy) at present, offer diverse options for investors to consider.

Zacks experts’ insights into stock valuation, dividends, and company focus areas, coupled with explorations into diverse fields within the energy sector, provides investors with a roadmap to navigate financial terrain riddled with uncertainty and volatility.