Wolfe Research Upgrades Netflix Outlook Amid Predictions of Price Drop

Analyst Forecasts Show Price Target Decrease

On January 23, 2025, Wolfe Research changed its rating for Netflix (NasdaqGS:NFLX) from Peer Perform to Outperform. Nonetheless, as of December 23, 2024, analysts have set an average one-year price target for Netflix at $850.41 per share. This target suggests a potential decline of 13.63% compared to the most recent closing price of $984.57 per share. Analysts predict a wide range for this target, from a low of $555.50 to as high as $1,243.20.

Projected Revenue Growth Highlights Corporate Performance

Netflix is expected to generate annual revenue of $39.63 billion, marking a growth of 1.61%. Additionally, the projected annual non-GAAP earnings per share (EPS) stands at 15.13.

Institutional Investment Trends

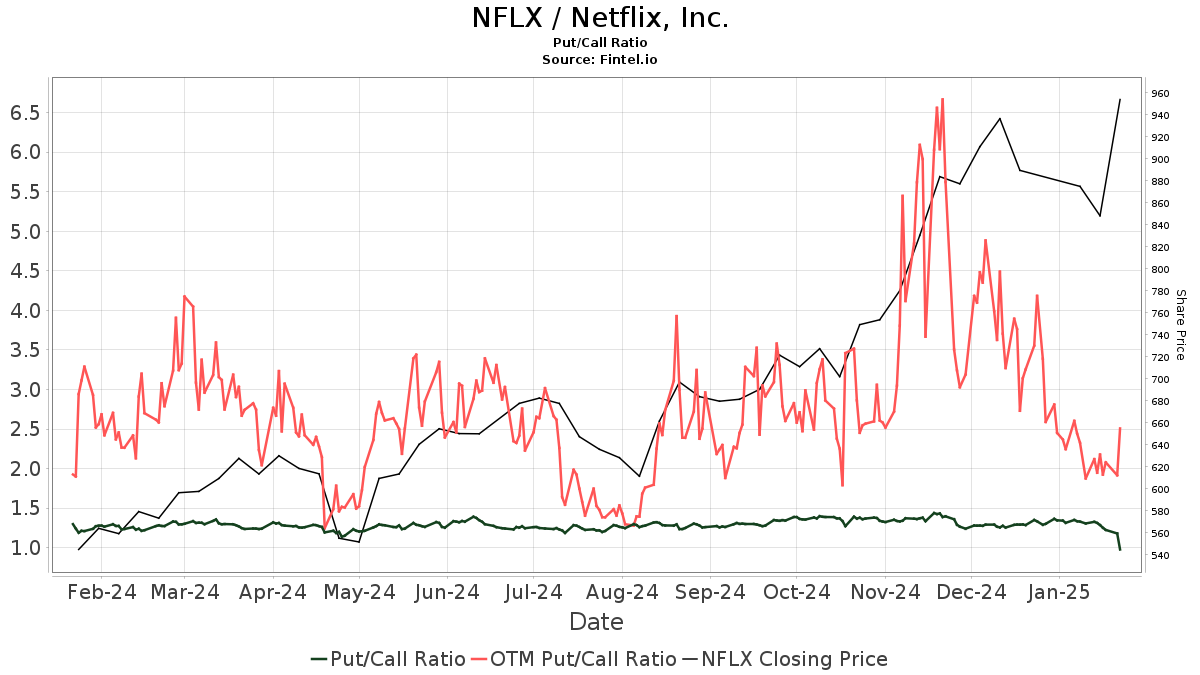

Currently, 4,177 institutional funds have reported their positions in Netflix, reflecting an increase of 146 funds or 3.62% in the last quarter. The average portfolio weight for these funds in Netflix is -13.51%, a substantial increase of 1,979.84%. Over the last three months, total institutional shares decreased slightly by 0.22%, totaling 413,578K shares. The put/call ratio for NFLX is 0.97, indicating that the market holds a bullish perspective on the stock.

Recent Changes in Major Shareholder Holdings

Vanguard Total Stock Market Index Fund Investor Shares holds 13,604K shares, accounting for 3.18% ownership but has seen a small decrease of 0.08% from the previous quarter. Price T Rowe Associates reported ownership of 11,834K shares (2.77%), down 4.36% from earlier filings. Similarly, Capital World Investors owns 11,763K shares (2.75%), which is a decrease of 1.22%. However, Vanguard 500 Index Fund Investor Shares saw an increase from 10,959K to 11,240K shares, representing a 2.50% growth. J.P. Morgan Chase, on the other hand, holds 9,432K shares after a decrease of 2.97% despite a significant increase in its portfolio allocation by 963.79% over the last quarter.

A Snapshot of Netflix’s Business Model

(Provided by the company)

Netflix stands as the leading streaming entertainment service globally, boasting over 195 million paid memberships across more than 190 countries. Subscribers enjoy a diverse selection of TV series, documentaries, and feature films, allowing them to watch unlimited content anytime, anywhere on any device connected to the internet. The service lets users play, pause, and resume viewing without interruptions or commitments.

Fintel serves as a vital resource for individual investors, traders, financial advisors, and smaller hedge funds, offering in-depth research and data.

Our platform encompasses a wide array of tools, including fundamentals, analyst insights, ownership data, fund sentiments, and much more. We also provide exclusive stock picks generated through advanced, backtested quantitative models for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.