W.R. Berkley Corporation Stock Shows Strong Performance and Growth Potential

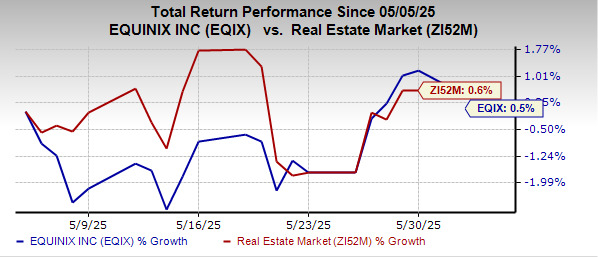

Shares of W.R. Berkley Corporation (WRB) ended Friday at $72.49, close to its 52-week high of $76.38. This position reflects strong investor confidence, signaling potential for further price increases. The stock trades above its 50-day and 200-day simple moving averages (SMA) of $67.27 and $61.04, respectively, indicating solid upward momentum. The SMA is a popular tool in technical analysis, helping investors predict future price trends based on historical data.

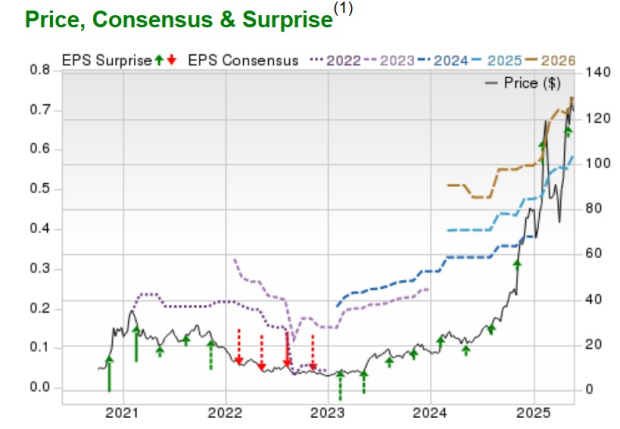

W.R. Berkley has shown impressive earnings growth of 27.8% over the last five years, exceeding the industry average of 18.9%. The company has a strong history of beating earnings estimates, achieving this in three of the last four quarters, with an average surprise of 8.59%.

W.R. Berkley’s Price Movement vs. 50-Day Moving Average

Image Source: Zacks Investment Research

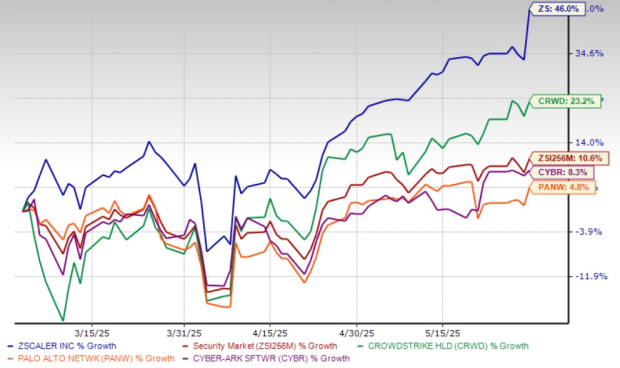

W.R. Berkley is Outperforming Peers

In the past year, W.R. Berkley shares have increased by 38.3%, outperforming both its industry and the broader market. The Finance sector and the Zacks S&P 500 grew by 23%, 15.9%, and 8.3%, respectively, showcasing WRB’s superior performance.

W.R. Berkley’s Growth Projections

The Zacks Consensus Estimate predicts a 2.9% year-over-year increase in W.R. Berkley’s earnings per share for 2025. Revenue is projected to reach $14.35 billion, signaling a 6.1% year-over-year improvement. For 2026, both earnings per share and revenues are forecasted to increase by 10.4% and 9.7%, respectively, compared to 2025.

Strong Returns on Capital

W.R. Berkley displayed a return on equity of 19.6% over the last 12 months, significantly higher than the industry’s average of 8.3%. This indicates effective use of shareholder funds. Additionally, the return on invested capital (ROIC) has been rising, standing at 9.6% in the trailing twelve months, compared to the industry average of 6.3%.

Key Factors Driving WRB’s Stock Performance

W.R. Berkley’s growth strategy emphasizes commercial lines, including excess and surplus lines, admitted lines, and specialty personal lines, where it maintains a competitive edge. Its insurance operations, which comprise the majority of its net premiums, are projected to expand through new startup units, increased international operations, rate hikes, market dislocations, and high retention rates.

W.R. Berkley is strategically focusing on select attractive global markets, operating in emerging economies such as the UK, Continental Europe, South America, Canada, Scandinavia, Asia, and Australia. The company has reported over 60 consecutive quarters of favorable reserve development, thanks to prudent underwriting and operational excellence that support a solid balance sheet with strong liquidity and cash flows.

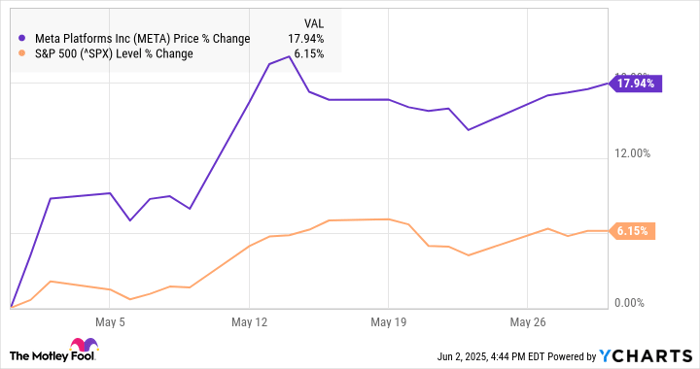

Valuation Considerations for WRB Shares

WRB shares are currently priced at a premium to the industry, with a price-to-book ratio of 3.08X compared to the industry average of 1.61X. Other insurers, like Arch Capital Group Ltd. (ACGL), The Travelers Companies, Inc. (TRV), and Cincinnati Financial Corporation (CINF), also trade at a premium to industry averages.

Image Source: Zacks Investment Research

Conclusion on W.R. Berkley Stock

W.R. Berkley stands to benefit from ongoing rate increases, disciplined reserving, diversification, growth in international markets, investments in alternative assets, and a consistent cash flow. The company has increased dividends since 2005 and has been paying special dividends as well as buying back shares. Its current dividend yield of 0.4% is competitive compared to the industry average of 0.2%, making it a compelling option for dividend-focused investors.

Nonetheless, due to its premium valuation, investors might consider exercising caution regarding this Zacks Rank #3 (Hold) stock.