“`html

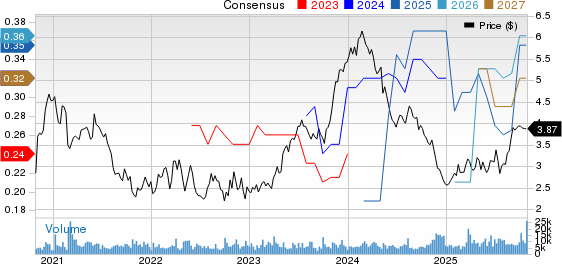

Waterstone Financial, Inc. (WSBF) reported a net income of $7.9 million for the third quarter of 2025, a 67.6% increase from $4.7 million in the same period last year. Earnings per share rose to 45 cents, up 73.1% from 26 cents year-over-year. The company’s shares gained 5% since the earnings report, outperforming the S&P 500 index, which grew by 2.9%.

Net interest income increased to $14.7 million, a 28% year-over-year growth. The return on average assets (ROAA) rose to 1.4% from 0.8%, while the return on average equity (ROAE) jumped to 9.1% from 5.6% in the prior-year quarter. As of September 30, 2025, the book value per share increased to $18.65 from $17.53 at year-end 2024.

During the quarter, Waterstone repurchased approximately 270,000 shares at a cost of $3.8 million and declared a quarterly dividend of 15 cents per share. The Community Banking segment generated pre-tax income of $8.4 million, a 49.4% increase from the previous year, while Mortgage Banking recorded pre-tax income of $1.3 million, up from $0.1 million.

“`