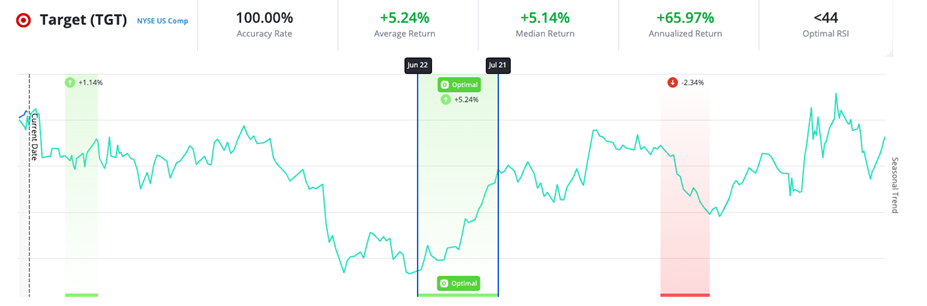

Legendary investor Warren Buffett’s advice on market sentiment resonates as shares of Wynn Resorts Ltd (Symbol: WYNN) hit an oversold level with a Relative Strength Index (RSI) of 29.5 during Tuesday’s trading, falling to $77.14 per share. This RSI indicates that the stock may be under significant selling pressure, as a reading below 30 typically suggests an oversold condition.

In comparison, the S&P 500 ETF (SPY) currently has an RSI of 54.6. Wynn’s stock has a 52-week range with a low of $71.63 and a high of $110.38, positioning its last trade at $77.00. This recent decline has potential bullish investors looking for buying opportunities as heavy selling could be nearing exhaustion.