Nvidia Poised for Growth as Elon Musk’s xAI Plans Major Chip Purchase

Elon Musk’s artificial intelligence (AI) venture, xAI, is gearing up for a significant chip acquisition from Nvidia (NVDA). According to a report from CNBC, xAI is expected to close its funding round next week, successfully raising about $6 billion to acquire 10,000 AI chips from Nvidia. These essential components will play a vital role in xAI’s data center located in Memphis, Tennessee, where the company is developing a supercomputer.

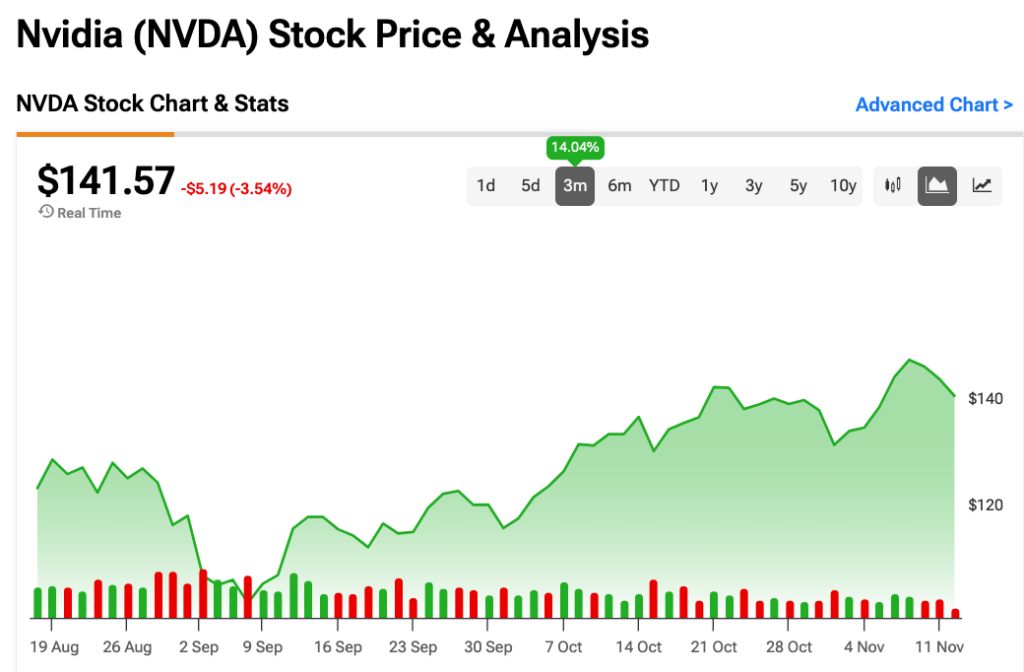

Despite some struggles today for NVDA stock, this anticipated transaction could help it recover, as xAI’s increasing activities will drive substantial demand for chips.

Understanding Today’s Nvidia Stock Situation

This week has been quite turbulent for Nvidia’s stock, with shares predicted to finish the week in the red, down approximately 3% today. This decline is largely attributed to negative market trends. However, Nvidia has had a strong quarter overall, bouncing back from a dip in September 2024, and showing a remarkable increase of 140% despite challenging market conditions.

For Nvidia investors, this news brings reassurance with the addition of a new client that has grand ambitions. Musk aims to leverage xAI for a supercomputer that could greatly enhance Tesla’s (TSLA) self-driving technology. If successful, this venture could lead to further Nvidia chip orders, acting as a potential growth driver for NVDA stock.

Additionally, Musk’s association with President-elect Donald Trump may foster advantageous policies for companies in the AI sector. TSLA stock has previously benefited from Musk’s ties to Trump, and other ventures could experience similar advantages. As xAI expands, Nvidia is well-positioned to grow as its primary chip supplier.

Positive Outlook from Wall Street for NVDA Stock

Throughout 2024, Wall Street has maintained a positive outlook on Nvidia, and the news from xAI could enhance these projections. Analysts currently have a Strong Buy consensus rating for NVDA stock, supported by 39 Buy ratings and three Hold ratings issued over the past three months. Following a significant 185% surge in share price over the previous year, the average price target for NVDA stands at $157.82 per share, suggesting a potential upside of 12%.

See more NVDA stock analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.