Analyst Projections Suggest Positive Upside for Major Communication Services Stocks

In analyzing the holdings of the ETFs we cover at ETF Channel, we’ve evaluated the trading prices of these assets against the average 12-month target prices set by analysts. This analysis points to an implied target price for The Communication Services Select Sector SPDR Fund ETF (Symbol: XLC) of $109.34 per share.

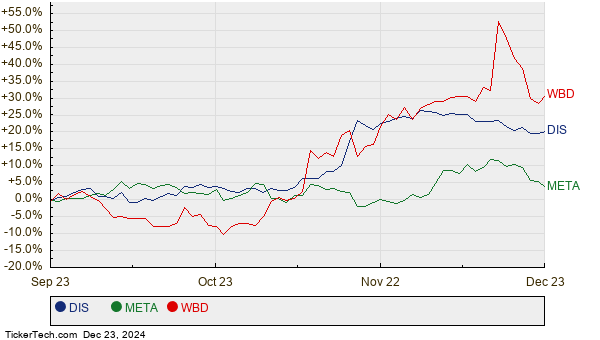

Currently, XLC trades at approximately $97.96 per share, indicating analysts foresee an 11.61% upside for this ETF based on the average targets of its underlying holdings. Notably, three holdings—Walt Disney Co. (Symbol: DIS), Meta Platforms Inc. (Symbol: META), and Warner Bros Discovery Inc. (Symbol: WBD)—show significant potential for growth relative to their target prices. DIS, trading at $112.03, has an average target of $127.15, reflecting a potential upside of 13.50%. Similarly, META is expected to rise from a recent price of $585.25 to an average target of $655.14, translating to an 11.94% upside. WBD also presents an outlook with a target of $11.95, suggesting an 11.82% increase from its current price of $10.69. Below is a twelve-month performance chart for DIS, META, and WBD:

Combined, DIS, META, and WBD constitute 28.25% of The Communication Services Select Sector SPDR Fund ETF. The following table summarizes the current analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| The Communication Services Select Sector SPDR Fund ETF | XLC | $97.96 | $109.34 | 11.61% |

| Walt Disney Co. | DIS | $112.03 | $127.15 | 13.50% |

| Meta Platforms Inc | META | $585.25 | $655.14 | 11.94% |

| Warner Bros Discovery Inc | WBD | $10.69 | $11.95 | 11.82% |

This raises important questions: Are analysts justified in their targets, or do they show unwarranted optimism about these stocks’ future values? Such high price targets can signal confidence in performance, yet they may also hint at potential downgrades if these targets are overly optimistic. Each investor should conduct thorough research to understand the factors influencing these expectations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• RAIL Historical Stock Prices

• Institutional Holders of PXS

• MTRN Next Dividend Date

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.