If one sector was the last place you’d want to be in 2023, it was the utility sector. In fact, utilities took the crown for one of the poorest performers in 2023. Comparing returns to the S&P 500, it’s evident that the sector felt the pain.

- S&P 500 2023 Return: +24%

- Utilities Select Sector SPDR ETF (NYSEARCA:XLU): -10%

Although the year was grueling, the utility sector ended on a high note, marking a 13% climb in the last three months, slightly outstripping the broader S&P 500. However, this robust finish begs the question: Could the sector have new life in 2024? Let’s delve into the 2023 miseries and prospects for 2024, while taking a closer look at the popular utility ETF, Utilities Select Sector SPDR Fund ETF (XLU).

2023: A Disheartening Year for Utilities

When it comes to utility companies, they aren’t typically the go-to for investors seeking substantial growth. Unlike companies such as Apple (AAPL) or Meta Platforms (META), which wield pricing power with existing products and can innovate to generate revenue growth, utility companies provide essential services and are constrained in terms of innovation. These firms supply energy and natural gas, often operating under government regulations regarding price hikes. Consequently, utility stocks are more geared toward income-seeking investors. The sector faced mounting challenges in 2023 and even the preceding year, as the Federal Reserve executed 11 rate hikes since March 2022. This surge in interest rates impacted various products, including high yield savings accounts, now offering a 4.5%-plus yield with minimal risk. Consequently, many investors redirected their investments away from such stocks in 2023, seeking income with lower risk.

Potential Resurgence in 2024 for Utilities

However, with rate hikes seemingly behind us, and the Federal Reserve hinting at possible rate cuts in the near future, prospects are turning brighter for utilities. The Federal Reserve’s announcement in Q4 of potential rate cuts in 2024 aligns with the recent surge in the utility sector. Consequently, as rates trend downward, financial institutions will slash interest rates on high-yield savings accounts, and US Treasury rates will follow suit. Lower rates on low-risk products are likely to draw income-seeking investors back to utility stocks. As with all sectors, investors have the option to invest in individual stocks, amplifying portfolio risk, or opt for a diversified approach by adding a high-quality, low-cost ETF to their portfolio. Hence, today, we spotlight the utility ETF.

XLU: A Low Cost Avenue to Utility Exposure

XLU, an exchange-traded fund launched by State Street Global Advisors in 1998, exclusively focuses on stocks within the utility sector, spanning electric utilities, water utilities, multi-utilities, independent power and renewable electricity producers, and gas utilities. With a nominal expense fee of 0.10%, each investor incurs a mere $10 for every $10,000 invested. A glance at XLU’s 10-year performance reveals that, until the onset of the pandemic, XLU was closely shadowing or outperforming the S&P 500. Furthermore, XLU currently yields a dividend of 3.3% and has consecutively increased its dividend for 13 years.

Insight into Top 3 Positions

We’ll now scrutinize XLU’s top positions, starting with NextEra Energy (NEE), which operates as the largest US utility company. The company, valued at $129 billion, operates in two segments and represents a high-quality energy company at the vanguard of the transition to renewable resources. Analysts anticipate an EPS of $3.40 per share in 2024, translating to a forward P/E ratio of 18.5x, modestly below the company’s 10-year average of 24x.

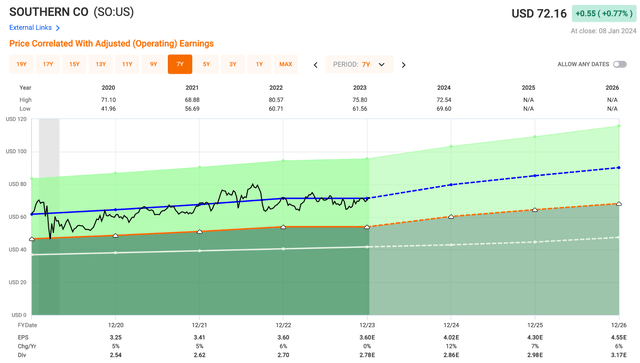

Next in line is The Southern Co (SO), an electric utility company recognized for its commitment to clean energy and sustainability. With a market capitalization of $72 billion, the company is a leading proponent of clean, safe, reliable, and affordable energy.

The Power Play: A Pensive Glimpse at Utilities’ Futures

The Southern Company is a stalwart utility company that holds sway over the energy stage. Operating through its triumvirate of segments — Gas Distribution Operations, Gas Pipeline Investments, and Gas Marketing Services — the company corroborates its dominance. The vigor of SO is reflected in its towering market cap of $78.7 billion.

Analysts are fueling high expectations as they anticipate an EPS of $4.02 per share for SO in 2024, translating into a forward P/E ratio of 17.9x. This figure resonates harmoniously with the company’s 10-year average of 18x, encapsulating SO’s enduring viability.

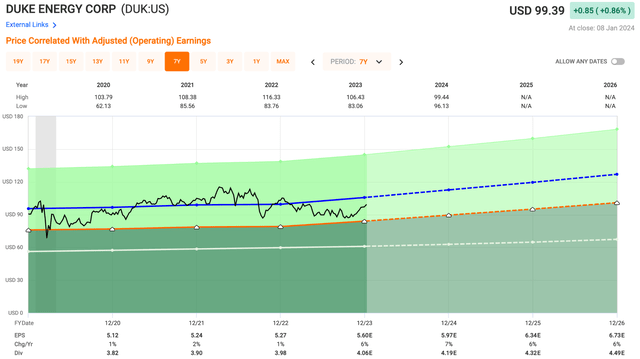

Vaulting to Position #3 – The Dazzling Duke Energy (DUK)

In the pantheon of energy companies, Duke Energy shines brilliantly. Its binary domain encompasses the Electric Utilities and Infrastructure (EU&I) and Gas Utilities and Infrastructure (GU&I) domains, where it orchestrates a symphony of electrifying operations. The EU&I juggernaut engineers, transmits, distributes, and merchandises electricity, all while harnessing the potential of renewable resources. Simultaneously, the GU&I dominion sees to the dissemination of natural gas, further enhancing the grandeur of Duke Energy.

DUK commands a princely market cap of $76.6 billion, a testament to its gravitational pull in the energy cosmos. Analysts are projecting an EPS of $5.97 per share for Duke Energy in 2024, corresponding to a forward P/E ratio of 16.6x. This figure outskirts the company’s 10-year average of 18x, striking a chord of optimism among investors.

Parting Thoughts

Seeking Alpha’s meticulous Rating Tracker:

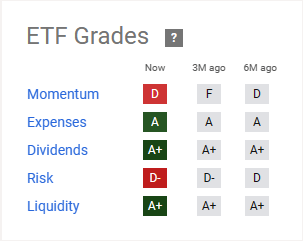

Seeking Alpha’s thorough ETF Grades:

With XLU’s expense ratio spinning at just 10 basis points, earning it an A grade, and an A+ dividend score, the ambience is rife with optimism. The current dividend yield of 3.33% and total assets under management of $14.6 billion illustrate the appeal of XLU, striking a chord with investors. As per the perspicacious insights of Seeking Alpha writer Steven Fiorillo, “Utilities look to be attractive as XLU’s top-10 holdings have significant double-digit EPS growth over the next two years, and trade for under 20x earnings based on their projected 2023 EPS while getting cheaper on a forward basis with an average 2025 forward P/E of 15.14x.”

“Utilities look to be attractive as XLU’s top-10 holdings have significant double-digit EPS growth over the next two years, and trade for under 20x earnings based on their projected 2023 EPS while getting cheaper on a forward basis with an average 2025 forward P/E of 15.14x.”

As the chapters of 2024 unfold, the anticipation of XLU ascending to the skies mounts. With the Federal Reserve drawing the curtains on its tightening cycle and imminent rate cuts looming in 2024 and 2025, the prophecy of XLU soaring comes to the fore. This rather staid utility ETF is poised to take an exhilarating flight in 2024, deserving a spot in the portfolios of discerning investors. As Seeking Alpha’s writer Brad Thomas aptly puts it, “I’m adding this boring utility ETF to my portfolio as this SWAN (sleep well at night) should soar in 2024.”

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.