XPeng Inc: The Future of EV Competition and Investment Opportunities

Chinese electric vehicle manufacturer XPeng Inc – ADR XPEV has experienced ups and downs in market performance over recent years, despite earlier enthusiasm. Yet, Tesla Inc TSLA CEO Elon Musk remains optimistic about its prospects.

Elon Musk’s Take on XPeng’s Potential

During Tesla’s fourth-quarter earnings call in January, Musk expressed strong confidence in XPeng and other Chinese EV companies. He remarked, “Frankly, I think if there are not trade barriers established, they will pretty much demolish most other car companies in the world. So they’re extremely good.” His words highlight the competition’s strengths, which cannot be ignored.

Strategic Moves to Gain an Edge

In anticipation of rising competition, XPeng revealed plans to reorganize its smart driving team in 2024. Part of this initiative includes forming an artificial intelligence department dedicated to advancing innovative technologies, especially in autonomous driving.

Ambitious Expansion Plans

Recently, a report from Reuters announced that XPeng intends to hire over 6,000 new employees this year, aiming to bolster its workforce as the EV landscape grows more competitive. The company also plans to broaden its reach to over 60 international markets by 2025. This growth strategy appears justified given that XPeng delivered 30,895 vehicles in November, reflecting a 54% increase from the previous year.

Investors Face Challenges

Even with these promising developments, XPeng’s stock has struggled. Over the last year, it fell about 17%, and it has lost roughly half of its value over the past five years. Nonetheless, some indicators suggest that the stock might be poised for recovery.

Technical Analysis: A Potential Upswing?

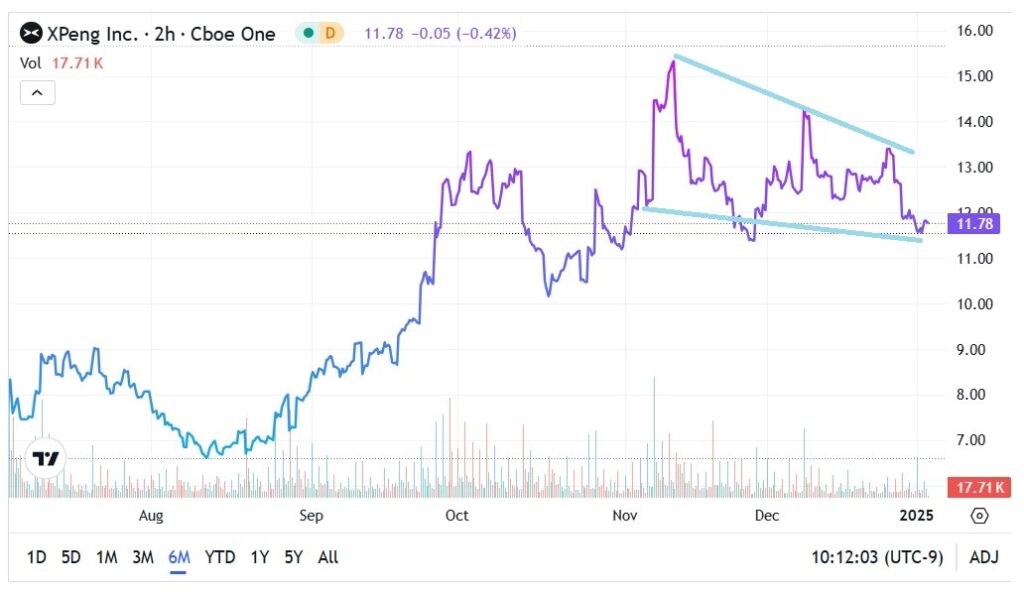

XPeng’s stock appears to be forming a bullish falling wedge pattern. This technical formation often signals a potential breakout as the upper and lower trendlines converge. Traders might expect the stock to rise once it nears this point.

Current Market Trends

Since late August, XPeng stock has started to rise again, hinting at a potential upward trend. This recent movement makes the falling wedge pattern perhaps a minor correction, rather than a reversal.

Analyzing Bearish Activity

Reports of bearish activity around XPeng’s stock exist, but the context of this data is crucial. Noteworthy purchases of put options will expire at the end of the week, which suggests the possibility of bullish activity returning as that pressure eases.

Related Market Insights: AST SpaceMobile’s Patterns

Meanwhile, AST SpaceMobile Inc ASTS is also showing a similar falling wedge pattern following a rise last year. After correcting, signs indicate potential positive movement ahead.

Strategies for Traders Looking to Enter

For those interested in XPeng, a multi-leg options strategy called the bull call spread may be worth considering. This involves buying one call option while simultaneously selling another call at a higher strike price for the same expiration date.

This strategy limits both risk and reward; the maximum loss and gain are predetermined. A key advantage of this approach is that it lowers the breakeven point compared to a standard call option. Here, the price must climb to the strike price plus the premium, while the spread reduces this premium cost.

Enticing Options for XPeng Stock

The 11/13 bull call spread (buying the $11 call and selling the $13 call) for options expiring on January 31, 2025, could be appealing as it allows a month for XPeng’s stock to reach the $13 mark, coinciding with the upper trendline of the falling wedge.

Alternatively, conservative traders might prefer the 11/12 bull call spread. This option is attractive since bulls might aim for the significant $12 mark. Keep in mind that if XPeng exceeds this level, the capped-return nature of the trade means potential profits could be lost to opportunity costs.

Read Next:

• Options Corner: Intel’s Slump Potentially Offers Rebound Ahead Of Q4 Earnings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.