XPeng’s EV Deliveries Soar While Tesla Faces Challenges

Chinese smart electric vehicle (EV) maker XPeng Inc. (NYSE: XPEV) reported impressive growth in March 2025, with monthly EV deliveries skyrocketing 268% year-over-year (YOY) to reach 33,205 units. This achievement marks the fifth consecutive month where XPeng delivered over 30,000 units. The company’s first-quarter 2025 deliveries also showed an outstanding 331% YOY increase, totaling 94,008 Smart EVs.

In contrast, these robust figures are overshadowed by the leading automaker in the sector, Tesla Inc. (NASDAQ: TSLA). Tesla announced 336,681 units delivered in the first quarter of 2025, although this fell short of the consensus estimate of 377,000 EVs. The figure represents a 13% decline from the 386,810 EVs delivered in the same period last year. This raises questions for Tesla investors about the implications of these contracting delivery figures compared to XPeng’s growth.

Tesla’s Declining Position in China

Tesla’s performance in the Chinese market also appears troubled, with sales dropping 11.5% YOY to 78,828 units in March 2025. Meanwhile, competitors such as Xiaomi made strides, delivering a record 29,000 EVs, while NIO Inc. (NYSE: NIO) and ZEEKR Intelligent Technology Holding Limited (NYSE: ZK) each delivered just under 20,000 units. Leapmotor achieved a commendable 37,095 deliveries, up 154% YOY. The clear leader in China, BYD Company Ltd. (OTCMKTS: BYDDY), delivered 166,109 EVs.

Remarkably, BYD has surpassed one million new energy vehicles (NEVs) sold in Q1 2025, marking three consecutive quarters of achieving that milestone. NEVs encompass battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell vehicles. As the competitive landscape intensifies, Tesla is steadily losing market share in its second-largest market.

Import Tariffs: Tesla’s Dilemma

The subject of tariffs has entered mainstream discussion, particularly as the United States has increased tariffs on imported automobiles and parts, particularly those not produced domestically. Further trade measures specifically target imports from China, raising the costs for Chinese-made goods. In turn, China has countered with reciprocal tariffs on U.S. products.

Tesla shareholders can take some comfort, as its vehicles manufactured in Fremont, California, and Austin, Texas, are not affected. However, the situation is complicated by the fact that 30% to 40% of Tesla’s components are imported, predominantly lithium-ion battery materials sourced from China.

Elon Musk emphasized on X, “Important to note that Tesla is NOT unscathed. The tariff impact on Tesla is still significant.”

Conversely, the impact of tariffs on Tesla’s Chinese operations is minimal. The EVs Tesla sells in China benefit from being manufactured at its Shanghai Gigafactory, where 95% of the supply chain is localized.

XPeng’s Competitive Edge in the EV Market

XPeng’s growth in delivery volume clearly outshines its rivals, achieving 268% and 331% YOY growth for March and Q1 2025, respectively. Another profitable Chinese manufacturer, Li Auto Inc. (NASDAQ: LI), reported 36,674 vehicle deliveries in March 2025, a 26% increase YOY, with a total of 92,864 units in Q1 2025, up 16% YOY. However, it’s important to note that XPeng is still posting losses. The company reported a Q4 2024 adjusted earnings-per-share (EPS) loss of 20 cents per American Depository Share (ADS), missing consensus estimates by 6 cents.

This represents an improvement over a loss of $1.51 per ADS in the previous year’s quarter. Revenue for Q4 2024 stood at $2.21 billion, although this fell slightly short of the consensus estimate of $2.25 billion. The company’s gross margin saw a positive shift, rising from 6.2% in the previous year to 14.4% in Q4 2024, despite a minor decline from 15.3% in Q3 2024.

Analysts Increasingly Bullish on XPeng Stock

From a year-over-year perspective, XPeng shows notable improvement in delivery numbers, EPS, revenue, and margin, even though it hasn’t met all consensus estimates. Recently, analysts have adjusted their price targets for XPeng upwards by 14.27%, establishing a new consensus price target of $22.20. This marks a significant change from a month earlier, when the consensus price target was $13.93, indicating a 37.38% downside as of April 3, 2025.

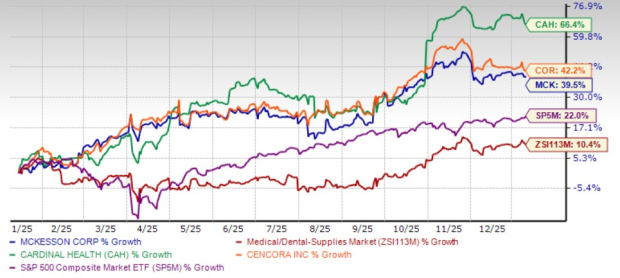

The stock is performing strongly compared to Tesla and the S&P 500, trading up more than 50% year-to-date (YTD) through April 3, 2025.

As you consider future investments, it may be wise to explore recommendations from leading analysts.

MarketBeat tracks top-performing research analysts and their stock recommendations daily. Our team has identified five stocks that analysts are currently advising clients to buy now, which may be under the radar for many investors.

To find out more about these five stocks, see here

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.