Yelp Inc. Share Prices Surge as Company Unveils Innovative Features

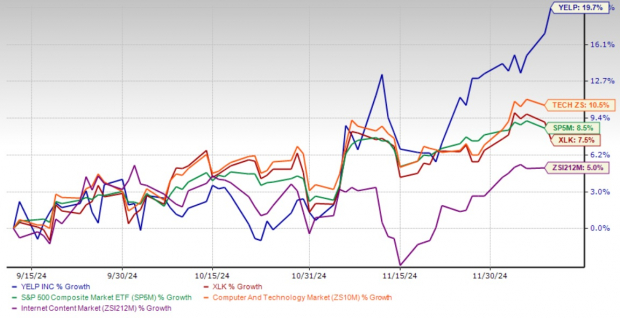

YELP shares have climbed 19.7% over the past three months. This performance surpasses the Zacks Computer Technology sector by 9.2%, the Zacks Internet Content industry by 14.7%, the S&P 500’s return of 10.5%, and the Technology Select Sector SPDR Fund’s (XLK) 7.5%. Such growth reflects strong investor confidence in Yelp’s product offerings and financial health.

Recently, Yelp introduced several enhancements to its platform, including AI-driven review insights, a personalized home feed for users, and improved features for customer recognition and tipping transparency. Businesses utilizing Yelp can now take advantage of AI-enhanced inbox capabilities, smart ad selection, and competitor insights.

The AI-powered review insights provide a sentiment summary, rating user opinions from 1 to 100 on factors like food quality and service. Yelp’s recognition feature has broadened its scope, allowing users to find more relevant feedback. Additionally, the smart selection feature optimizes ad visibility by highlighting top reviews and photos.

Yelp’s 3-Month Price Performance Chart

Image Source: Zacks Investment Research

Yelp’s Growth Strategy: Innovative Features Drive Success

Earlier this year, Yelp rolled out its Summer Ad Product Updates, introducing tools for advertisers such as Spotlight Video Ads and Yelp Audiences Expansion. This followed earlier enhancements that included Yelp Assistant and Yelp Fusion AI API, successfully attracting new users and driving revenue growth.

Yelp’s commitment to artificial intelligence and machine learning has led to increased ad clicks while reducing average costs per click (CPC). Other improvements have focused on enhancing user experience and accessibility for individuals with disabilities.

Yelp has also formed partnerships with industry leaders, including Alphabet (GOOGL) and Apple (AAPL), to further enhance its platform capabilities. These initiatives signify the company’s dedication to boosting user engagement and loyalty, which is expected to support revenue growth.

For instance, Yelp Guest Manager integrates with Reserve with Google, enabling diners to make reservations or join waitlists through Google services. Recently, Yelp added Request a Quote on Apple Maps, allowing users to obtain quotes from local professionals. These expansions are likely to aid in acquiring new businesses and elevating advertising and recurring revenues.

Looking ahead to 2024, Yelp forecasts revenue between $1.397 billion and $1.402 billion. The Zacks Consensus Estimate aligns with this projection at $1.40 billion, representing an expected year-over-year growth of 5.11%.

Investor Insights: What’s Next for Yelp?

YELP has achieved revenue growth thanks to its innovative offerings and an increasing number of paying ad locations. The company currently holds a Zacks Value Style score of A, signaling a fair valuation.

Given these favorable indicators, investors may consider purchasing this Zacks Rank #2 (Buy) stock. To explore a complete list of Zacks’ top-ranked stocks, click here.

Exclusive Access to Zacks’ Stock Picks for Just $1

Yes, really.

Years ago, we surprised our members by offering 30-day access to all our stock picks for only $1, with no further obligations.

While many took advantage of this offer, some hesitated, fearing there was a catch. There is a reason we do this: we want you to explore our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 228 positions with impressive double- and triple-digit gains in 2023 alone.

Want to see the latest stock recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free here.

Apple Inc. (AAPL): Free Stock Analysis Report

Yelp Inc. (YELP): Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Alphabet Inc. (GOOGL): Free Stock Analysis Report

For the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.