PPI Inflation Decline and Trump’s Tariff Threats Impact Market Outlook

This week, a second inflation measure delivered surprising results. Following a weaker-than-expected Consumer Price Index (CPI) report yesterday, today’s Producer Price Index (PPI) data revealed that wholesale prices remained unchanged in February.

The PPI report showed no increase after a significant rise of 0.6% in January. Economists from Dow Jones had predicted a 0.3% gain.

Additionally, Core PPI decreased by 0.1%, which also fell short of expectations for a 0.3% increase. This marked the first negative reading since July.

This news could have provided positive momentum for stocks; however, it was overshadowed by President Trump’s latest threats in the ongoing trade conflict.

This morning on Truth Social, President Trump announced a potential 200% tariff on French alcohol, stating:

The European Union, one of the most hostile and abusive taxing and tariffing authorities in the World, which was formed for the sole purpose of taking advantage of the United States, has just put a nasty 50% Tariff on Whisky.

If this Tariff is not removed immediately, the U.S. will shortly place a 200% Tariff on all WINES, CHAMPAGNES, & ALCOHOLIC PRODUCTS COMING OUT OF FRANCE AND OTHER E.U. REPRESENTED COUNTRIES. This will be great for the Wine and Champagne businesses in the U.S.

It’s important to note that Trump plans to announce more “reciprocal” tariffs in April that could affect the EU.

As this unfolds, Wall Street responded negatively. Trump’s previous remarks downplaying volatility in the Stock market come to mind. Treasury Secretary Scott Bessent echoed this sentiment this morning:

We’re focused on the real economy… I’m not concerned about a little bit of volatility over three weeks.

This trade conflict continues, as discussed in yesterday’s Digest, highlighting the ongoing challenges investors face.

Amid Market Declines, Luke Lango Identifies New Buying Opportunities

In light of the market’s recent performance, our hypergrowth expert Luke Lango has suggested new “buys.” Understanding his rationale will aid us in managing our portfolios through this volatility.

Let’s begin with insights from Luke’s Innovation Investor Daily Notes earlier this week:

Hold and wait. Buy the dip and pile into growth stocks on signs of a technical bottom and rebound.

Reach for protection and play defense on signs of a technical breakdown.

When Luke shared this guidance, the market had just lost two crucial support levels: the S&P 500’s 250-day moving average (MA) and the Nasdaq-100’s level of 19,440.

The significance of the “19,440” mark lies in its proximity to the Nasdaq-100’s 200-day MA. Luke explained:

[The Nasdaq-100] has crossed below its 200-day moving average precisely 11 times before since 1990.

In every instance, the market was on the cusp of a significant rebound or downturn, depending on subsequent market behavior within the following two weeks.

Additionally, if the Nasdaq-100 remains within 4% of its 200-day MA, stocks typically rebound over the next 12 months with average gains exceeding 25%. Conversely, falling more than 4% below that threshold often signals a bear market.

Luke’s strategy was to closely monitor whether the S&P and Nasdaq-100 could recover these vital levels.

Yesterday’s Market Bounce Signals Opportunity for Investors

Turning to yesterday’s market activity, both the S&P 500 and Nasdaq-100 experienced gains:

The Nasdaq 100 has reclaimed the critical 19,440 level (or about 4% below its 200-day moving average), a historically significant threshold for the index.

The S&P 500 has also risen above its 250-day moving average, marking another important recovery point.

Moreover, the S&P’s Relative Strength Index (RSI) has rebounded from oversold conditions in just two days—a setup that historically precedes substantial 12-month rallies.

Due to this strength, Luke made four new “buy” recommendations in his Innovation Investor service yesterday afternoon, after five previous recommendations on Monday.

While Luke acknowledged the risk of further market declines, he posited:

History shows that significant market volatility often presents excellent buying opportunities or leads to major crashes.

Currently, technical indicators suggest that the former is more likely. We may be mistaken, but we see it as a calculated risk.

As I write on Thursday, both the S&P and Nasdaq-100 remain just below Luke’s critical thresholds.

We will provide additional updates as needed.

Investors Skeptical Amid Tariff Concerns—Focus on Fundamentals

Some investors are choosing to exit the market due to fears related to Trump’s unpredictable tariff policies. However, it’s crucial to maintain perspective about the broader implications of his strategies.

To gain insight, let’s look at renowned investor Louis Navellier. In his Flash Alert podcast yesterday on Breakthrough Stocks, he noted:

If we implement tit-for-tat tariffs, ultimately, trade will become freer as the U.S. has more leverage than other countries. The goal is to achieve free trade while ensuring fair competition.

Clearly, many in the media are critical of President Trump and his approach. While he can be unpredictable, the ultimate objective remains free trade, and that responsibility falls on Howard Lutnick.

I know Howard Lutnick personally—a respectable individual who aligns with America’s interests, aiming to encourage businesses to relocate here.

As President Trump continues to navigate these challenges, the media’s frustration might cloud the potential long-term outcomes.

For Investor Peace of Mind, Emphasize Stocks with Strong Fundamentals

If concerns persist, consider adopting Louis’ market approach: concentrate on stocks with robust fundamentals.

This fundamentals-driven strategy has fostered one of the industry’s best long-term performances for Louis.

Eight Essential Criteria for Stock Recommendations Revealed

For those seeking sound stock recommendations, here are eight crucial criteria:

- Increasing sales growth

- Expanding operating margins

- Earnings growth

- Positive earnings momentum

- Positive earnings surprises

- Positive earnings revisions

- Strong free cash flow

- Healthy return on equity.

Understanding the fundamental strength of a particular stock is significantly more valuable for personal wealth than trying to predict market direction influenced by macroeconomic factors or political events.

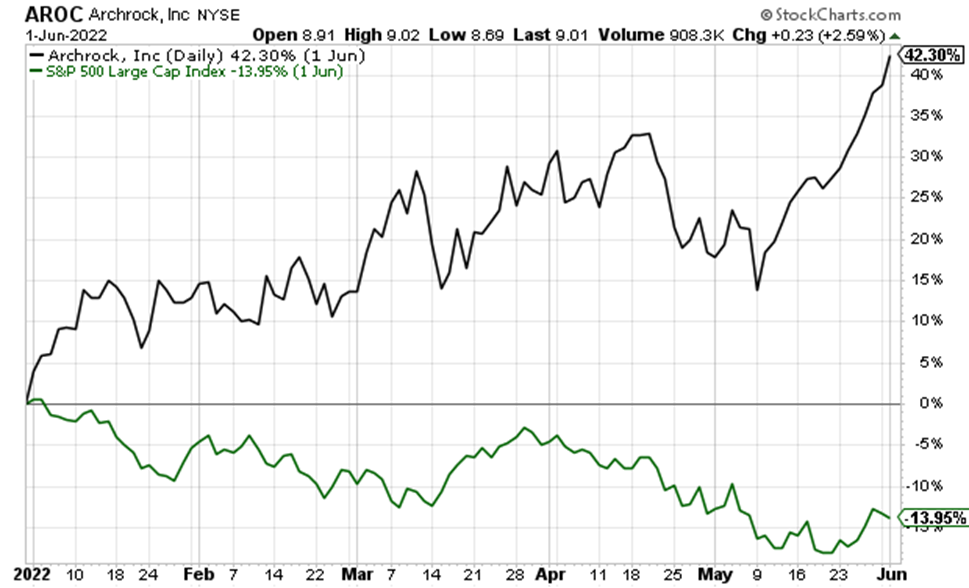

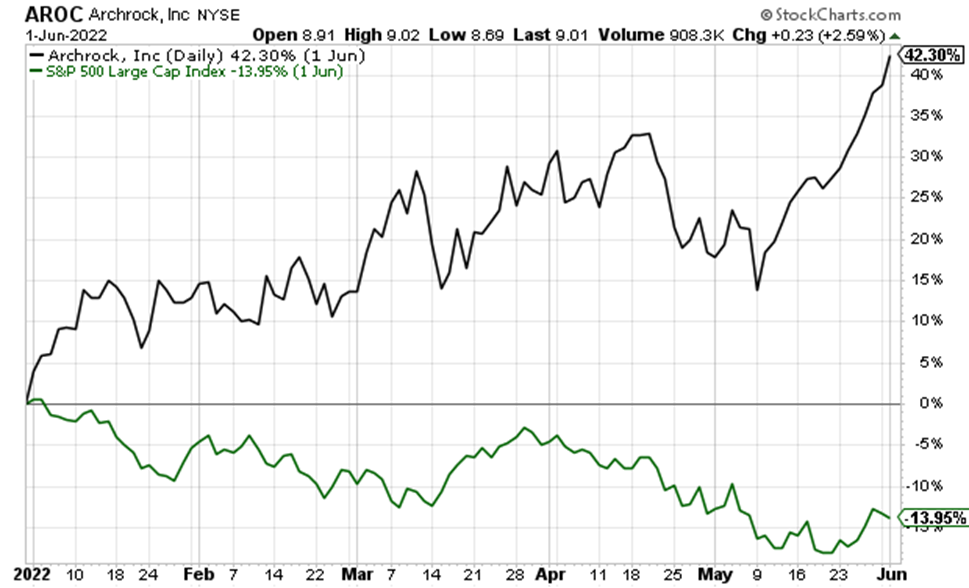

As a case in point, look at Archrock Inc. (AROC), which Louis includes in his Breakthrough Stocks portfolio.

During the first half of 2022, amid investor fears regarding rampant inflation and the Federal Reserve’s rate hikes, the S&P 500 dropped 14% by June 1, yet AROC increased by 42% in the same timeframe.

The underlying theme is clear: focusing on the fundamentals of stocks significantly influences portfolio performance.

If you are uncertain about this approach, consider it further validated by Warren Buffett. He stated this mindset during the 1994 Berkshire Hathaway Inc. (BRK.A, B) annual meeting:

“You may have trouble believing this, but Charlie (Munger) and I have never had an opinion about the market because it wouldn’t be any good and it might interfere with the opinions we have that are good.”

“If we think a business is attractive, it would be very foolish for us to not take action on that because we thought something about what the market was going to do.”

“Guesses about what’s going to happen in some macro way just don’t make any sense to us.”

The bottom line? Focus on the microeconomic factors and disregard broader market speculations.

Recent Event Highlights Next Potential Stock Opportunity

On a related note, if you missed Louis’ recent event – The Next 50X NVIDIA Call – it concentrated on one particular stock.

According to Louis:

“My system is flagging another stock that I believe could be the next NVIDIA with a 50X profit potential. This is a small-cap stock holding 102 patents and closely linked to NVIDIA.”

“Moreover, I think something significant is about to happen.”

NVIDIA CEO Jensen Huang has recently minimized the impact of quantum computing, suggesting it is decades away. However, NVIDIA plans to host a “Quantum Day” event, dubbed “Q Day,” on March 20.

“Why?”

“I believe NVIDIA is about to assert its presence in the quantum computing market. When that occurs, this lesser-known stock could experience explosive growth.”

“Earlier today, I provided comprehensive details regarding Q-Day, including insights into my top pick that may surge following NVIDIA’s announcement.”

To access a free replay, click here.

Stay tuned for more updates on these developments here in the Digest.

Wishing you a pleasant evening,

Jeff Remsburg