Yum China Faces Challenges as Stock Shows Mixed Trends YUMC had a turbulent year, with its stock increasing by 4% so far in 2023. However, the past twelve months have seen a significant decline, with the shares down nearly 17%.

Even after a notable 27.8% increase over the last month, the stock still maintains a moderately negative outlook. Ongoing selling pressure indicates that there may be further risks of decline.

Technical Analysis Reveals Uncertainty

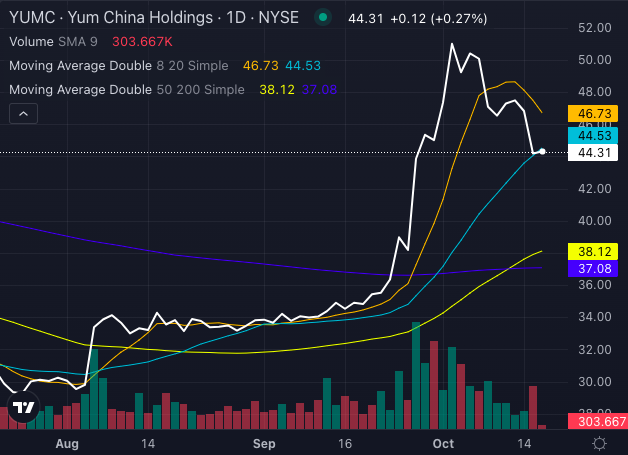

The technical indicators for Yum China stock are offering conflicting signals.

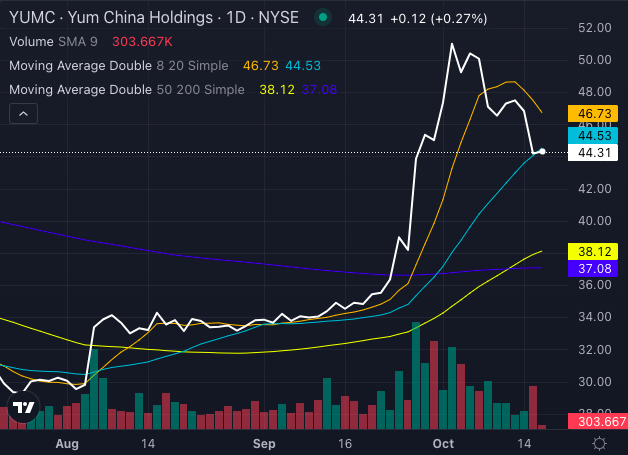

Chart created using Benzinga Pro

The current stock price of $44.31 is below the eight-day and 20-day simple moving averages (SMA) of $46.73 and $44.53, respectively. This hints at short-term bearish conditions.

However, Yum China’s shares are trading above the 50-day SMA of $38.12, which could indicate potential for longer-term buying opportunities. The stock remains strong when viewed through the lens of the 200-day SMA, currently at $37.08.

Read Also: As China’s Stimulus Efforts Dwindle, Reports Suggest Beijing is Considering $850B in Special Treasury Bonds for Economic Stimulus and Local Debt Relief

BofA Securities Raises Price Target Based on Sales Growth

Despite the bearish signals in the short term, BofA Securities has increased its price target for Yum China from $41.60 to $49.00. This adjustment stems from strong same-store sales growth, improving profit margins, and a favorable yuan (RMB) exchange rate.

The firm also announced Yum China’s proactive share buyback program and noted improvements in the company’s valuation related to its stake in Meituan MPNGF. Analysts believe that Yum China is navigating immediate challenges, including market uncertainties linked to the forthcoming U.S. elections.

With plans to launch numerous K-Coffee cafes and upscale its Pizza Hut WOW model, Yum China showcases promising long-term growth potential.

Nonetheless, with conflicting technical indicators and divided analyst opinions, this is a pivotal time for investors.

Read Next:

Photo via Wikimedia Commons

Market News and Data brought to you by Benzinga APIs