Strong Q4 Earnings Season Highlights Tech Sector Spending Trends

Chicago, IL – February 6, 2025 – Zacks Director of Research Sheraz Mian states, “The picture emerging from the 2024 Q4 earnings season continues to be one of strength and improving outlook, with companies beating estimates and delivering reassuring guidance.”

Members of the Magnificent Seven Show Solid Earnings and Increased Spending

Note: The following is an excerpt from this week’s Earnings Trends report. Access the complete report for detailed historical actuals and estimates for the current and future periods by clicking here>>>

Key Highlights:

- 245 S&P 500 companies that have reported their results show total earnings up +11.6% from last year on +5.1% higher revenues; 80.0% exceeded EPS estimates, while 66.9% surpassed revenue estimates.

- The 2024 Q4 earnings season reveals strong performance and optimistic guidance for upcoming quarters.

- In the Tech sector, Q4 results for 68.3% of the index’s market capitalization reveal earnings rising +23.2% from the same period last year on +8.8% higher revenues; 88.9% beat EPS estimates and 77.8% exceeded revenue estimates, demonstrating notable improvement.

- Looking at all of Q4, combined reports estimate total S&P 500 earnings will rise +11.9% from the previous year on +5.3% higher revenues.

Companies Show No Signs of Slowing Down Spending

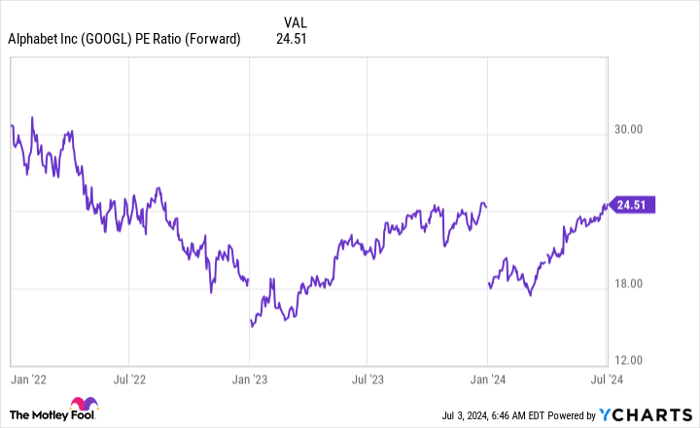

Alphabet (GOOGL) continues to increase its investment in artificial intelligence, joining Microsoft (MSFT) and Meta Platforms (META) in committing to expansive spending plans despite market fluctuations and recent results from China’s DeepSeek.

Alphabet plans to increase its capital expenditures by +47% this year, targeting $75 billion. Similarly, Meta and Microsoft plan to spend $60 billion and $80 billion, respectively, with analysts predicting even higher spending from Microsoft.

Following Alphabet’s announcement, stock prices declined, largely due to perceived performance issues in the company’s core business, a sentiment mirrored by concerns surrounding Microsoft’s cloud operations affecting its stock price.

While these companies are profitable and experiencing growth, some investors anticipated a more cautious approach given the high stakes associated with such expenditures.

Alphabet’s Q4 earnings grew +28.3% year-over-year to $26.5 billion, with revenues increasing by +12.9% to $81.6 billion. Microsoft reported a +10.2% increase in Q4 earnings to $24.1 billion, and Meta saw a +48.7% rise to $20.8 billion.

These companies justify their high spending by emphasizing the need to maintain their industry leadership as artificial intelligence becomes increasingly essential for sustaining their earnings power.

For Q4, Mag 7 earnings are projected to rise +26.1% from last year on +12.4% higher revenues.

Tech Sector Expected to Drive Growth Ahead

The Tech sector has consistently been a major growth driver, with earnings projected to increase +23.3% year-over-year for Q4 on +10.9% higher revenues, marking the sixth consecutive quarter of double-digit growth.

This follows Q3’s +22.7% earnings growth on +11% higher revenues.

In addition to robust growth, the Tech sector has seen steady improvements in its earnings outlook, as reflected in revised forecasts for both Q4 and the entirety of 2025.

The Broader Earnings Landscape

Total S&P 500 earnings for Q1 2025 are expected to rise 8.8% year-over-year, with revenues increasing by +4.4%.

Revisions show a bearish trend across 15 of 16 sectors since early January; only the Medical sector managed to see increased estimates. Sectors like Conglomerates, Aerospace, Construction, and Basic Materials have faced the most significant decreases.

Looking ahead, double-digit earnings growth is anticipated for each of the next two years. Unlike the past two years, when the Mag 7 group drove most earnings growth, 2025 is expected to see growth across all 16 Zacks sectors, with 8 of those experiencing double-digit growth.

Is It Time to Consider Zacks’ Top Stocks?

Since 2000, our top stock-picking strategies have significantly outperformed the S&P’s average annual gain of +7.0%. These strategies achieved average gains of +44.9%, +48.4%, and +55.2%.

You can access their current picks at no cost or obligation.

Discover Stocks Free >>

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

https://www.zacks.com

Zacks.com offers investment resources that may assist you in making your financial decisions. This information is provided under the Zacks “Terms and Conditions of Service” disclaimer. Visit www.zacks.com/disclaimer for details.

Past performance does not guarantee future results. Investments carry the risk of loss. This material is for informational purposes only and does not constitute financial, legal, accounting, or tax advice. Recommendations are not meant for specific investors. It should not be assumed that any securities will be profitable. All information is current as of the date herein and subject to change without notice. The opinions expressed may not reflect those of the firm as a whole. Zacks Investment Research does not engage in investment banking or asset management activities. These returns come from hypothetical portfolios of stocks rated Zacks Rank = 1, rebalanced monthly with zero transaction costs. The S&P 500 is an unmanaged index. Learn more about performance numbers at https://www.zacks.com/performance.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from a current pool of 220 Zacks Rank #1 Strong Buys, labeling them “Most Likely for Early Price Pops.”

Since 1988, this full list has outperformed the market more than two-fold, averaging a gain of +24.3% annually. Therefore, these handpicked stocks deserve your immediate attention.

Discover them now >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.