Zimmer Biomet Navigates Tough Conditions Despite Growth Opportunities

Zimmer Biomet (ZBH) experiences steady growth due to procedural strength, skilled execution, and robust innovation. However, the stock faces pressure from a challenging macroeconomic landscape that has raised operating costs. Currently, the stock holds a Zacks Rank #3 (Hold).

Key Growth Drivers for Zimmer Biomet

The company is focused on enhancing its presence in both developed and emerging international markets that are poised for long-term growth. Zimmer Biomet’s strategic investments in these areas over recent quarters have begun to yield positive results. Particularly, the company’s extensive portfolio, which includes upper and lower joints, positions it well to drive future growth in the extremities and trauma sectors.

Within emerging markets, the Asia Pacific region has shown considerable revenue growth. Supported by a series of product launches and strong customer adoption, Zimmer Biomet is effectively expanding its influence in these markets.

Despite facing pricing pressures, the global musculoskeletal market has stabilized, reflecting better-than-expected sales growth in some areas driven by increased procedural volume. This trend is supported by favorable demographics and an uptick in musculoskeletal healthcare usage in emerging and lesser-penetrated developed markets. The focused efforts of Zimmer Biomet’s global sales teams have also led to acceleration in global sales for Persona, its personalized knee system.

In the fourth quarter of 2024, Zimmer Biomet reported solid growth, propelled by enduring procedural strength and sustained innovation. Year-over-year growth was evident in large joints, with the overall business for global Knees, Hips, and S.E.T. increasing by 5.6%, 4%, and 8.4%, respectively, at constant exchange rates.

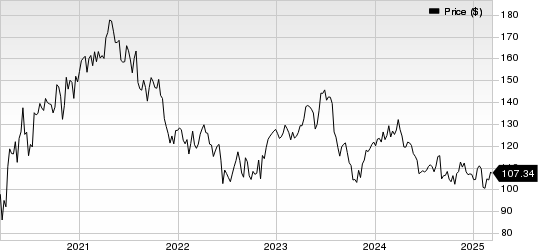

Current Stock Performance of Zimmer Biomet

Zimmer Biomet Holdings, Inc. price | Zimmer Biomet Holdings, Inc. Quote

Over the past three months, ZBH shares have increased by 0.7%, compared to a 4.6% uptick in the industry. With the company continuing to prioritize strategic market expansion and product launches, we anticipate further stock momentum in the near future.

Challenges Facing Zimmer Biomet Stock

Zimmer Biomet contends with ongoing industry-wide staffing shortages and supply chain challenges. Complications in international trade and geopolitical tensions have intensified issues related to raw material costs, labor expenses, and freight charges.

Moreover, high interest rates aimed at curbing inflation, combined with the gradual retreat of fiscal policies amid rising national debt, have negatively impacted economic growth, putting additional pressure on Zimmer Biomet’s market situation. In the Hip category, the challenges in Russia disproportionately affect sales outside the U.S. Furthermore, reimbursement difficulties within the S.E.T. category, especially in the Restorative Therapies business, have compounded the company’s issues. Acute supply challenges in Sports and Trauma further strain revenues and operating profits.

During the fourth quarter, Zimmer Biomet registered a 5.1% increase in the cost of products sold (excluding intangible asset amortization) and a 3.4% rise in selling, general, and administrative expenses. The adjusted gross margin contracted by 123 basis points, and the adjusted operating margin saw a 43 basis point decline. Our model predicts increases of 5.7% and 4.2% in the company’s cost of products sold and selling, general, and administrative expenses for 2025, respectively.

A significant portion of Zimmer Biomet’s revenues comes from Europe and Japan. Recent surges in the U.S. dollar’s value against the euro and other currencies have negatively impacted the company’s financial results. In 2024, the company’s net sales were affected by a 1% decline due to foreign exchange fluctuations. For 2025, Zimmer Biomet anticipates an adverse impact of 1.5%-2% on revenues from foreign exchange factors.

Selected Stocks to Consider

Investors may want to look at stocks like Hims & Hers Health (HIMS), Inspira Medical Systems (INSP), and Cardinal Health (CAH), all of which currently hold Zacks Rank #2 (Buy).

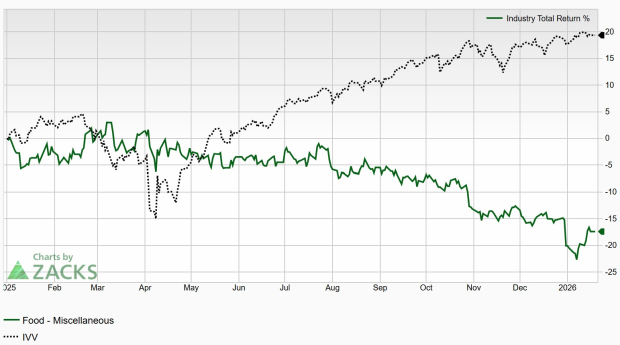

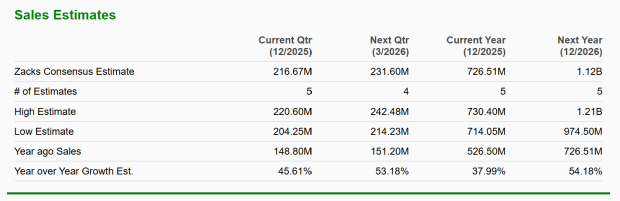

In the past 30 days, estimates for Hims & Hers’ 2025 earnings per share rose by 34.6% to 70 cents. The stock has surged 129.5% over the past year, contrasting with a 14% drop in the industry. HIMS demonstrated earnings above estimates in two of its last four quarters, matching once and missing once, with an average surprise of 40.4%.

In the last year, Inspira shares decreased by 8.9%. However, estimates for 2025 earnings per share increased by 6.4% to $2.16. INSP beat estimates in each of the last four quarters, exhibiting an average surprise of 332.5%, with a 55.4% surprise in the most recent quarter.

The 2025 earnings per share estimates for Cardinal Health have increased by 14.7% to $7.94. The stock has risen 11.8% over the past year, against a 3.9% industry decline. CAH has exceeded earnings estimates in each of its last four quarters, with an average surprise of 9.6% and a 10.3% surprise in the latest quarter.

Growth Potential in Emerging Stocks

Experts at Zacks have identified five stocks expected to double in value by 2024. These selections are primarily unnoticed by Wall Street, presenting a unique opportunity for investors to enter early.

Discover These 5 Potential Growth Stocks >>

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH): Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP): Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.