The latest buzz surrounding Zebra Technologies (NasdaqGS:ZBRA) is nothing short of impressive – with its price target skyrocketing to a noteworthy 307.47 per share, marking an impressive soaring of 11.55% from the previous estimate of 275.63, a benchmark set on January 16, 2024.

These estimations are no flight of fancy but a collective opinion voiced by numerous analysts. Their deliberations span a wide spectrum, ranging from a low of 237.35 to a high of 357.00 per share. The average target hits the bullseye with an 11.74% increase from the most recent reported closing price of 275.18 per share.

The Fund Sentiment: Unveiling Investor Sentiments

Slicing through the financial jargon, a whopping 1341 funds or institutions have been churning their positions in Zebra Technologies recently, marking an 18-owner rise of 1.36% in the last quarter. The average portfolio weight dedicated to ZBRA by all funds clocks in at 0.22%, accelerating by 0.23%. Institutions have shown a keen interest, upping their share count by 2.03% to a total of 54,115K shares.

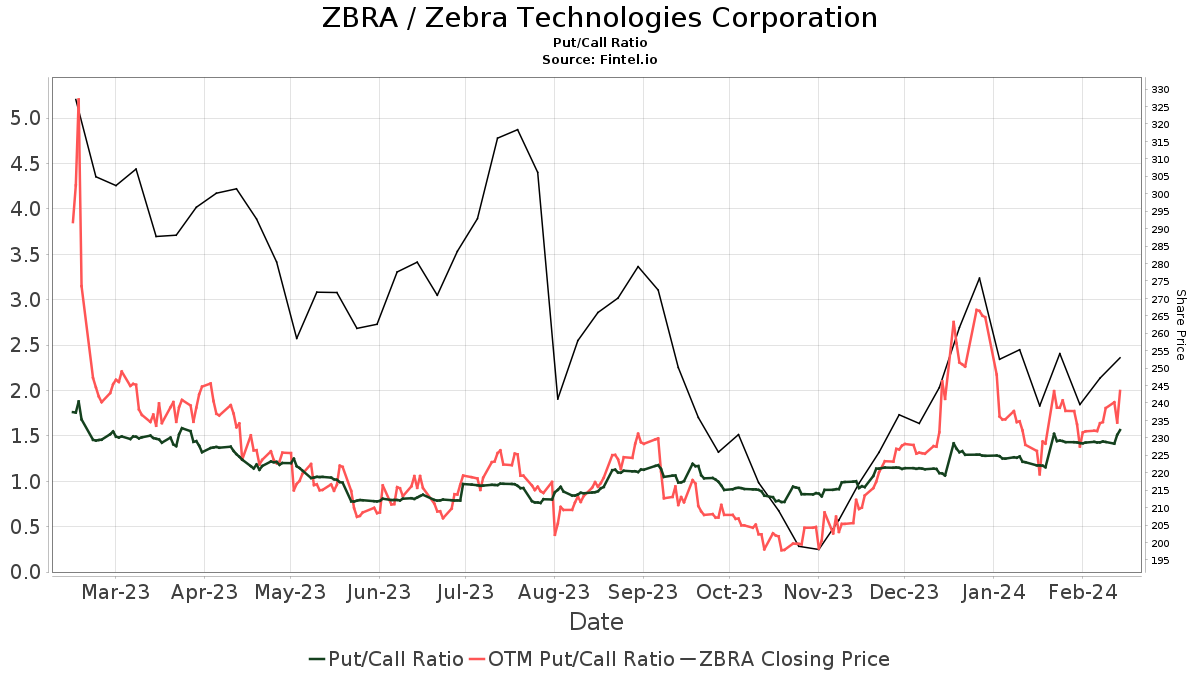

Peering into the crystal ball, the put/call ratio of ZBRA stands at 1.75, ushering in a note of caution with its bearish outlook.

Insight into Shareholder Moves

APG Asset Management N.V. has played its cards right, upping its ownership stake to 4.22% by acquiring 2,169K shares. The firm bolstered their ZBRA portfolio by a resounding 16.37% over the last quarter, a move that underscores their growing confidence in the company.

Vanguards like VTSMX and VFINX made strategic maneuvers of their own, witnessing fluctuations in their ZBRA holdings. VTSMX, holding 1,607K shares representing 3.13% ownership, tiptoed a minor increase of 0.12%. Contrarily, VFINX displayed a nuanced dance, increasing its share count by 0.75%, with 1,234K shares representing 2.40% ownership – a subtle shift amidst the financial tides.

Zebra Technologies, a stalwart in its domain, has sculpted a legacy in retail, manufacturing, healthcare, and beyond. With a global presence spanning 100 countries and a network of over 10,000 partners, Zebra orchestrates end-to-end solutions that usher in visibility, connectivity, and optimization for every asset and worker. Reveling in accolades like Forbes Global 2000 and Fast Company’s Best Companies for Innovators, Zebra’s innovative solutions improve the shopping experience, streamline inventory management, and amplify supply chain efficiency and patient care.

Fintel, a beacon in the investing research realm, offers a treasure trove of analytical insights catering to individual investors, traders, advisors, and hedge funds. With a vast expanse of data that includes fundamentals, analyst reports, ownership insights, and more, Fintel equips investors with the tools to navigate the intricate world of finance adeptly.

For those seeking an edge in the investment landscape, Fintel stands as a steadfast companion, guiding financial endeavors with grit and wisdom.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.