Zebra Technologies Corporation ZBRA recently announced the pricing of its private offering of senior notes worth $500 million in aggregate principal amount. The offering is anticipated to close on May 28, 2024, conditional on certain customary closing conditions.

The company’s shares gained 1.6% yesterday, thereby ending the trading session at $326.98.

Inside the Headlines

The senior notes carry an interest rate of 6.500% and are scheduled to mature on Jun 1, 2032. Notably, the senior notes are Zebra Technologies’ unsecured obligations and will be guaranteed by certain of its domestic subsidiaries. The notes will be offered only to qualified institutional buyers per Rule 144A under the Securities Act of 1933 and to non-U.S. investors conforming to Regulation S.

Zebra Technologies expects to use the net proceeds from this offering to repay all of its outstanding debt under the revolving credit facility and to meet general corporate purposes. Exiting the first quarter, the company’s outstanding debt under its revolving credit facility totaled $172 million.

We believe that the offering of senior notes will increase ZBRA’s debts and, in turn, might inflate its financial obligations and hurt profitability. However, prepaying part of certain indebtedness will offer some relief. Exiting the first quarter, the company’s long-term debt remained high at $1.8 billion. At the end of the first quarter, its cash and cash equivalents were $127 million, less than the current portion of long-term debt of $272 million.

Zacks Rank, Price Performance and Earnings Trend

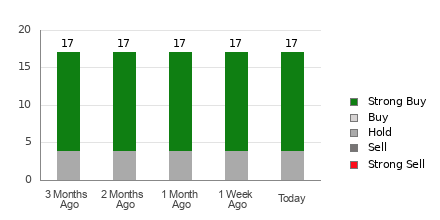

ZBRA, with a $16.8 billion market capitalization, currently sports a Zacks Rank #1 (Strong Buy). It stands to benefit from strong demand for services and software, and RFID (radio frequency identification) products. Also, its cost-management actions are enabling it to cut down operating expenses and improve margin performance.

Image Source: Zacks Investment Research

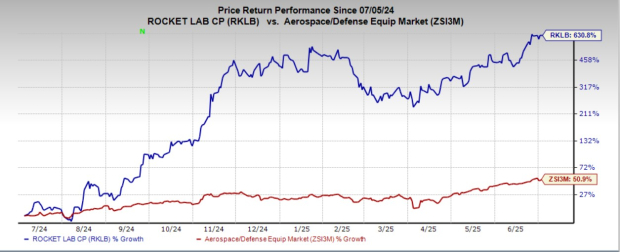

Its shares have gained 18.9% compared with the industry’s 11.6% growth in the past three months.

The Zacks Consensus Estimate for 2024 earnings has increased 9.3% to $12.11 in the past 60 days.

Other Stocks to Consider

Other top-ranked stocks from the Zacks Industrial Products sector are discussed below.

Luxfer Holdings LXFR presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 122.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LXFR’s 2024 earnings has increased 13.5% in the past 60 days.

Crane Company CR presently carries a Zacks Rank of 2. It delivered a trailing four-quarter average earnings surprise of 15.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has risen 3.3%.

Tennant Company TNC currently carries a Zacks Rank of 2. TNC delivered a trailing four-quarter average earnings surprise of 38%.

In the past 60 days, the Zacks Consensus Estimate for its 2024 earnings has inched up 1.9%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Crane Company (CR) : Free Stock Analysis Report

Luxfer Holdings PLC (LXFR) : Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.