Warren Buffett’s Strategy: Understanding Zimmer Biomet’s RSI Levels

Legendary investor Warren Buffett famously advises investors to be fearful when others are greedy and to be greedy when others are fearful. One metric for gauging market sentiment is the Relative Strength Index (RSI). This technical analysis tool measures momentum on a scale from zero to 100, indicating whether a stock is oversold. Typically, a stock is deemed oversold if its RSI falls below 30.

Zimmer Biomet Holdings Enters Oversold Territory

On Tuesday, shares of Zimmer Biomet Holdings Inc (Symbol: ZBH) slipped into oversold territory, recording an RSI of 29.6 after reaching a low of $97.37 per share. In contrast, the current RSI for the S&P 500 ETF (SPY) stands at 44.7. This lower RSI reading for Zimmer Biomet may signal to bullish investors that the recent sell-off is nearing its end, potentially presenting future buying opportunities.

Performance Review and 52-Week Range

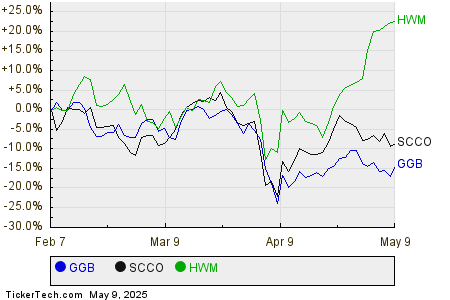

The one-year performance chart for ZBH illustrates its recent price movements:

ZBH’s shares have experienced a 52-week low of $97.37 and a high of $124.32, with the last trade recorded at $97.46.

![]() Discover the other 9 oversold stocks you should consider »

Discover the other 9 oversold stocks you should consider »

Related Insights:

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.