Aiming to navigate through turbulent waters, Zions Bancorporation is banking on a sturdy loan balance, escalating revenues, and rising interest rates to reinforce its financial standing. However, the company is faced with heightened expenses and deteriorating asset quality amidst an uncertain macroeconomic backdrop.

Robust Revenue Growth and Loan Expansion

ZION has maintained a streak of sustained organic growth. Notably, the company’s total revenues exhibited a compound annual growth rate (CAGR) of 3.4% over the past three years, despite a dip in 2020, and this upward trajectory continued in the initial nine months of 2023.

While the ongoing operating environment may pose challenges, revenue growth is expected to be tempered. Projections indicate a 1.1% and 4.8% decline in total revenues for 2023 and 2024, respectively, before rebounding with a 3.3% increase in 2025.

With a CAGR of 4.5% witnessed in net loans and leases over the last three years and a consistent upward trend in the initial nine months of 2023, ZION is anticipated to maintain a 1.4% CAGR in total loans by 2025.

Impact of Interest Rates and Stock Performance

Benefiting from the high interest rate environment, ZION’s net interest margin (NIM) is expected to witness substantial expansion, despite escalating deposit costs. Projections point to NIM reaching 2.96% for 2023.

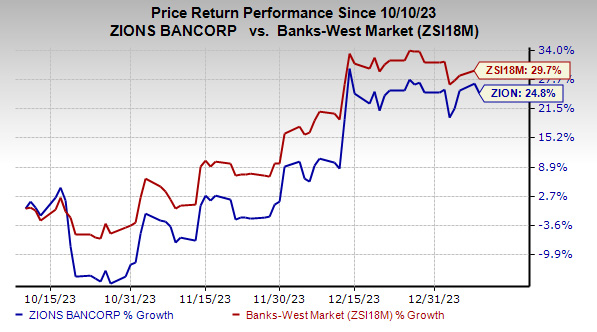

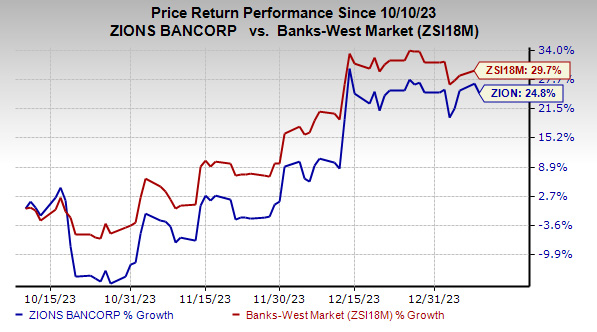

Over the preceding three months, ZION’s shares have surged by a notable 24.8%, although this trailed behind the industry’s growth, which stood at 29.7%.

Image Source: Zacks Investment Research

Challenges with Expenses and Asset Quality

It’s not all rosy for Zions as the company grapples with escalating expenses. Even though total non-interest expenses declined in 2020, they recorded a positive CAGR of 2.5% over the past three years, which persisted in the initial nine months of 2023. The primary culprits behind these mounting expenses are higher salaries and employee benefit costs.

With continual investments in franchises and digital operations, it is anticipated that expenses will remain elevated in the coming quarters. Estimates forecast a 3.3% CAGR in non-interest expenses by 2025.

ZION’s asset quality has been on a downward spiral in recent years. Provision for credit losses escalated in 2022 and continued to surge in the initial nine months of 2023, reflecting the company’s efforts to bolster reserves in response to the challenging operating environment. Projections indicate provisions for credit losses to spike by 58.5% in 2023.

Bank Stocks of Interest

While ZION forges ahead, investors might consider alternative options in the banking realm. Two notable stocks in this sector are Associated Bancorp ASB and OP Bancorp OPBK, both presently carrying a Zacks Rank #2 (Buy).