Operations: Setting the Stage for Growth

Zscaler reported a robust q1’24, ushering in the new fiscal year at full throttle. Emphasizing its three product pillars—ZIA, ZPA, and ZDX—the company is aligning itself as a single-platform security provider, similar to its competitors. ZIA and ZPA are the core-adopted products, with ZDX acting as the cross-selling component, comparable to Datadog (DDOG) or SolarWinds’ (SWI) network monitoring feature for SaaS application optimization. Zscaler’s primary focus lies within web API security, securing data traffic between the network infrastructure and the outside world, be it a cloud platform or basic internet browsing.

Zscaler’s go-to-market in q1’24 saw nearly 50% of new logo customers adopting the three core products. As companies strive to reduce vendor exposures and costs while maintaining effectiveness, this trend of single-company solutions is likely to persist. The federal exposure also showcases promise, with products deployed across 100,000 users at the federal level. The firm’s DoD exposure, with growth potential, presents opportunities within the government contracts arena.

Zscaler’s AI-driven features have the potential to shield outside traffic from a company’s sensitive data, as GenAI continues to evolve. Emphasizing AI-driven features through upselling to mitigate risks posed by GenAI is a strategic move. The firm’s latest offering, Risk360, quantifies and mitigates risks in real time, providing critical insights to CISOs in light of new SEC regulations.

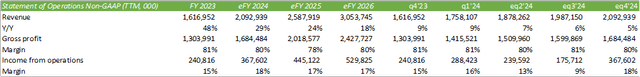

Financials: Navigating Billing Challenges

The firm faced similar billing challenges seen in other cybersecurity companies due to elevated borrowing costs. Billings grew 34% y/y, albeit dropping -37% sequentially. Notably, customers over $100k in ARR and over $1mm in ARR saw a 4% increase each, reflecting a moderate slowdown compared to previous periods. Despite management’s guided ~31% top-line growth for eq2’24 and ~29% for eFY24, representing a significant slowdown from previous years, the company’s platforms have reached a strong business saturation and now aim for a more normalized growth rate.

Addressing these challenges, management expressed openness to M&A activities, not for revenue growth, but to acquire emerging technologies that bolster the firm’s platforms. This strategic approach is poised to benefit Zscaler in the long run as the company evolves to stay ahead of threat actors. The acquisition of innovative, disruptive technologies aligns with the company’s goal of expanding its offerings for a broader cross-selling cycle, reinforcing its vital role in the evolving cybersecurity landscape.

Zscaler’s Strategic Outlook and Investment Opportunity

During Palo Alto Networks (PANW) q1’24 earnings call, Zscaler’s potential future strategies were discussed. Quantum security was highlighted as a looming concern, presenting itself as an emerging technology that companies are mindful of as it takes shape.

Considering this, it was expressed that Zscaler might shift its focus to quantum security after GenAI, given that the company’s platforms function as the web gateway for enterprises. This insight suggests that upcoming deals from Zscaler could likely center around advancements in either GenAI or quantum security.

Management also hinted at the possibility of future acquisitions, projecting that gross margins are expected to range from 78-82%. The introduction of new releases and emerging technologies was noted to potentially create a slight headwind to overall margins as they scale up.

The company anticipates a positive trajectory for revenue growth, albeit with some margin compression in the coming quarters due to strategic expansions in the sales and marketing team.

Value and Shareholder Prospects

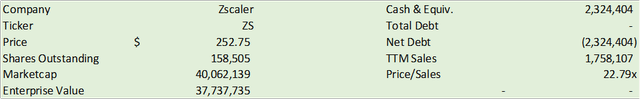

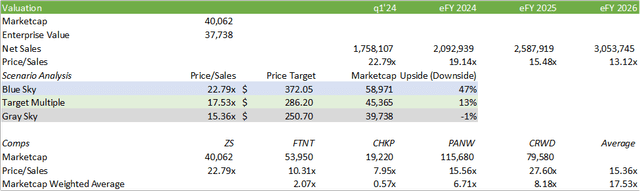

Zscaler’s current shares trade at 22.79x sales, slightly above its peer group, but notably lower than high-growth company CrowdStrike (CRWD). Considering Zscaler’s moderating top-line growth, it was suggested that a more moderate pricing multiple may be necessary in valuing the firm.

Using a market cap-weighted approach, the average price/sales multiple was determined to be 17.53x trailing sales. This is deemed a more appropriate benchmark for Zscaler going forward, given its position between high growth and maturing operations. Consequently, a BUY recommendation for the stock was proposed, with a price target of $286.20/share at 17.53x eFY25 revenue.

Technical Analysis and Market Insights

From a tactical standpoint, it is anticipated that Zscaler shares might undergo a pullback in the near term, before aligning with the fundamental price target of $286.20. Given the stock’s sharp upward trajectory since June 2023, a retracement is expected, possibly bringing the share price back to around $186/share.

Despiting this, the market is expected to absorb this significant price increase, and the stock is predicted to trend upwards again. For active traders, a strategic approach is to consider reducing one’s position and re-entering at a lower price, below the $200 mark.