Zscaler Stock Surges Amid Growing Cybersecurity Demand

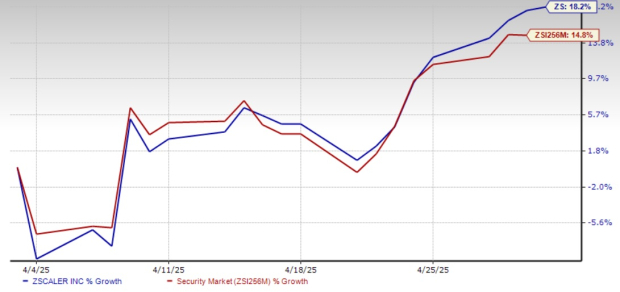

Zscaler, Inc. ZS Stock has climbed 18.2% in the past month, outperforming the Zacks Security industry’s return of 14.8%. As Zscaler’s stock continues to rise, investors now face a crucial decision: Should they hold onto their shares or take profits?

Recent Performance Overview

Image Source: Zacks Investment Research

Strengthening Demand for Cybersecurity Solutions

Zscaler continues to see strong demand for its cybersecurity products. This surge is attributed to increasing threats, including nation-state cyber warfare, ransomware attacks, and escalating malware incidents. As organizations shift from traditional security measures to cloud-based solutions, Zscaler’s cloud-native platform offers a more flexible, scalable zero-trust security model.

In the second quarter of fiscal 2025, ZS reported a 12-month trailing dollar-based retention rate of 115%. This achievement stems from larger bundle sales and strong upsell initiatives. Additionally, the company’s Remaining Performance Obligations, which reflect committed future revenues, grew by 28% year over year. As of the end of the quarter, ZS had 620 customers with annual recurring revenues (ARR) exceeding $1 million, and its customer count for ARR over $100,000 reached 3,291.

Zscaler is also enhancing its GovCloud solutions to secure approvals from government agencies. The company is committed to meeting government security standards, allowing many agencies to utilize AI-powered Cloud Browser Isolation and IPv6 for secure connectivity, thereby solidifying its GovCloud offerings among federal clients.

Zscaler’s focus on government clients has led to the addition of one cabinet-level agency during the fourth quarter, raising the total to 13 out of 15 U.S. cabinet agencies. As more agencies adopt Zscaler’s products, the company’s presence in the public sector is positioned to expand, creating a stable revenue stream.

Integrating AI to Enhance Cybersecurity

Additionally, Zscaler is incorporating generative AI into its offerings to tap into new growth avenues. Collaborations with NVIDIA NVDA and CrowdStrike CRWD aim to leverage their AI expertise.

Zscaler has fortified its Zero Trust Security model by integrating AI technologies from NVIDIA, including software for inferencing and real-time insights. Through its partnership with CrowdStrike, Zscaler aims to enhance capabilities in SIEM, cyber risk quantification, and threat intelligence.

With a robust partnership network and strong demand for cybersecurity products, ZS is poised for revenue growth, as indicated by the Zacks Consensus Estimate predicting a 22.2% year-over-year increase in fiscal 2025 revenues.

Challenges in a Competitive Landscape

Operating in a highly competitive cybersecurity sector, Zscaler needs to invest considerably to enhance its capabilities. Over the years, the company has significantly increased investments in sales and marketing (S&M), primarily by expanding its salesforce.

In the second quarter of fiscal 2025, non-GAAP S&M expenses climbed 12.9% year over year to $237.5 million. These expenses accounted for 36.7% of the second-quarter revenues, highlighting Zscaler’s aggressive market strategies.

Zscaler also prioritizes investment in research and development (R&D), nearly doubling its expenditures to enhance its cloud platform’s design and performance. For instance, R&D expenses surged 34.7% year over year to $105 million in the same quarter, constituting 16.2% of total revenues.

Increasing S&M and R&D expenditures could impact the company’s profitability. Zscaler’s fiscal 2025 EPS consensus mark has been adjusted downward by a penny to $3.06 over the past week, highlighting analyst concerns regarding its earnings potential.

Zscaler Price and Consensus Overview

Zscaler, Inc. price-consensus-chart | Zscaler, Inc. Quote

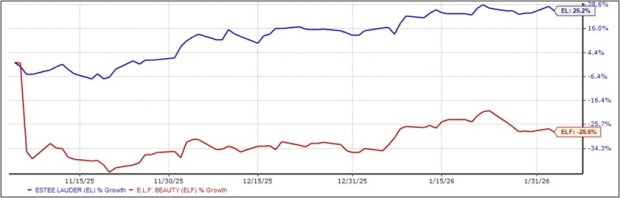

Valuation Concerns for Zscaler Stock

Zscaler’s current valuation raises concerns, reflected in its Zacks Value Score of F. Its Forward 12-month price-to-sales (P/S) ratio stands at 11.56X, significantly higher than the Zacks Computer and Technology sector average of 5.71X.

Zscaler Forward Twelve Month (P/S) Chart

Image Source: Zacks Investment Research

Investment Recommendation: Hold ZS Stock

Despite its high valuation, Zscaler’s commitment to AI innovations and its strong foothold in the Zero Trust security space indicate potential for growth. Currently, Zscaler holds a Zacks Rank #3 (Hold).